Answered step by step

Verified Expert Solution

Question

1 Approved Answer

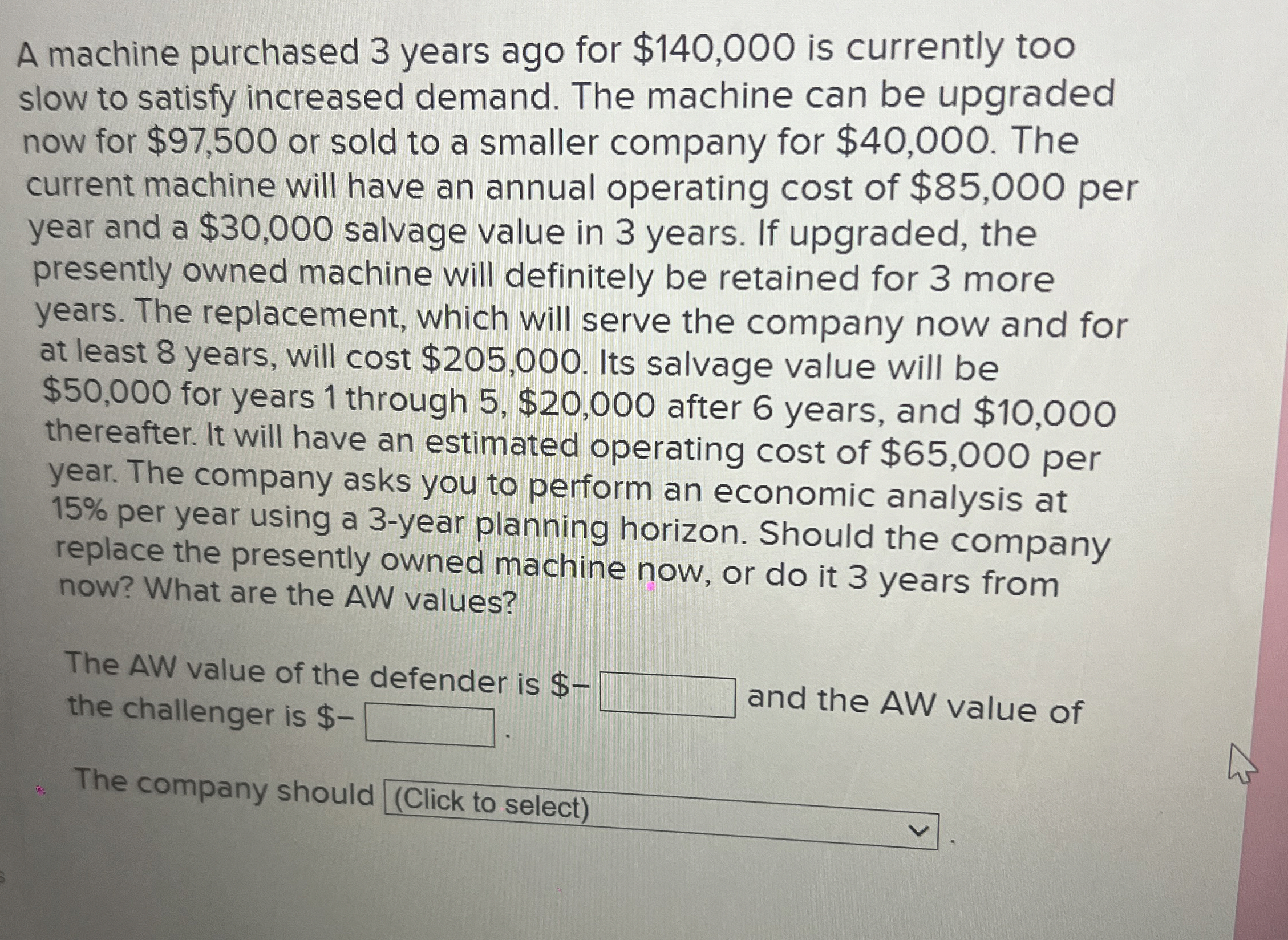

A machine purchased 3 years ago for $ 1 4 0 , 0 0 0 is currently too slow to satisfy increased demand. The machine

A machine purchased years ago for $ is currently too slow to satisfy increased demand. The machine can be upgraded now for $ or sold to a smaller company for $ The current machine will have an annual operating cost of $ per year and a $ salvage value in years. If upgraded, the presently owned machine will definitely be retained for more years. The replacement, which will serve the company now and for at least years, will cost $ Its salvage value will be $ for years through $ after years, and $ thereafter. It will have an estimated operating cost of $ per year. The company asks you to perform an economic analysis at per year using a year planning horizon. Should the company replace the presently owned machine now, or do it years from now? What are the AW values?

The AW value of the defender is $ the challenger is $ and the AW value of

The company should

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started