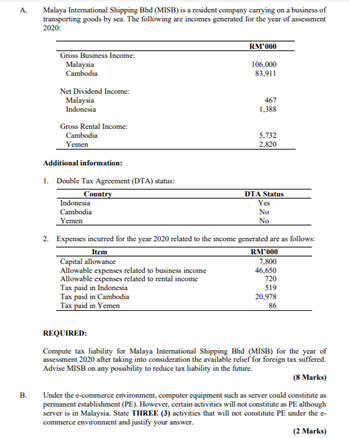

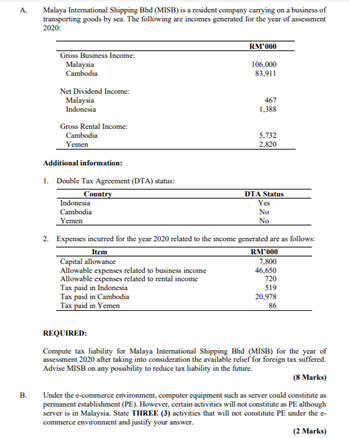

A Malaya International Shipping Bhd (MISB) is a resident company carrying on a business of transporting goods by sea. The following are incomes generated for the year of assessment 2020: RM1000 Gross Business Income: Malaysia 106,000 Cambodia 83.911 Net Dividend Income Malaysia 467 Indonesia 1,388 Gross Rental Income Cambodia 5,732 Yemen 2.820 Additional information: 1. Double Tax Agreement (DTA) status: Country DT A Status Indonesia Yo Cambodia No Yemen No 2. Expenses incurred for the year 2020 related to the income generated are as follows: RM 800 Capital allowance 7.500 Allowable expenses related to business income 46,650 Allowable expenses related to rental income 720 Tax paid in Indonesia 519 Tax paid in Cambodia 20.978 Tax paid in Yemen 36 REQUIRED: Compute tax liability for Malaya International Shipping Bhd (MISB) for the year of assessment 2020 after taking into consideration the available relief for foreign tax suffered. Advise MISB on any possibility to reduce tax liability in the future. (8 Marks) Under the e-commerce environment, computer equipment such as server could constitute as permanent establishment (PE). However certain activities will not constitute as PE although server is in Malaysia. State THREE (3) activities that will not constitute PE under the commerce environment and justify your answer. (2 Marks) A Malaya International Shipping Bhd (MISB) is a resident company carrying on a business of transporting goods by sea. The following are incomes generated for the year of assessment 2020: RM1000 Gross Business Income: Malaysia 106,000 Cambodia 83.911 Net Dividend Income Malaysia 467 Indonesia 1,388 Gross Rental Income Cambodia 5,732 Yemen 2.820 Additional information: 1. Double Tax Agreement (DTA) status: Country DT A Status Indonesia Yo Cambodia No Yemen No 2. Expenses incurred for the year 2020 related to the income generated are as follows: RM 800 Capital allowance 7.500 Allowable expenses related to business income 46,650 Allowable expenses related to rental income 720 Tax paid in Indonesia 519 Tax paid in Cambodia 20.978 Tax paid in Yemen 36 REQUIRED: Compute tax liability for Malaya International Shipping Bhd (MISB) for the year of assessment 2020 after taking into consideration the available relief for foreign tax suffered. Advise MISB on any possibility to reduce tax liability in the future. (8 Marks) Under the e-commerce environment, computer equipment such as server could constitute as permanent establishment (PE). However certain activities will not constitute as PE although server is in Malaysia. State THREE (3) activities that will not constitute PE under the commerce environment and justify your answer. (2 Marks)