Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturer has three plants with access production capacity. It can use this capacity to produce a product that comes in three sizes, Large, Medium,

A manufacturer has three plants with access production capacity. It can

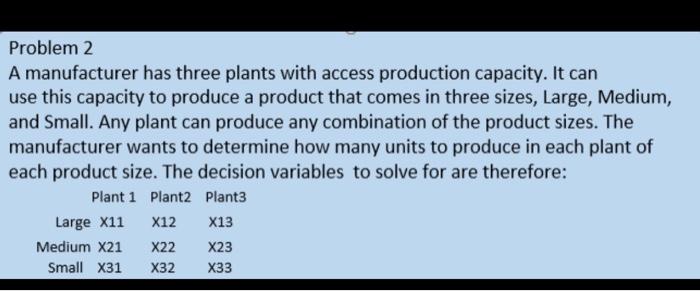

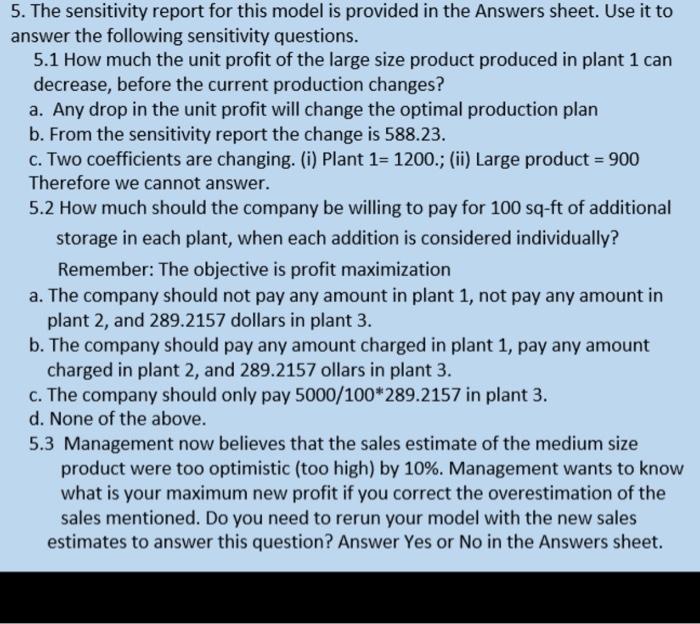

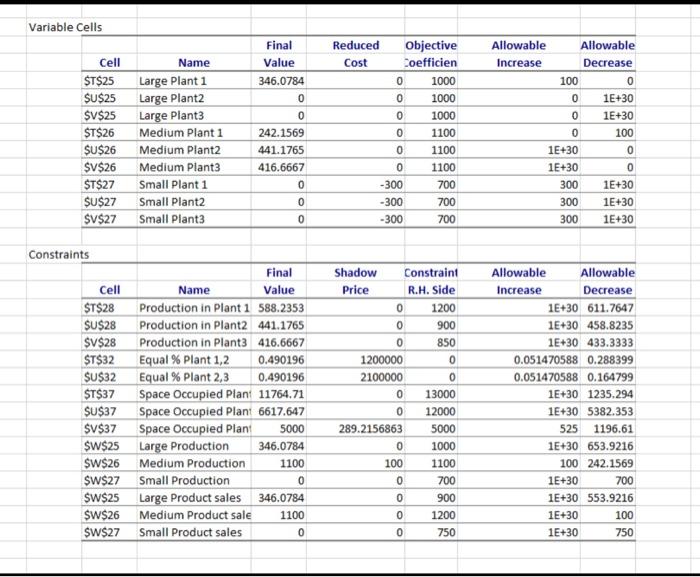

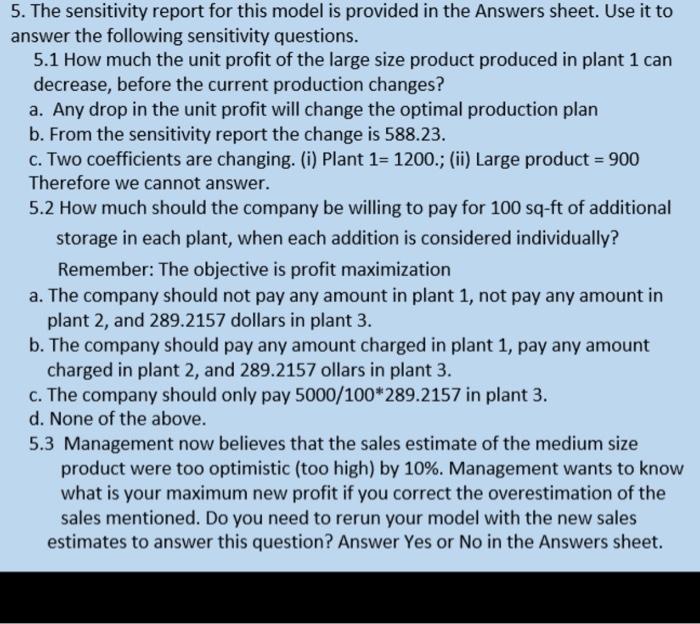

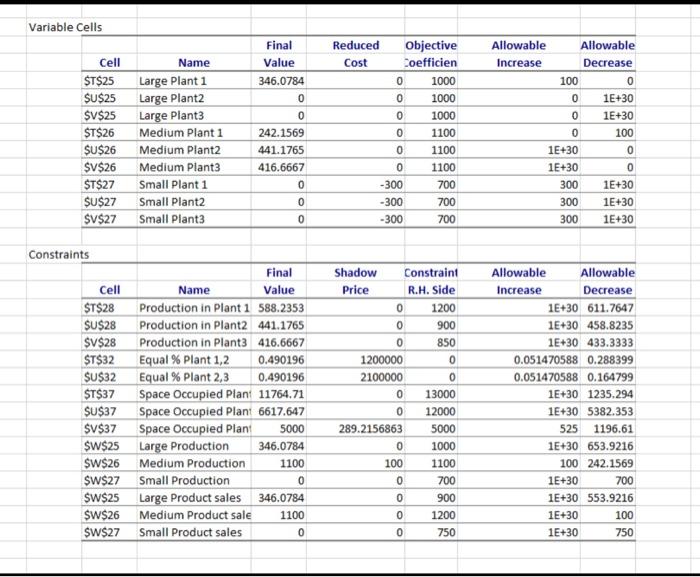

Problem 2 A manufacturer has three plants with access production capacity. It can use this capacity to produce a product that comes in three sizes, Large, Medium, and Small. Any plant can produce any combination of the product sizes. The manufacturer wants to determine how many units to produce in each plant of each product size. The decision variables to solve for are therefore: Plant 1 Plant2 Plant3 Large X11 X12 X13 Medium X21 X22 X23 Small X31 X32 X33 5. The sensitivity report for this model is provided in the Answers sheet. Use it to answer the following sensitivity questions. 5.1 How much the unit profit of the large size product produced in plant 1 can decrease, before the current production changes? a. Any drop in the unit profit will change the optimal production plan b. From the sensitivity report the change is 588.23. c. Two coefficients are changing. (i) Plant 1= 1200.; (ii) Large product = 900 Therefore we cannot answer. 5.2 How much should the company be willing to pay for 100 sq-ft of additional storage in each plant, when each addition is considered individually? Remember: The objective is profit maximization a. The company should not pay any amount in plant 1, not pay any amount in plant 2, and 289.2157 dollars in plant 3. b. The company should pay any amount charged in plant 1, pay any amount charged in plant 2, and 289.2157 ollars in plant 3. C. The company should only pay 5000/100*289.2157 in plant 3. d. None of the above. 5.3 Management now believes that the sales estimate of the medium size product were too optimistic (too high) by 10%. Management wants to know what is your maximum new profit if you correct the overestimation of the sales mentioned. Do you need to rerun your model with the new sales estimates to answer this question? Answer Yes or No in the Answers sheet. Variable Cells Final Value 346.0784 100 0 0 Cell $T$25 $U$25 $V$25 $T$26 $U$26 $V$26 $T$27 $U$27 $V$27 