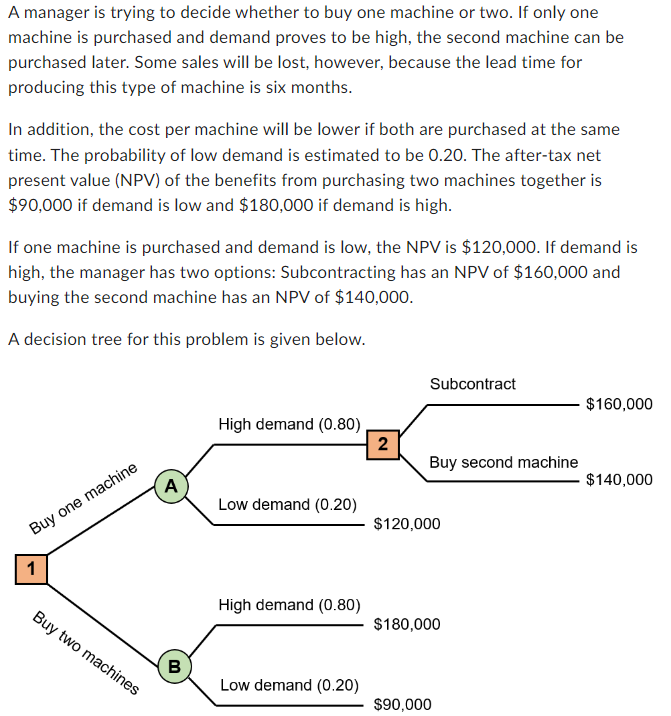

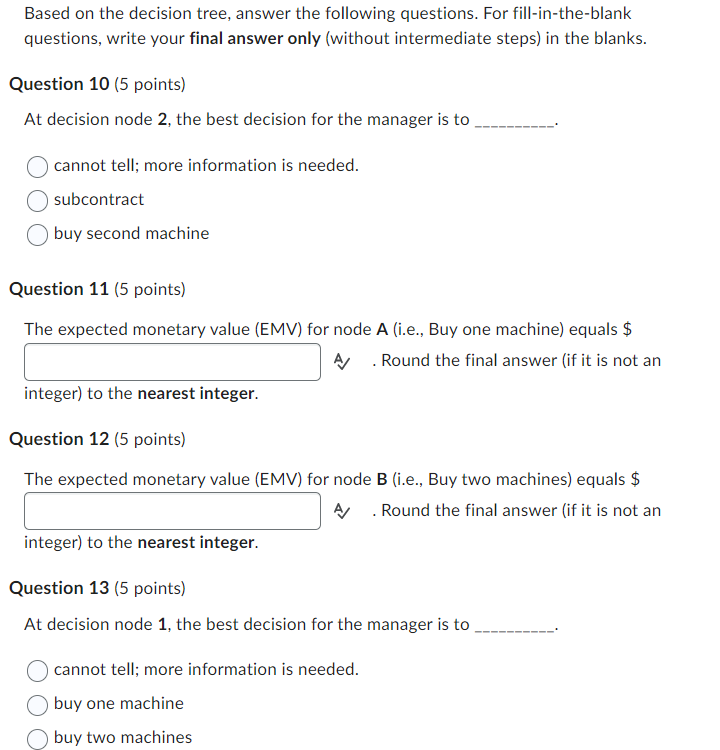

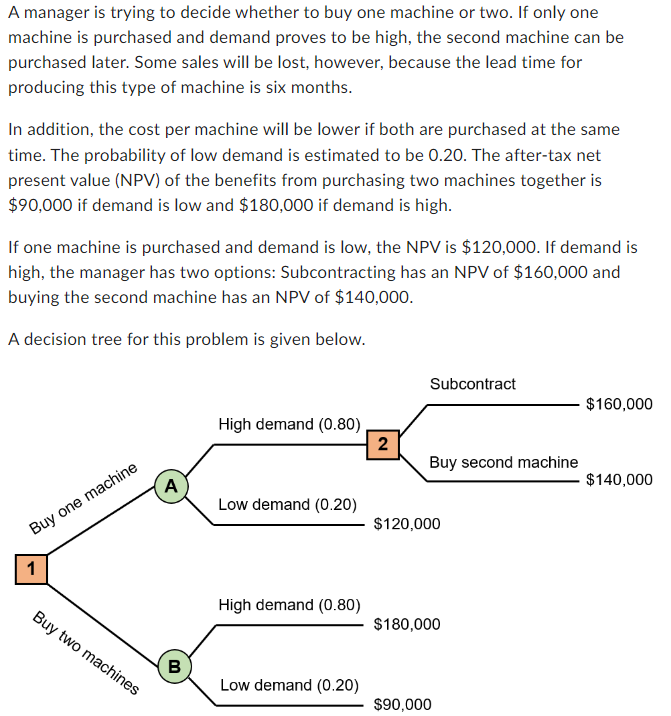

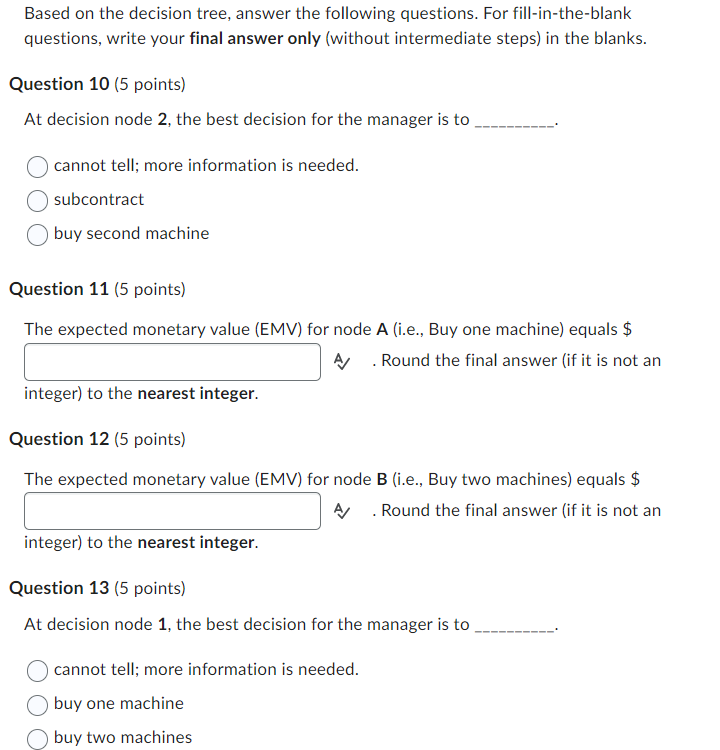

A manager is trying to decide whether to buy one machine or two. If only one machine is purchased and demand proves to be high, the second machine can be purchased later. Some sales will be lost, however, because the lead time for producing this type of machine is six months. In addition, the cost per machine will be lower if both are purchased at the same time. The probability of low demand is estimated to be 0.20. The after-tax net present value (NPV) of the benefits from purchasing two machines together is $90,000 if demand is low and $180,000 if demand is high. If one machine is purchased and demand is low, the NPV is $120,000. If demand is high, the manager has two options: Subcontracting has an NPV of $160,000 and buying the second machine has an NPV of $140,000. A decision tree for this problem is given below. Based on the decision tree, answer the following questions. For fill-in-the-blank questions, write your final answer only (without intermediate steps) in the blanks. Question 10 (5 points) At decision node 2 , the best decision for the manager is to cannot tell; more information is needed. subcontract buy second machine Question 11 (5 points) The expected monetary value (EMV) for node A (i.e., Buy one machine) equals $ A . Round the final answer (if it is not an integer) to the nearest integer. Question 12 (5 points) The expected monetary value (EMV) for node B (i.e., Buy two machines) equals $ A . Round the final answer (if it is not an integer) to the nearest integer. Question 13 (5 points) At decision node 1 , the best decision for the