Answered step by step

Verified Expert Solution

Question

1 Approved Answer

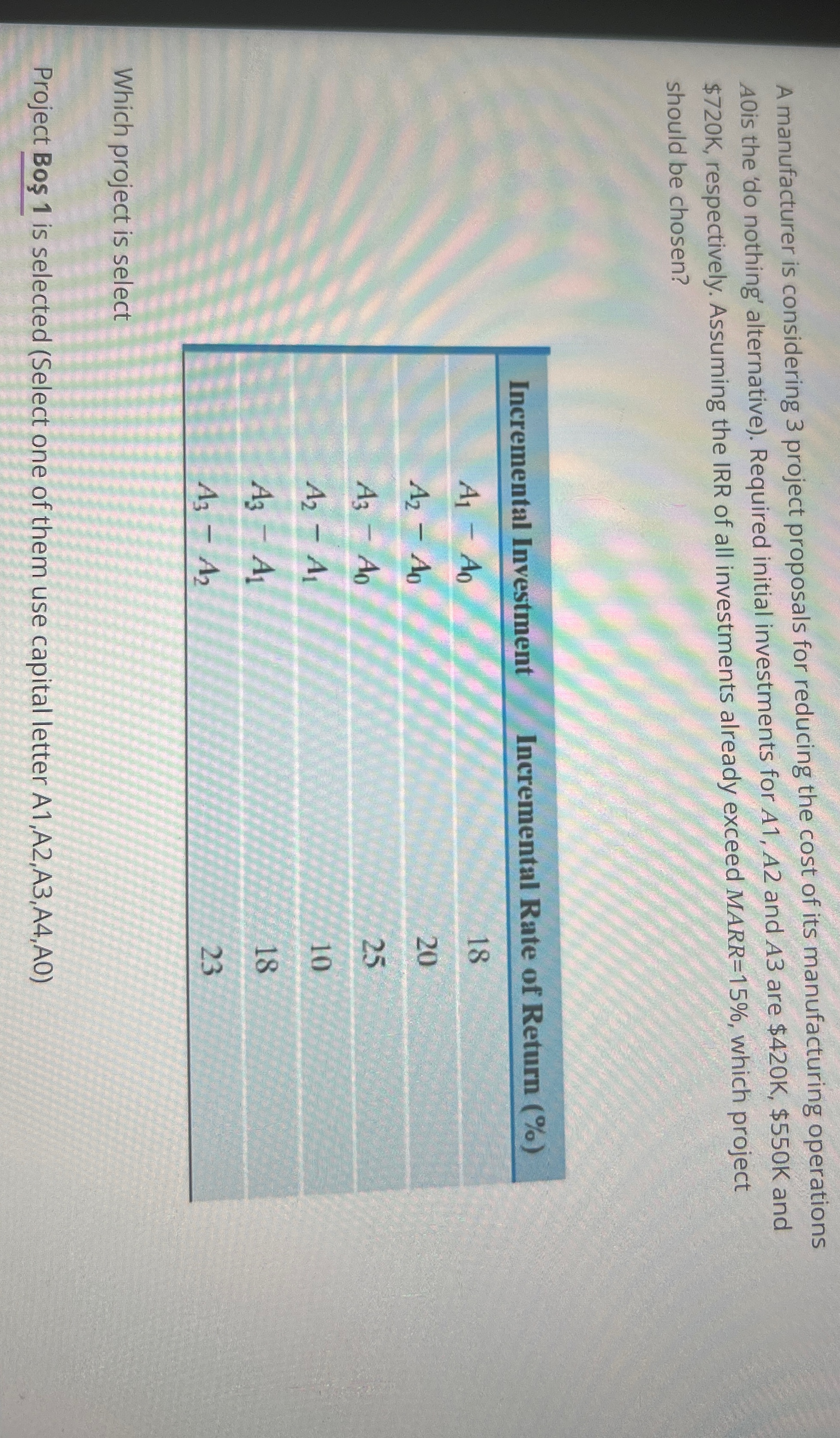

A manufacturer is considering 3 project proposals for reducing the cost of its manufacturing operations A Ois the ' do nothing' alternative ) . Required

A manufacturer is considering project proposals for reducing the cost of its manufacturing operations A Ois the do nothing' alternative Required initial investments for and are $$ and $ respectively. Assuming the IRR of all investments already exceed MARR which project should be chosen?

tableIncremental Investment,Incremental Rate of Return

Which project is select

Project Bo is selected Select one of them use capital letter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started