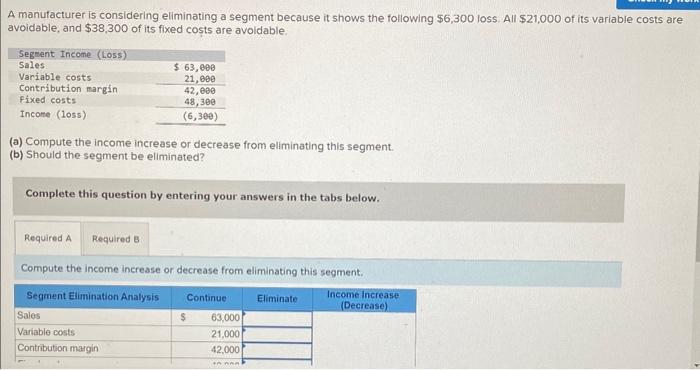

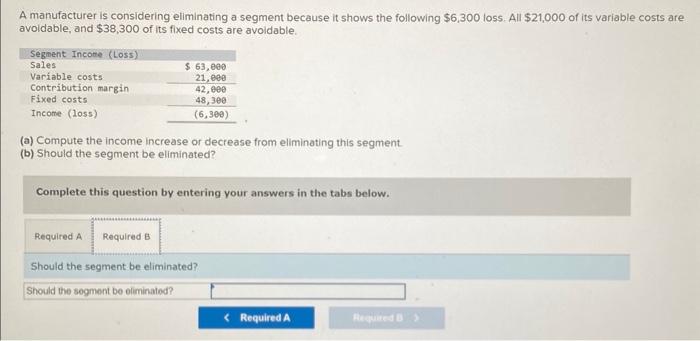

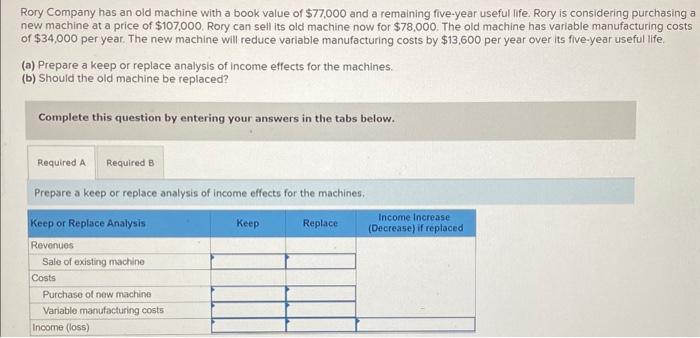

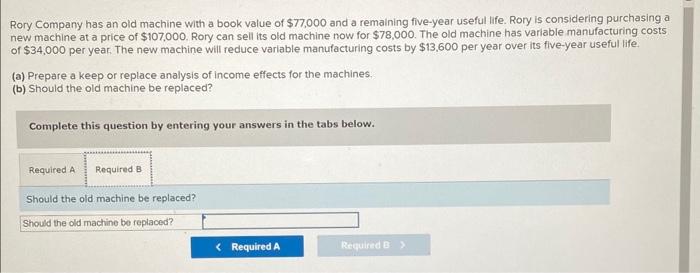

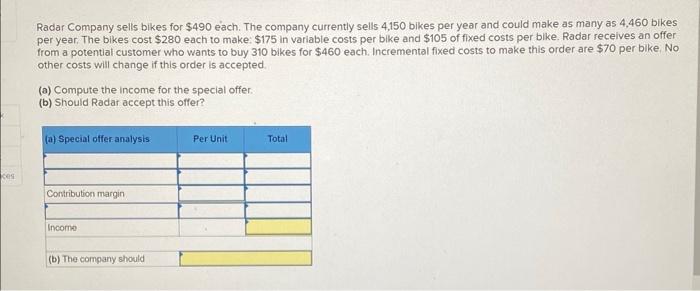

A manufacturer is considering eliminating a segment because it shows the following $6,300 loss. All $21,000 of its variable costs are avoidable, and $38,300 of its fixed costs are avoldable. (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segment be eliminated? Complete this question by entering your answers in the tabs below. Compute the income increase or decrease from eliminating this segment. A manufacturer is considering eliminating a segment because it shows the following $6,300 loss. All $21,000 of its variable costs are avoldable, and $38,300 of its fixed costs are avoidable. (a) Compute the income increase or decrease from eliminating this segment (b) Should the segment be eliminated? Complete this question by entering your answers in the tabs below. Should the segment be eliminated? Rory Company has an old machine with a book value of $77,000 and a remaining five-year useful life. Rory is considering purchasing a new machine at a price of $107,000. Rory can sell its old machine now for $78,000. The old machine has variable manufacturing costs of $34,000 per year. The new machine will reduce variable manufacturing costs by $13,600 per year over its five-year useful life. (a) Prepare a keep or replace analysis of income effects for the machines. (b) Should the old machine be replaced? Complete this question by entering your answers in the tabs below. Prepare a keep or replace analysis of income effects for the machines. Rory Company has an old machine with a book value of $77,000 and a remaining five-year useful life. Rory is considering purchasing a new machine at a price of $107,000. Rory can sell its old machine now for $78,000. The old machine has variable manufacturing costs of $34,000 per year. The new machine will reduce varlable manufacturing costs by $13,600 per year over its five-year useful life. (a) Prepare a keep or replace analysis of income effects for the machines. (b) Should the old machine be replaced? Complete this question by entering your answers in the tabs below. Should the old machine be replaced? Radar Company sells bikes for $490 each. The company currently sells 4,150 bikes per year and could make as many as 4,460 bikes per year. The bikes cost $280 each to make: $175 in variable costs per bike and $105 of fixed costs per blke. Radar recelves an offer from a potential customer who wants to buy 310 bikes for $460 each. Incremental fixed costs to make this order are $70 per bike. No other costs will change if this order is accepted (a) Compute the income for the special offer. (b) Should Radar accept this offer