Name Large Plant 1 Large Plant2 Large Plant3 Medium Plant 1 Medium Plant2 Medium Plants Small Plant 1 Small Plant2 Small Plant3 242.1569 441.1765 416.6667 0 Reduced Objective Cost Coefficien 0 1000 0 1000 0 1000 0 1100 0 1100 0 1100 -300 700 -300 700 -300 700 Allowable Allowable Increase Decrease 0 0 1E+30 0 1E+30 0 100 1E+30 0 1E+30 0 300 1E+30 300 1E+30 300 1E+30 0 0 Constraints Final Cell Name Value $T$28 Production in Plant 1 588.2353 $U$28 Production in Plant2 441.1765 $V$28 Production in Plant3416.6667 $T$32 Equal % Plant 1,2 0.490196 SU$32 Equal % Plant 2,3 0.490196 $T$37 Space Occupied Plant 11764.71 $U$37 Space Occupied Plant 6617.647 $V$37 Space Occupied Plant 5000 $W$25 Large Production 346.0784 $W$26 Medium Production 1100 $W$27 Small Production 0 SW$25 Large Product sales 346.0784 $W$26 Medium Product sale 1100 $W$27 Small Product sales 0 Shadow Constraint Price R.H. Side 0 1200 0 900 0 850 1200000 0 2100000 0 0 13000 0 12000 289.2156863 5000 0 1000 100 1100 0 700 0 900 0 1200 0 750 Allowable Allowable Increase Decrease 1E+30 611.7647 1E+30 458.8235 1E+30 433.3333 0.051470588 0.288399 0.051470588 0.164799 1E+30 1235.294 1E+30 5382.353 525 1196.61 1E+30 653.9216 100 242.1569 1E+30 700 1E+30 553.9216 1E+30 100 1E+30 750 Problem 2 A manufacturer has three plants with access production capacity. It can use this capacity to produce a product that comes in three sizes, Large, Medium, and Small. Any plant can produce any combination of the product sizes. The manufacturer wants to determine how many units to produce in each plant of each product size. The decision variables to solve for are therefore: Plant 1 Plant2 Plant3 Large X11 X12 X13 Medium X21 X22 X23 Small X31 X32 X33 5. The sensitivity report for this model is provided in the Answers sheet. Use it to answer the following sensitivity questions. 5.1 How much the unit profit of the large size product produced in plant 1 can decrease, before the current production changes? a. Any drop in the unit profit will change the optimal production plan b. From the sensitivity report the change is 588.23. c. Two coefficients are changing. (i) Plant 1= 1200.; (ii) Large product = 900 Therefore we cannot answer. 