Question

A mall with two levels is under construction. The plan is to install only 9 escalators at the start, although the ultimate design calls for

A mall with two levels is under construction. The plan is to install only 9 escalators at the start, although the ultimate design calls for 16. The question arises as to whether to provide necessary facilities (stair supports, wiring conduits, motor foundations, etc.) that would permit the installation of the additional escalators at the mere cost of their purchase and installation or to defer investment in these facilities until the escalators need to be installed. Option 1: Provide these facilities now for all seven future escalators at $320,000. Option 2: Defer the investment in the facility as needed. Install two more escalators in two years, three more in five years, and the last two in eight years. The installation of these facilities at the time they are required is estimated to cost $210,000 in year 2, $230,000 in year 5, and $250,000 in year 8. Additional annual expenses are estimated at $7,000 for each escalator facility installed. Assume that these costs begin one year subsequent to the actual addition. At an interest rate of 18%, compare the net present worth of each option over eight years. Do not take into account the cost of 9 escalators installed under both options.

Also can you tell me where I have to see in the table because I am confuse thank you !

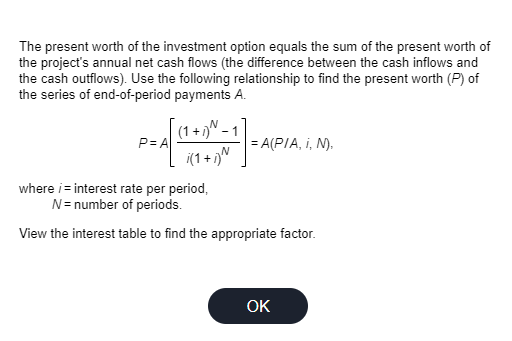

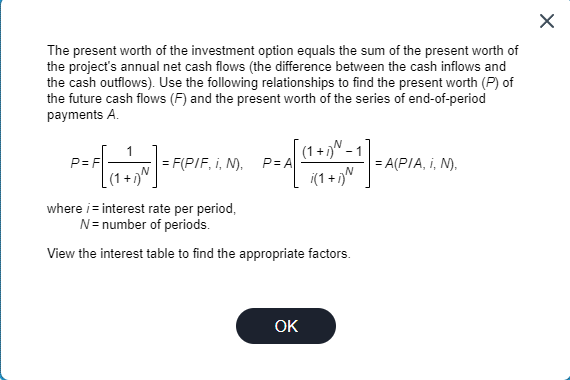

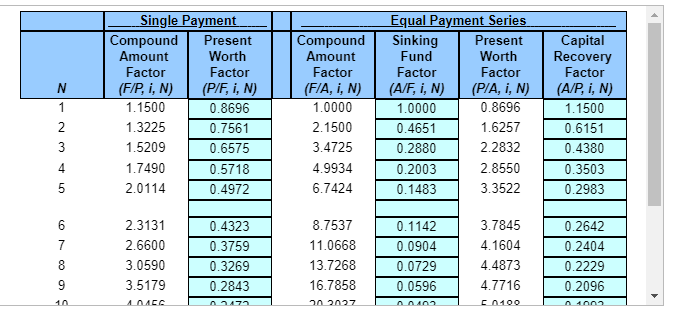

The present worth of the investment option equals the sum of the present worth of the project's annual net cash flows (the difference between the cash inflows and the cash outflows). Use the following relationship to find the present worth (P) of the series of end-of-period payments A. P=A[i(1+i)N(1+i)N1]=A(P/A,i,N), where i= interest rate per period, N= number of periods. View the interest table to find the appropriate factor. The present worth of the investment option equals the sum of the present worth of the project's annual net cash flows (the difference between the cash inflows and the cash outflows). Use the following relationships to find the present worth (P) of the future cash flows (F) and the present worth of the series of end-of-period payments A. P=F[(1+i)N1]=F(P/F,i,N),P=A[i(1+i)N(1+i)N1]=A(P/A,i,N), where i= interest rate per period, N= number of periods. View the interest table to find the appropriate factors. