Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Ltd always had an eye on the Business of B Ltd despite the fact B Ltd was not doing great in business. Despite

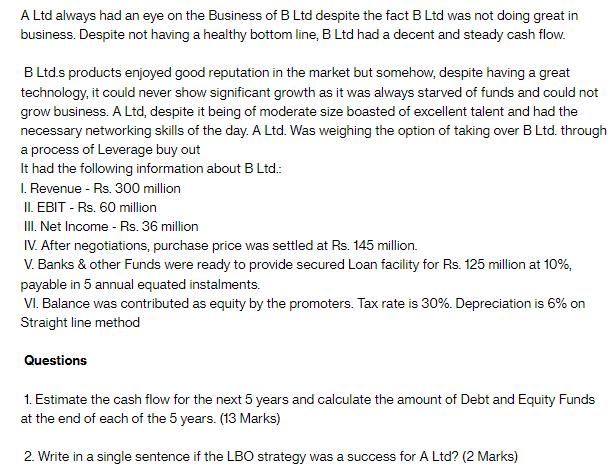

A Ltd always had an eye on the Business of B Ltd despite the fact B Ltd was not doing great in business. Despite not having a healthy bottom line, B Ltd had a decent and steady cash flow. B Ltd.s products enjoyed good reputation in the market but somehow, despite having a great technology, it could never show significant growth as it was always starved of funds and could not grow business. A Ltd, despite it being of moderate size boasted of excellent talent and had the necessary networking skills of the day. A Ltd. Was weighing the option of taking over B Ltd. through a process of Leverage buy out It had the following information about B Ltd.: 1. Revenue - Rs. 300 million II. EBIT - Rs. 60 million III. Net Income - Rs. 36 million IV. After negotiations, purchase price was settled at Rs. 145 million. V. Banks & other Funds were ready to provide secured Loan facility for Rs. 125 million at 10%, payable in 5 annual equated instalments. VI. Balance was contributed as equity by the promoters. Tax rate is 30%. Depreciation is 6% on Straight line method Questions 1. Estimate the cash flow for the next 5 years and calculate the amount of Debt and Equity Funds at the end of each of the 5 years. (13 Marks) 2. Write in a single sentence if the LBO strategy was a success for A Ltd? (2 Marks)

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To estimate the cash flow for the next 5 years and calculate the amount of debt and equity funds at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started