Answered step by step

Verified Expert Solution

Question

1 Approved Answer

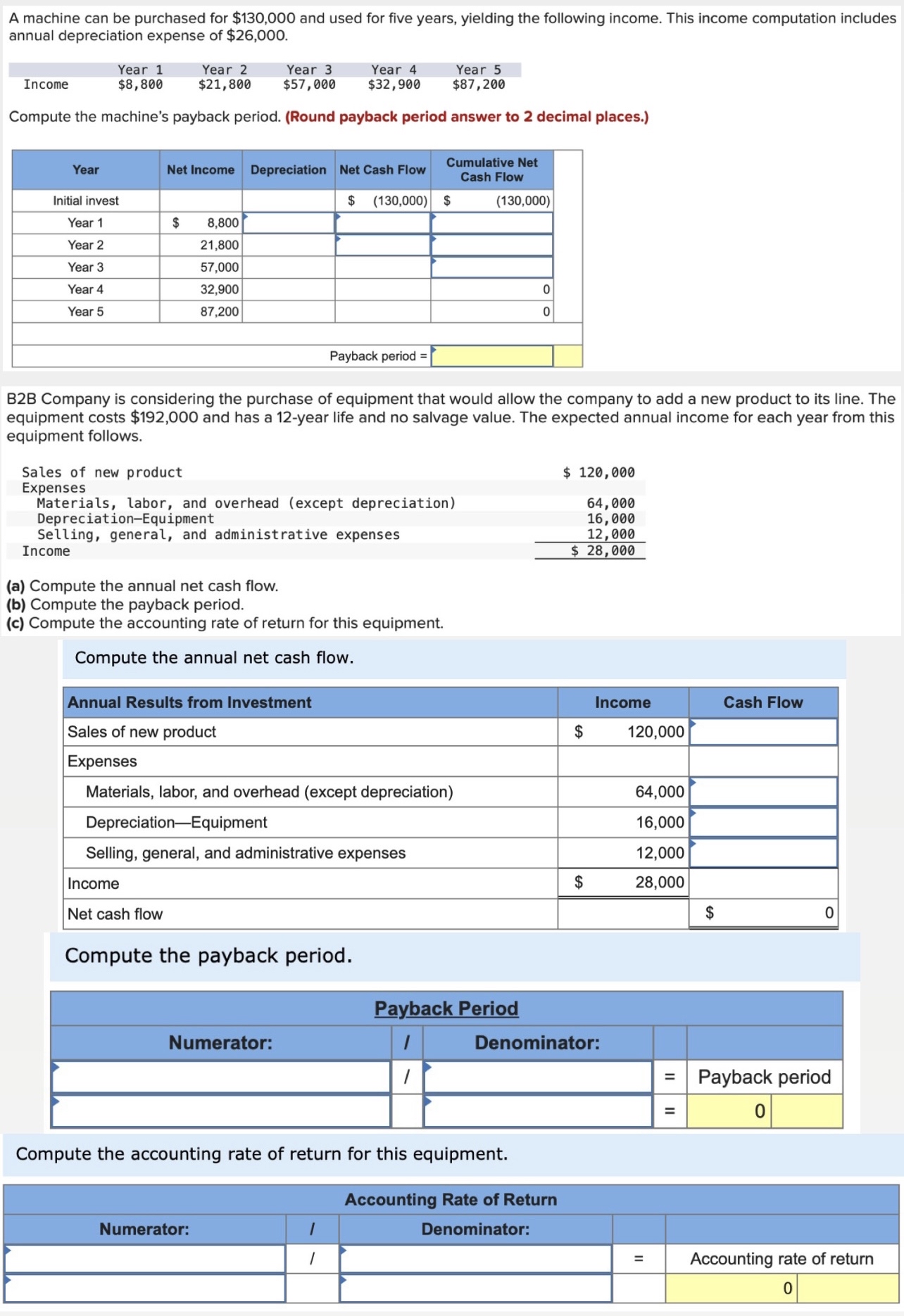

A machine can be purchased for $130,000 and used for five years, yielding the following income. This income computation includes annual depreciation expense of

A machine can be purchased for $130,000 and used for five years, yielding the following income. This income computation includes annual depreciation expense of $26,000. Income Year 1 $8,800 Year 2 $21,800 Year 3 $57,000 Year 4 $32,900 Year 5 $87,200 Compute the machine's payback period. (Round payback period answer to 2 decimal places.) Net Income Depreciation Net Cash Flow Year Initial invest Year 1 $ 8,800 Year 2 21,800 Year 3 57,000 Year 4 32,900 Year 5 87,200 Cumulative Net Cash Flow $ (130,000) $ (130,000) 0 0 Payback period = B2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $192,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Equipment Selling, general, and administrative expenses Income (a) Compute the annual net cash flow. (b) Compute the payback period. (c) Compute the accounting rate of return for this equipment. Compute the annual net cash flow. Annual Results from Investment Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Equipment Selling, general, and administrative expenses Income Net cash flow Compute the payback period. $ 120,000 64,000 16,000 12,000 $ 28,000 Income Cash Flow $ 120,000 64,000 16,000 12,000 $ 28,000 0 Numerator: Payback Period Denominator: Compute the accounting rate of return for this equipment. Accounting Rate of Return Numerator: I 1 Denominator: = Payback period = 0 = Accounting rate of return 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started