Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A machine was purchased 10 years ago for $45,000, with an estimated life of 15 years and a 15% salvage. Seven year MACRS has

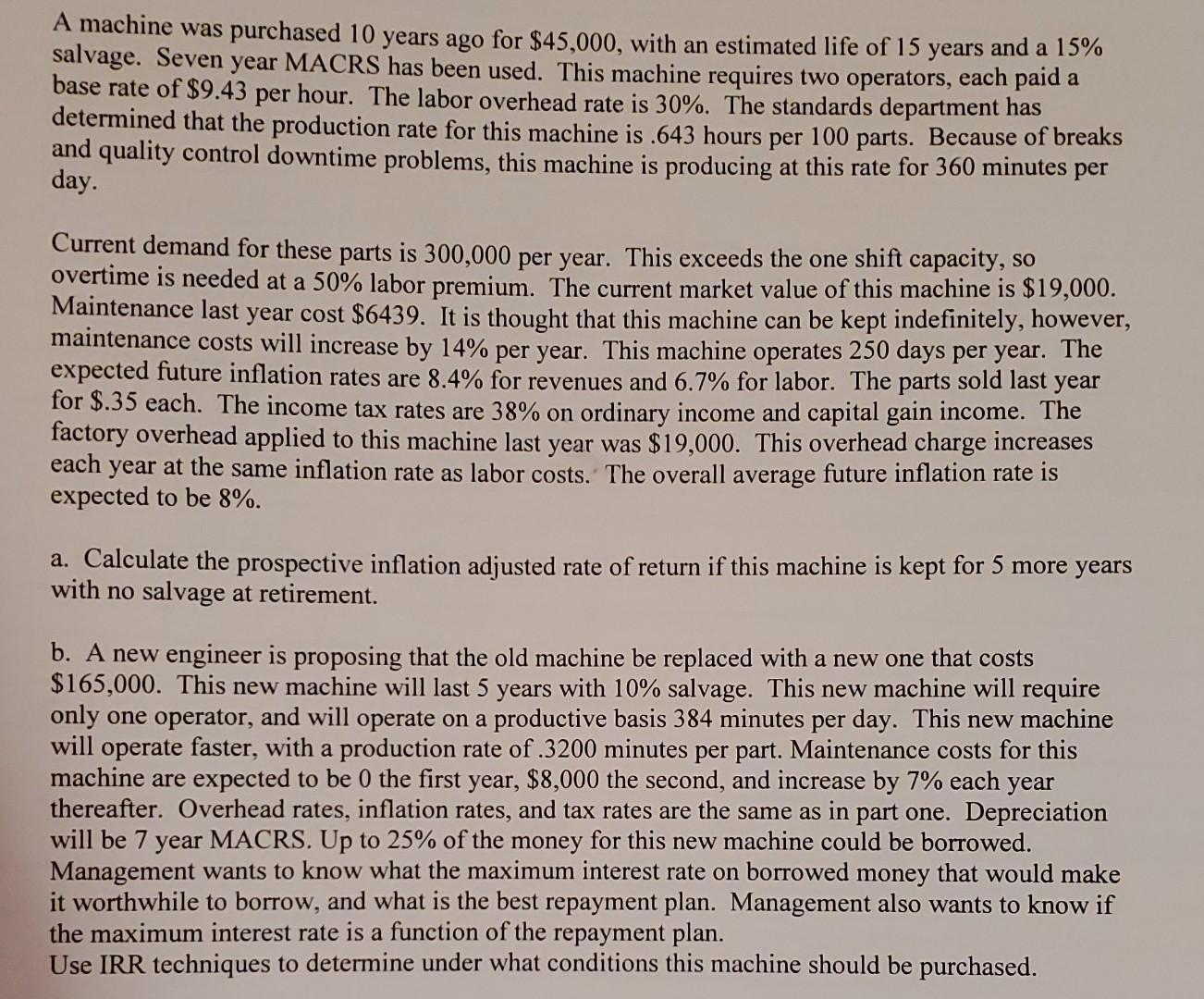

A machine was purchased 10 years ago for $45,000, with an estimated life of 15 years and a 15% salvage. Seven year MACRS has been used. This machine requires two operators, each paid a base rate of $9.43 per hour. The labor overhead rate is 30%. The standards department has determined that the production rate for this machine is .643 hours per 100 parts. Because of breaks and quality control downtime problems, this machine is producing at this rate for 360 minutes per day. Current demand for these parts is 300,000 per year. This exceeds the one shift capacity, so overtime is needed at a 50% labor premium. The current market value of this machine is $19,000. Maintenance last year cost $6439. It is thought that this machine can be kept indefinitely, however, maintenance costs will increase by 14% per year. This machine operates 250 days per year. The expected future inflation rates are 8.4% for revenues and 6.7% for labor. The parts sold last year for $.35 each. The income tax rates are 38% on ordinary income and capital gain income. The factory overhead applied to this machine last year was $19,000. This overhead charge increases each year at the same inflation rate as labor costs. The overall average future inflation rate is expected to be 8%. a. Calculate the prospective inflation adjusted rate of return if this machine is kept for 5 more years with no salvage at retirement. b. A new engineer is proposing that the old machine be replaced with a new one that costs $165,000. This new machine will last 5 years with 10% salvage. This new machine will require only one operator, and will operate on a productive basis 384 minutes per day. This new machine will operate faster, with a production rate of .3200 minutes per part. Maintenance costs for this machine are expected to be 0 the first year, $8,000 the second, and increase by 7% each year thereafter. Overhead rates, inflation rates, and tax rates are the same as in part one. Depreciation will be 7 year MACRS. Up to 25% of the money for this new machine could be borrowed. Management wants to know what the maximum interest rate on borrowed money that would make it worthwhile to borrow, and what is the best repayment plan. Management also wants to know if the maximum interest rate is a function of the repayment plan. Use IRR techniques to determine under what conditions this machine should be purchased.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

aProspective Inflation Adjusted Rate of Return Market Value of Machine Depreciation Maintenance Cost...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started