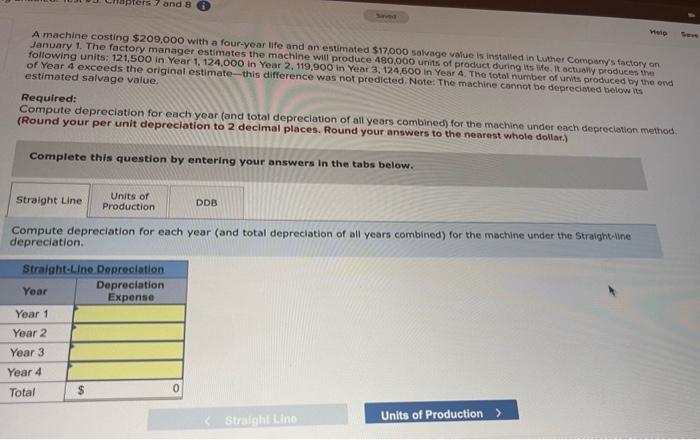

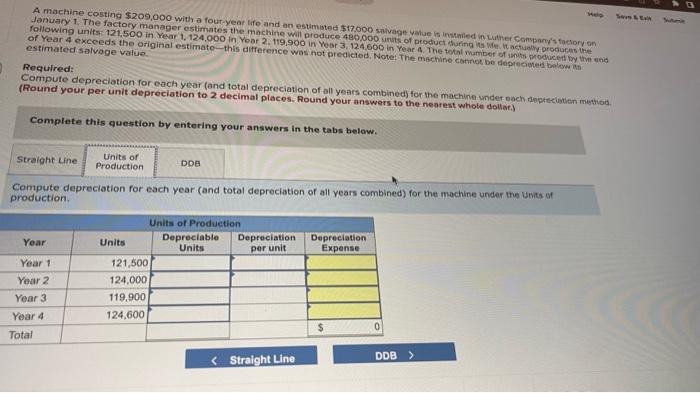

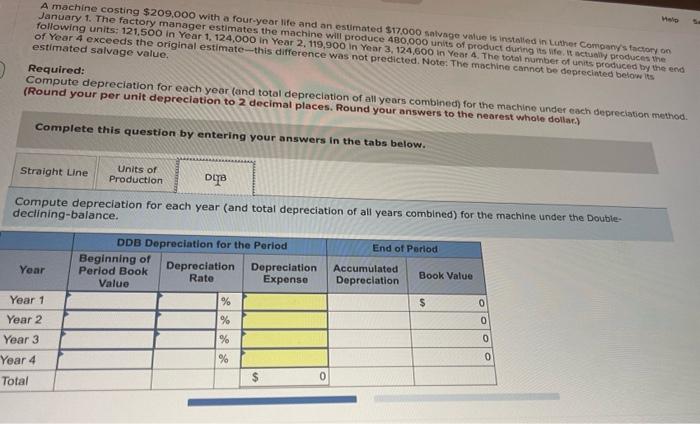

A machine costing $209,000 with a four-year life and an estimated $17,000 saluage value is instalted in Luther Company's factory on January 1. The factory manager estimates the machine will produce 480,000 units of product during its life. 1t actualily produces the following units; 121,500 in Year 1, 124,000 in Year 2,119,900 in Year 3,124,500 in Year 4 , The totol number of unts produced by the end estimated salvage value. Requirect; Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation metnod. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) Complete this question by entering your answers in the tabs below. Compute depreclation for each year (and total depreciation of all years combined) for the machine under the Straightaline depreciation. Required: Compute depreciotion for each year (and total depreciation of all yoars combined) for the machine under each depteciatien mentiod (Round your per unit depreciation to 2 decimal places. Round your answers to the mearest whole dollas.) Conplete this question by entering your answers in the tabs below. Compute depreclation for each year (and total depreciation of all years combined) for the machine under the Units of aroduction. A machine costing $209,000 with a four-year life and an esumated $17,000 salvage valuo is installed in Luther Companys therory on January 1. The factory manager estimates the machine will produce 480,000 units of product during ins life. 1 actualivans producest the following units; 121,500 in Year 1,124,000 in Year 2, 19,900 in Year 3,124,600 in Yeat 4 . The total number of units prothiced by the end Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under cach depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) Complete this question by entering your answers in the tabs below. Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Doubieeclining-balance