manager is to cannot tell; more information is needed. buy one machine buy two machines A manager is trying to decide whether to buy one machine or two. If only one machine is purchased and demand proves to be high, the second machine can be purchased later. Some sales will be lost, however, because the lead time for producing this type of machine is six months. In addition, the cost per machine will be lower if both are purchased at the same time. The probability of low demand is estimated to be 0.20. The after-tax net present value (NPV) of the benefits from purchasing two machines together is $90,000 if demand is low and $180,000 if demand is high. If one machine is purchased and demand is low, the NPV is $120,000. If demand is high, the manager has two options: Subcontracting has an NPV of $160,000 and buying the second machine has an NPV of $140,000. A decision tree for this problem is given below. Based on the decision tree, answer the following questions. For fill-in-the-blank questions, write your final answer only (without intermediate steps) in the blanks. Question 10 (5 points) At decision node 2 , the best decision for the manager is to cannot tell; more information is needed. subcontract buy second machine Question 11 (5 points) The expected monetary value (EMV) for node A (i.e., Buy one machine) equals $ A . Round the final answer (if it is not an integer) to the nearest integer. Question 12 (5 points) The expected monetary value (EMV) for node B (i.e., Buy two machines) equals $ A . Round the final answer (if it is not an integer) to the nearest integer. Question 13 (5 points) At decision node 1 , the best decision for the manager is to cannot tell; more information is needed. buy one machine buy two machines