Answered step by step

Verified Expert Solution

Question

1 Approved Answer

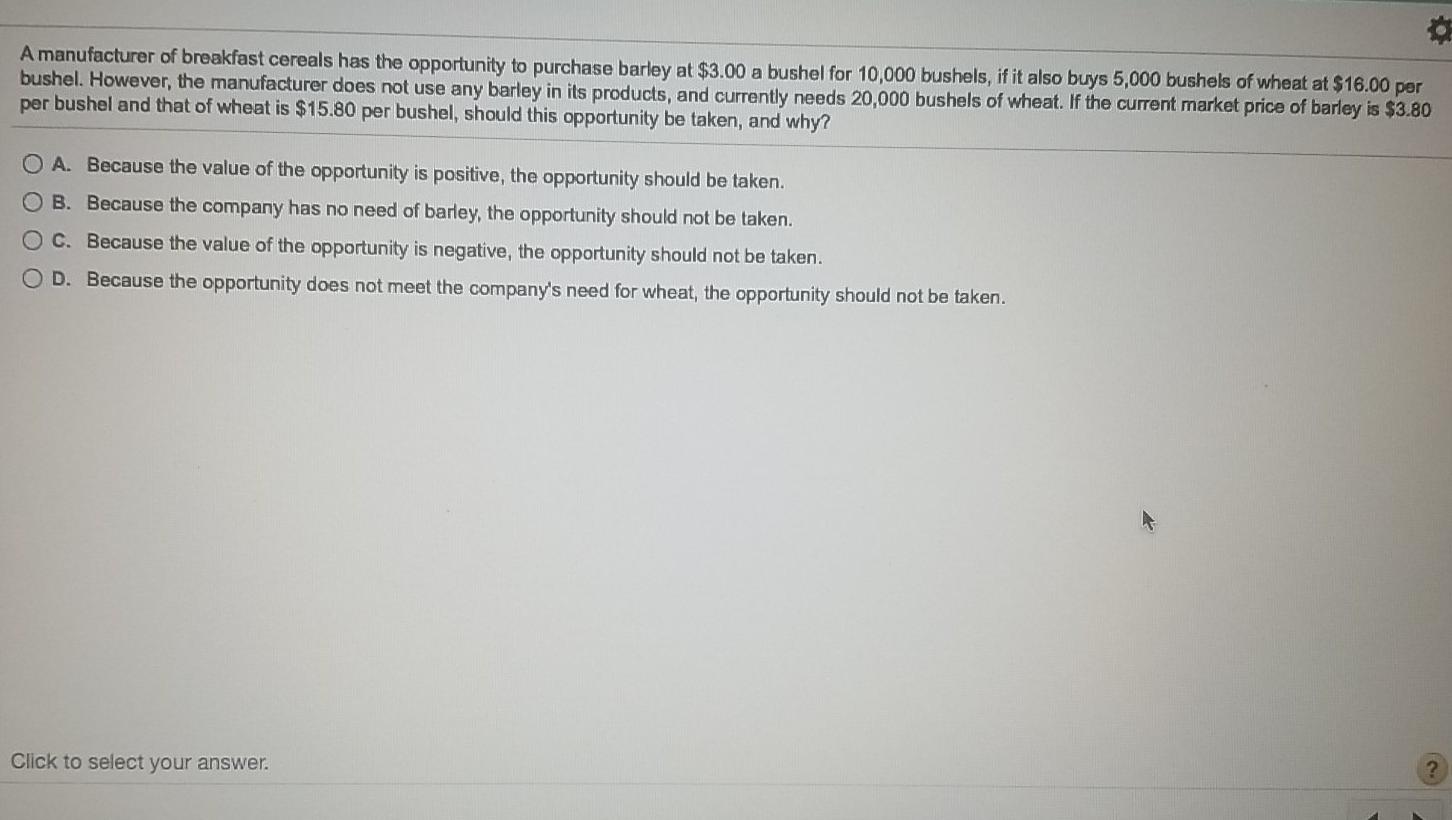

A manufacturer of breakfast cereals has the opportunity to purchase barley at $3.00 a bushel for 10,000 bushels, if it also buys 5,000 bushels of

A manufacturer of breakfast cereals has the opportunity to purchase barley at $3.00 a bushel for 10,000 bushels, if it also buys 5,000 bushels of wheat at $16.00 per bushel. However, the manufacturer does not use any barley in its products, and currently needs 20,000 bushels of wheat. If the current market price of barley is $3.80 per bushel and that of wheat is $15.80 per bushel, should this opportunity be taken, and why? O A. Because the value of the opportunity is positive, the opportunity should be taken. B. Because the company has no need of barley, the opportunity should not be taken. C. Because the value of the opportunity is negative, the opportunity should not be taken. D. Because the opportunity does not meet the company's need for wheat, the opportunity should not be taken. Click to select your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started