Answered step by step

Verified Expert Solution

Question

1 Approved Answer

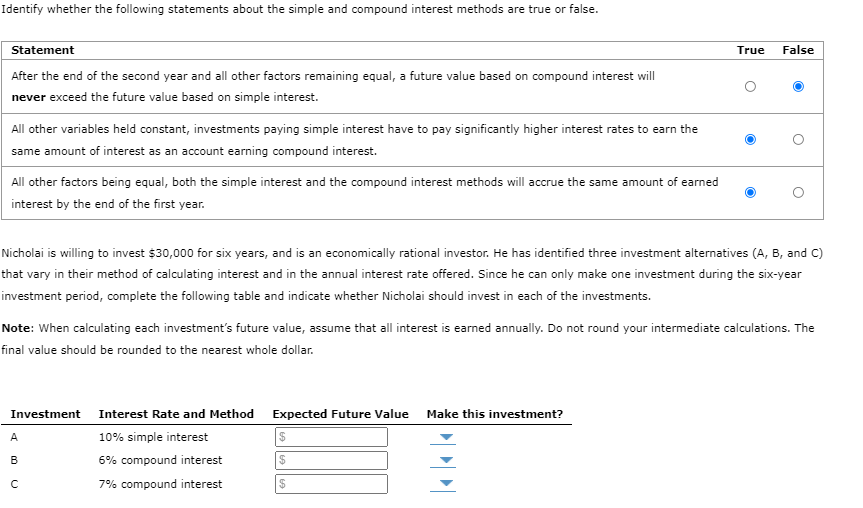

A - Make this investment? Yes or No? B - Make this investment? Yes or No C - Make this investment? Yes or No? Identify

A - Make this investment? Yes or No?

B - Make this investment? Yes or No

C - Make this investment? Yes or No?

Identify whether the following statements about the simple and compound interest methods are true or false. True False Statement After the end of the second year and all other factors remaining equal, a future value based on compound interest will never exceed the future value based on simple interest. All other variables held constant, investments paying simple interest have to pay significantly higher interest rates to earn the same amount of interest as an account earning compound interest. All other factors being equal, both the simple interest and the compound interest methods will accrue the same amount of earned interest by the end of the first year. Nicholai is willing to invest $30,000 for six years, and is an economically rational investor. He has identified three investment alternatives (A, B, and C) that vary in their method of calculating interest and in the annual interest rate offered. Since he can only make one investment during the six-year investment period, complete the following table and indicate whether Nicholai should invest in each of the investments. Note: When calculating each investment's future value, assume that all interest is earned annually. Do not round your intermediate calculations. The final value should be rounded to the nearest whole dollar. A Investment Interest Rate and Method Expected Future Value Make this investment? 10% simple interest $ B 6% compound interest $ 7% compound interest $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started