Answered step by step

Verified Expert Solution

Question

1 Approved Answer

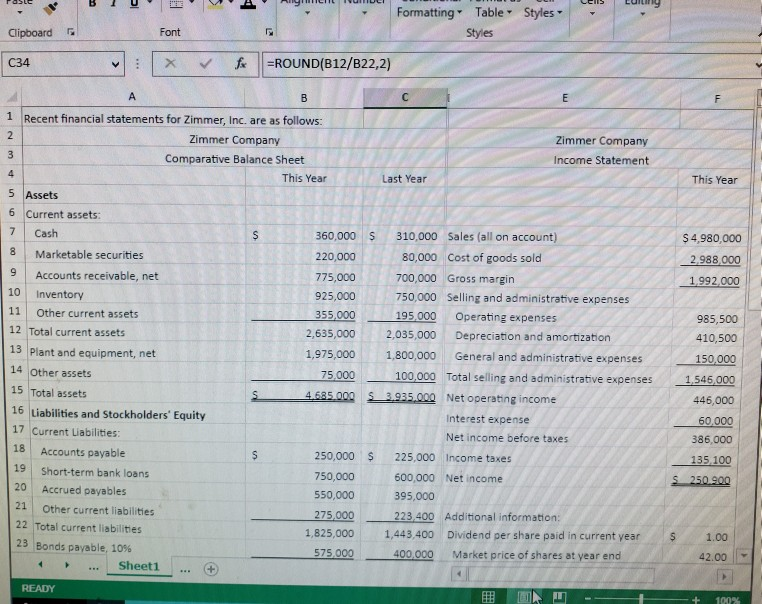

a LUI Formatting Styles Table Styles Clipboard Font C34 f =ROUND(B12/B22,2) A This Year $ 4,980,000 2,988,000 1992 000 1 Recent financial statements for Zimmer,

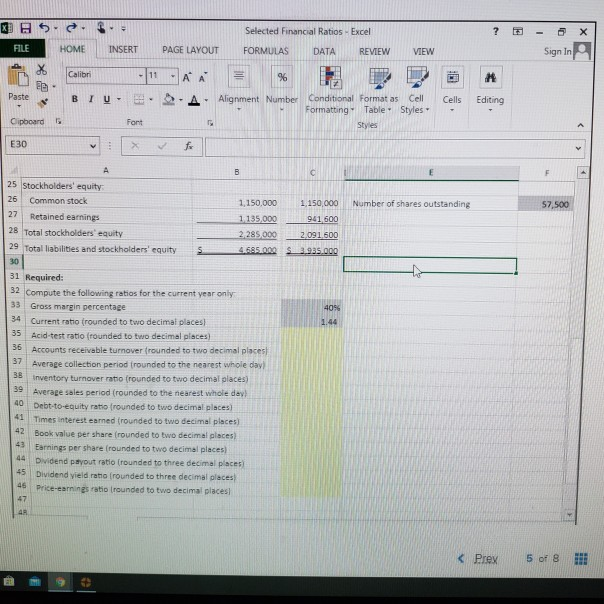

a LUI Formatting Styles Table Styles Clipboard Font C34 f =ROUND(B12/B22,2) A This Year $ 4,980,000 2,988,000 1992 000 1 Recent financial statements for Zimmer, Inc. are as follows: Zimmer Company Zimmer Company Comparative Balance Sheet Income Statement This Year Last Year 5 Assets 6 Current assets: Cash 360,000 $ 310,000 Sales (all on account) Marketable securities 220,000 80,000 Cost of goods sold Accounts receivable, net 775,000 700,000 Gross margin Inventory 925,000 750,000 Selling and administrative expenses Other current assets 355,000 195,000 Operating expenses 12 Total current assets 2,635,000 2,035,000 Depreciation and amortization 13 Plant and equipment, net 1,975,000 1,800,000 General and administrative expenses 14 Other assets 75,000 - 100,000 Total selling and administrative expenses 15 Total assets 4.685.000 53.995.000 Net operating income 16 Liabilities and Stockholders' Equity Interest expense 17 Current Liabilities: Net income before taxes Accounts payable 250,000 $ 225,000 Income taxes 19 Short-term bank loans 750,000 600,000 Net income 20 Accrued payables 550,000 395,000 Other current liabilities 275,000 223,400 Additional information: 22 Total current liabilities 1,825,000 1,443,400 Dividend per share paid in current year 23 Bonds payable, 10% 575,000 400,000 Market price of shares at year end ... Sheet1 ... + 985,500 410,500 150,000 1,545,000 446,000 50,000 386,000 135 100 S250.200 $ 1.00 42.00 READY 5 . Selected Financial Ratios - Excel ? x - 6 Sign In FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW 11 AA # Editing . A. Alignment Number Conditional Formatas Cell Formatting Table Styles Cells - 25 Stockholders' equity Common stock 25 1150 000 1 150 000 Number of shares outstanding 1.135.000 Retained earnings Total stockholders' equity 29 Total liabilities and stockholders' equity 28 2.285.000 65. 2.995.0 31 Required: 32 Compute the following ratios for the current year only 33 Gross margin percentage 34 Current ratio (rounded to two decimal places) 35 Acid-test ratio (rounded to two decimal places) 36 Accounts receivable turnover (rounded to two decimal places 37 Average collection period frounded to the nearest whole day! 38 Inventory turnover ratio (rounded to two decimal places) Average sales period (rounded to the nearest whole day! 40 Debt-to-equity ratio (rounded to two decimal places) 41 Times interest earned frounded to two decimal places) Book value per share (rounded to two decimal places) Earnings per share (rounded to two decimal places Dividend payout ratio rounded to three decimal places Dividend yield ratio rounded to three decimal places Price-camins ratio rounded to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started