Question

A manufacturer of fabricated metal products has acquired a new plasma table for $37,000. It is projected that the acquisition of this equipment will increase

A manufacturer of fabricated metal products has acquired a new plasma table for $37,000. It is projected that the acquisition of this equipment will increase revenue by $10,000 per year. Operating costs for the machine will average $2,600 per year. The machine will be depreciated using the MACRS method, with a recovery period of 7 years. The company uses an after-tax MARR rate of 10% and has an effective tax rate of 30%.

1. Has this asset been correctly classified? Justify your answer (be specific). In subsequent parts, use the depreciation method and classification indicated above regardless of your conclusion.

2. Now, suppose that the duration of the project is six years and that an estimate of the value of the equipment cannot be obtained from the marketplace.

2.1. Estimate the SV value at the end of the project period using the appropriate technique. In subsequent parts, assume the estimated SV is $12,000, regardless of the result that you actually obtained.

2.2. Find the before-tax PW, IRR and discounted payback period (before-tax MARR = 10%). Can the acquisition be economically justified? Why or why not?

2.3. Find the after-tax PW, IRR and discounted payback period. Can the acquisition be economically justified? Why or why not?

2.4. What is the tax on the disposal transaction?

2.5. What conclusion can be drawn by comparing the results of the before- and after-tax analyses?

Part 2.3 must be completed using Microsoft Excel1 ; hand calculations and the use of tables should be avoided, with the notable exception of MACRS recovery rates, which may be entered directly. In addition, you must provide documentation that your (basic) spreadsheet has been checked using an example with a known solution (provide copy of example and cite source).

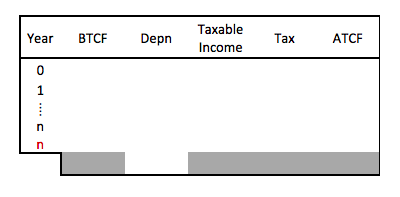

The results for Part 2.3 must be presented in tables that adhere to the template below. However, you may use additional columns and hidden columns. In particular, note that a separate row is required for the disposal transaction. The manner in which your results are presented will be evaluated. Specifically, tables should not span multiple pages (e.g., neither the rightmost columns nor lowermost rows should appear on a page different from that of the main table). The spreadsheet table should be pasted into a Word document.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started