Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A machine costing $58,550 with a 4-year life and $54,820 depreciable cost was purchased January 1, Compute the yearly depreciation expense using straight-line depreciation. Round

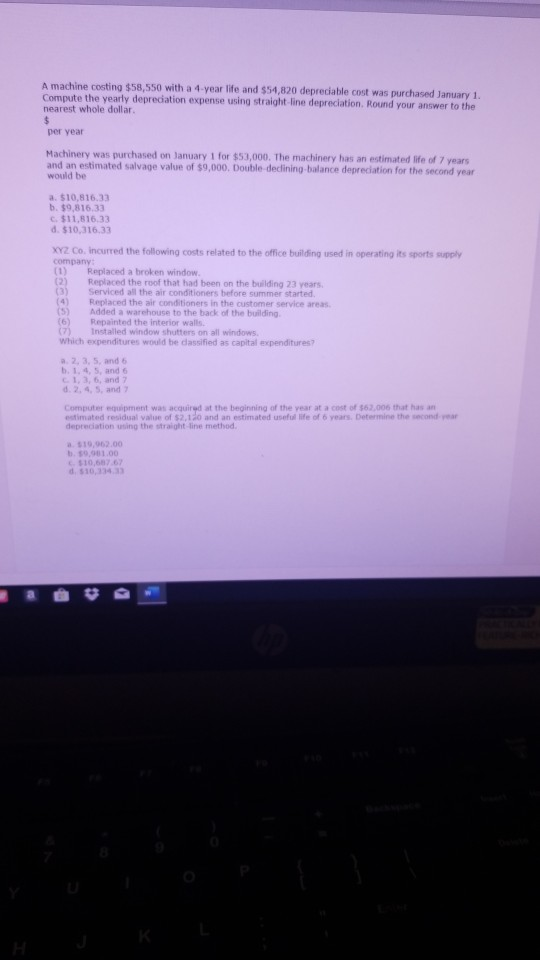

A machine costing $58,550 with a 4-year life and $54,820 depreciable cost was purchased January 1, Compute the yearly depreciation expense using straight-line depreciation. Round your answer to the nearest whole dollar. $ per year Machinery was purchased on January 1 for $53,000. The machinery has an estimated life of 7 years and an estimated salvage value of $9,000. Double-declining-balance depreciation for the second year would be a. $10,816.33 b. $9,816.33 c. $11,816.33 d. $10,316.33 XYZ Co. incurred the following costs related to the office building used in operating its sports supply company (1) (2) (3) (4) (5) Replaced a broken window. Replaced the roof that had been on the building 23 years Serviced all the air conditioners before summer started Replaced the air conditioners in the customer service areas Added a warehouse to the back of the building. (6) (7) Which expenditures would be dassified as capital expenditures Repainted the interior walls Installed window shutters on all windows. a. 2, 3, 5, and 6 b. 1, 4, 5, and 6 CI, 3, 6, and 7 d. 2, 4, 5, and 7 Computer equipment was acquired at the beginning of the year at a cost of $62,006 that has an estimated residual value of $2,120 and an estimated useful life of 6 years. Determine the second year depreciation using the straight line method a $19,962.00 b. s9,981.00 C$10,687 67 d. $10,334.33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started