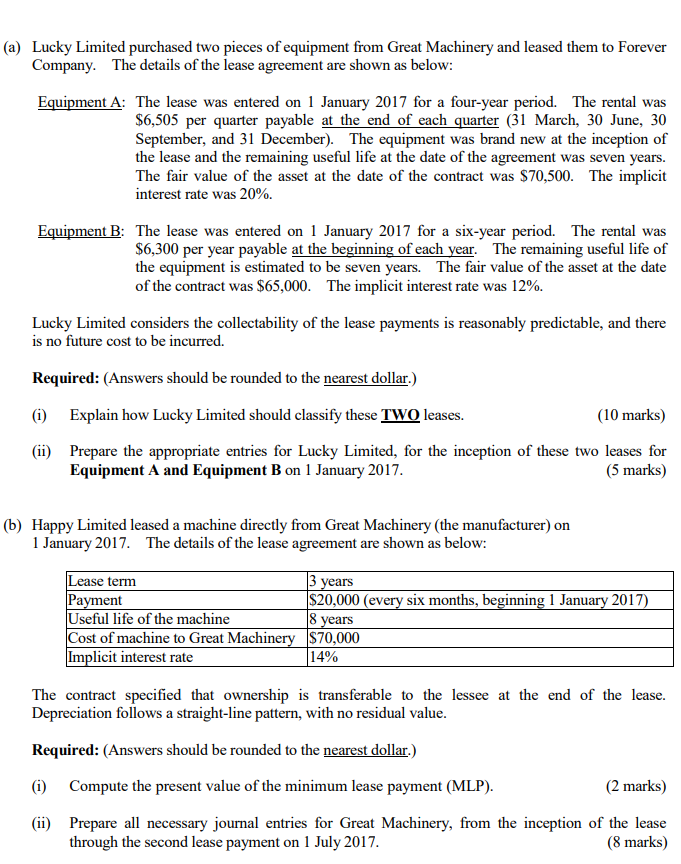

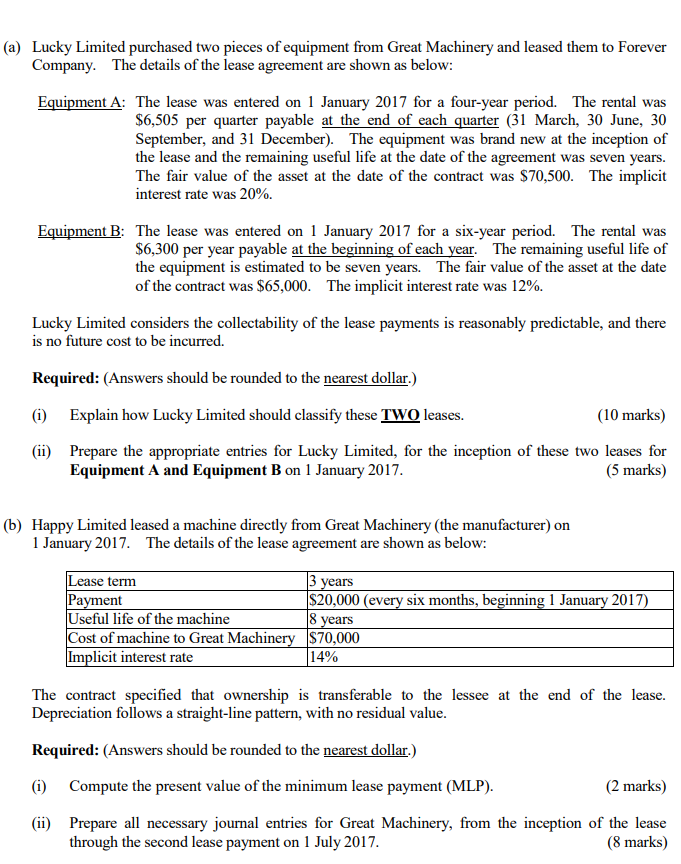

(a) Lucky Limited purchased two pieces of equipment from Great Machinery and leased them to Forever Company. The details of the lease a greement are shown as below: Equipment A: The lease was entered on 1 January 2017 for a four-year period. The rental was S6,505 per quarter payable at the end of each quarter (31 March, 30 June, 30 September, and 31 December). The equipment was brand new at the inception of the lease and the remaining useful life at the date of the agreement was seven years. The fair value of the asset at the date of the contract was $70,500. The implicit interest rate was 20%. Equipment B: The lease was entered on 1 January 2017 for a six-year period. The rental was S6,300 per year payable at the beginning of each year. The remaining useful life of the equipment is estimated to be seven years. The fair value of the asset at the date of the contract was $65,000. The implicit interest rate was 12%. Lucky Limited considers the collectability of the lease payments is reasonably predictable, and there is no future cost to be incurred. Required: (Answers should be rounded to the nearest dollar.) (i) Explain how Lucky Limited should classify these TWQ leases. (ii) Prepare the appropriate entries for Lucky Limited, for the inception of these two leases for (10 marks) Equipment A and Equipment B on 1 January 2017 (5 marks) (b) Happy Limited leased a machine directly from Great Machinery (the manufacturer) on 1 January 2017. The details of the lease agreement are shown as below: Lease term Pavment Useful life of the machine ears S20,000 (every six months, beginning 1 January 2017 of machine to Great Machin 70,000 Implicit interest rate The contract specified that ownership is transferable to the lessee at the end of the lease. Depreciation follows a straight-line pattern, with no residual value Required: (Answers should be rounded to the nearest dollar.) (i) Compute the present value of the minimum lease payment (MLP). (ii) Prepare all necessary journal entries for Great Machinery, from the inception of the lease (2 marks) through the second lease payment on 1 July 2017 (8 marks)