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Single Payment } & \multicolumn{4}{|c|}{ Equal Payment Series } & \\ \hlineN & CompoundAmountFactor(F/P,i,N) & PresentWorthFactor(P/F,i,N) & CompoundAmountFactor(F/A,i,N) & SinkingFundFactor(A/F,i,N) & PresentWorthFactor(P/A,i,N) & CapitalRecoveryFactor(A/P,i,N) & \\ \hline 1 & 1.1500 & 0.8696 & 1.0000 & 1.0000 & 0.8696 & 1.1500 & \\ \hline 2 & 1.3225 & 0.7561 & 2.1500 & 0.4651 & 1.6257 & 0.6151 & \\ \hline 3 & 1.5209 & 0.6575 & 3.4725 & 0.2880 & 2.2832 & 0.4380 & \\ \hline 4 & 1.7490 & 0.5718 & 4.9934 & 0.2003 & 2.8550 & 0.3503 & \\ \hline 5 & 2.0114 & 0.4972 & 6.7424 & 0.1483 & 3.3522 & 0.2983 & \\ \hline 6 & 2.3131 & 0.4323 & 8.7537 & 0.1142 & 3.7845 & 0.2642 & \\ \hline 7 & 2.6600 & 0.3759 & 11.0668 & 0.0904 & 4.1604 & 0.2404 & \\ \hline 8 & 3.0590 & 0.3269 & 13.7268 & 0.0729 & 4.4873 & 0.2229 & \\ \hline 9 & 3.5179 & 0.2843 & 16.7858 & 0.0596 & 4.7716 & 0.2096 & \\ \hline \end{tabular}

The present worth of the investment option equals the sum of the present worth of the project's annual net cash flows (the difference between the cash inflows and the cash outflows). Use the following relationship to find the present worth (P) of the series of end-of-period payments A. P=A[i(1+i)N(1+i)N1]=A(P/A,i,N), where i= interest rate per period, N= number of periods. View the interest table to find the appropriate factor. The present worth of the investment option equals the sum of the present worth of the project's annual net cash flows (the difference between the cash inflows and the cash outflows). Use the following relationships to find the present worth (P) of the future cash flows (F) and the present worth of the series of end-of-period payments A. P=F[(1+i)N1]=F(P/F,i,N),P=A[i(1+i)N(1+i)N1]=A(P/A,i,N), where i= interest rate per period, N= number of periods. View the interest table to find the appropriate factors. \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{ Single Payment } & \multicolumn{4}{|c|}{ Equal Payment Series } & \\ \hlineN & CompoundAmountFactor(F/P,i,N) & PresentWorthFactor(P/F,i,N) & CompoundAmountFactor(F/A,i,N) & SinkingFundFactor(A/F,i,N) & PresentWorthFactor(P/A,i,N) & CapitalRecoveryFactor(A/P,i,N) & \\ \hline 1 & 1.1500 & 0.8696 & 1.0000 & 1.0000 & 0.8696 & 1.1500 & \\ \hline 2 & 1.3225 & 0.7561 & 2.1500 & 0.4651 & 1.6257 & 0.6151 & \\ \hline 3 & 1.5209 & 0.6575 & 3.4725 & 0.2880 & 2.2832 & 0.4380 & \\ \hline 4 & 1.7490 & 0.5718 & 4.9934 & 0.2003 & 2.8550 & 0.3503 & \\ \hline 5 & 2.0114 & 0.4972 & 6.7424 & 0.1483 & 3.3522 & 0.2983 & \\ \hline 6 & 2.3131 & 0.4323 & 8.7537 & 0.1142 & 3.7845 & 0.2642 & \\ \hline 7 & 2.6600 & 0.3759 & 11.0668 & 0.0904 & 4.1604 & 0.2404 & \\ \hline 8 & 3.0590 & 0.3269 & 13.7268 & 0.0729 & 4.4873 & 0.2229 & \\ \hline 9 & 3.5179 & 0.2843 & 16.7858 & 0.0596 & 4.7716 & 0.2096 & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started