Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A machine cost $600,000, has annual depreciation of $100,000, and has accumulated depreciation of $450,000 on December 31, 2016. On April 1, 2017, when the

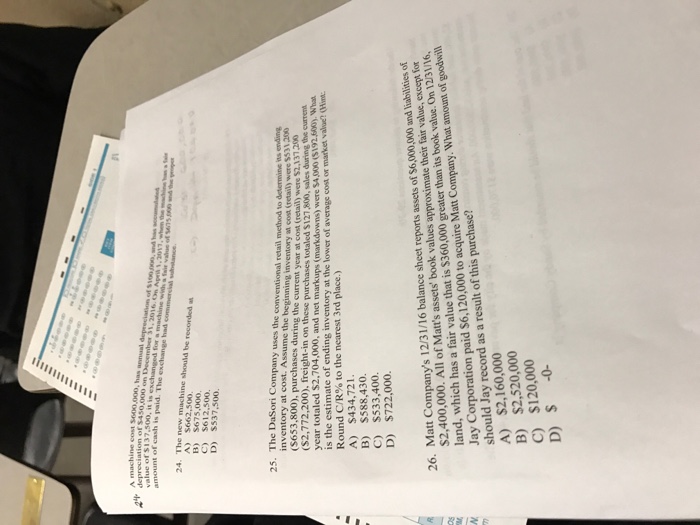

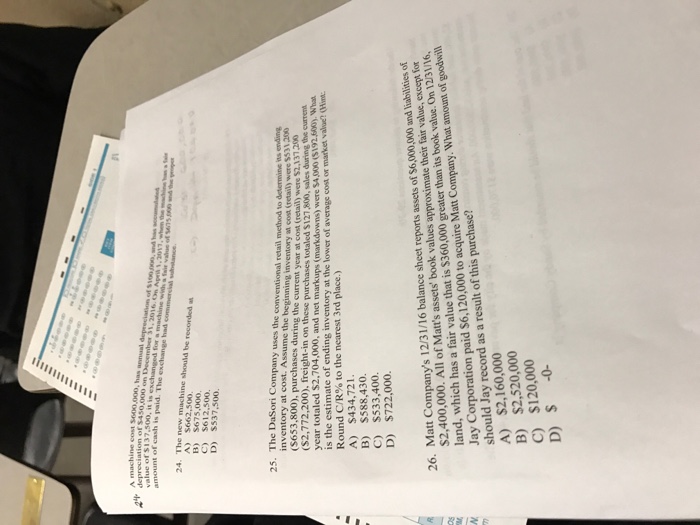

A machine cost $600,000, has annual depreciation of $100,000, and has accumulated depreciation of $450,000 on December 31, 2016. On April 1, 2017, when the machine has a fair value of $137, 500, it is exchanged for a machine with a fair value of $675,000 and the proper amount of cash is paid. The exchange had commercial substance. The new machine should be recorded at $662, 500. $675,000. $612, 500. $537, 500. The DaSori Company uses the conventional retail method to determine its ending inventory at cost. Assume the beginning inventory at cost (retail) were $531, 200 ($653, 800), purchases during the current year at cost (retail) were $2, 137, 200 ($2, 772, 200), freight-in on these purchases totaled S127, 800, sales during the current year totaled $2, 704,000, and net markups (markdowns) were $4,000 ($192, 600). What is the estimate of ending inventory at the lower of average cost or market value? $432, 721. $588, 430. $533, 400. $722,000. Malt Company's 12/31/16 balance sheet reports assets of $6,000,000 and liabilities of $2, 400,000. All of Matt's assets' book values approximate their fair value, except for land, which has a fair value that is $360,000 greater than its book value. On 12\31\16, Jay Corporation paid $6, 120,000 to acquire Matt Company. What amount of goodwill should Jay record as a result of this purchase? $2, 160,000 $2, 520,000 $120,000 $ -0

A machine cost $600,000, has annual depreciation of $100,000, and has accumulated depreciation of $450,000 on December 31, 2016. On April 1, 2017, when the machine has a fair value of $137, 500, it is exchanged for a machine with a fair value of $675,000 and the proper amount of cash is paid. The exchange had commercial substance. The new machine should be recorded at $662, 500. $675,000. $612, 500. $537, 500. The DaSori Company uses the conventional retail method to determine its ending inventory at cost. Assume the beginning inventory at cost (retail) were $531, 200 ($653, 800), purchases during the current year at cost (retail) were $2, 137, 200 ($2, 772, 200), freight-in on these purchases totaled S127, 800, sales during the current year totaled $2, 704,000, and net markups (markdowns) were $4,000 ($192, 600). What is the estimate of ending inventory at the lower of average cost or market value? $432, 721. $588, 430. $533, 400. $722,000. Malt Company's 12/31/16 balance sheet reports assets of $6,000,000 and liabilities of $2, 400,000. All of Matt's assets' book values approximate their fair value, except for land, which has a fair value that is $360,000 greater than its book value. On 12\31\16, Jay Corporation paid $6, 120,000 to acquire Matt Company. What amount of goodwill should Jay record as a result of this purchase? $2, 160,000 $2, 520,000 $120,000 $ -0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started