5.2 How much should the company be willing to pay for 100 sq-ft of additional storage in each plant, when each addition is considered individually? Remember: The objective is profit maximization a. The company should not pay any amount in plant 1, not pay any amount in plant 2, and 289.2157 dollars in plant 3. b. The company should pay any amount charged in plant 1, pay any amount charged in plant 2, and 289.2157 ollars in plant 3. C. The company should only pay 5000/100*289.2157 in plant 3. d. None of the above. 5.3 Management now believes that the sales estimate of the medium size product were too optimistic (too high) by 10%. Management wants to know what is your maximum new profit if you correct the overestimation of the sales mentioned. Do you need to rerun your model with the new sales estimates to answer this question? Answer Yes or No in the Answers sheet. Variable Cells Final Value 346.0784 100 0 0 Cell $T$25 $U$25 $V$25 $T$26 $U$26 $V$26 $T$27 $U$27 $V$27 Name Large Plant 1 Large Plant2 Large Plant3 Medium Plant 1 Medium Plant2 Medium Plants Small Plant 1 Small Plant2 Small Plant3 242.1569 441.1765 416.6667 0 Reduced Objective Cost Coefficien 0 1000 0 1000 0 1000 0 1100 0 1100 0 1100 -300 700 -300 700 -300 700 Allowable Allowable Increase Decrease 0 0 1E+30 0 1E+30 0 100 1E+30 0 1E+30 0 300 1E+30 300 1E+30 300 1E+30 0 0 Constraints Final Cell Name Value $T$28 Production in Plant 1 588.2353 $U$28 Production in Plant2 441.1765 $V$28 Production in Plant3416.6667 $T$32 Equal % Plant 1,2 0.490196 SU$32 Equal % Plant 2,3 0.490196 $T$37 Space Occupied Plant 11764.71 $U$37 Space Occupied Plant 6617.647 $V$37 Space Occupied Plant 5000 $W$25 Large Production 346.0784 $W$26 Medium Production 1100 $W$27 Small Production 0 SW$25 Large Product sales 346.0784 $W$26 Medium Product sale 1100 $W$27 Small Product sales 0 Shadow Constraint Price R.H. Side 0 1200 0 900 0 850 1200000 0 2100000 0 0 13000 0 12000 289.2156863 5000 0 1000 100 1100 0 700 0 900 0 1200 0 750 Allowable Allowable Increase Decrease 1E+30 611.7647 1E+30 458.8235 1E+30 433.3333 0.051470588 0.288399 0.051470588 0.164799 1E+30 1235.294 1E+30 5382.353 525 1196.61 1E+30 653.9216 100 242.1569 1E+30 700 1E+30 553.9216 1E+30 100 1E+30 750 use this capacity to produce a product that comes in three sizes, Large, Medium,

and Small. Any plant can produce any combination of the product sizes. The

manufacturer wants to determine how many units to produce in each plant of

each product size. The decision variables to solve for are therefore:

PLEASE SOLVE FOR#5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started