Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturer plans to launch a new product line. Product line will be viable for 8 years. Annualized cost of capital is 8%. Initial

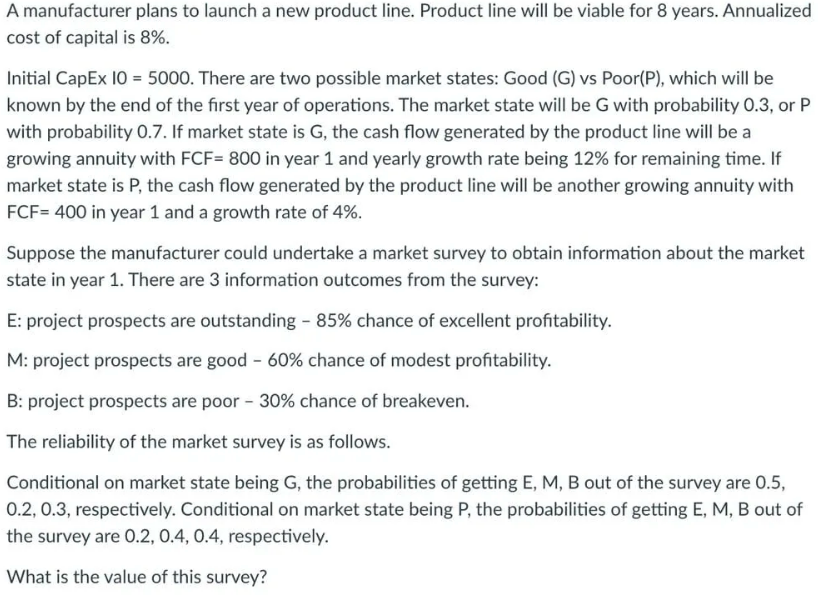

A manufacturer plans to launch a new product line. Product line will be viable for 8 years. Annualized cost of capital is 8%. Initial CapEx 10 = 5000. There are two possible market states: Good (G) vs Poor (P), which will be known by the end of the first year of operations. The market state will be G with probability 0.3, or P with probability 0.7. If market state is G, the cash flow generated by the product line will be a growing annuity with FCF= 800 in year 1 and yearly growth rate being 12% for remaining time. If market state is P, the cash flow generated by the product line will be another growing annuity with FCF= 400 in year 1 and a growth rate of 4%. Suppose the manufacturer could undertake a market survey to obtain information about the market state in year 1. There are 3 information outcomes from the survey: E: project prospects are outstanding - 85% chance of excellent profitability. M: project prospects are good - 60% chance of modest profitability. B:project prospects are poor - 30% chance of breakeven. The reliability of the market survey is as follows. Conditional on market state being G, the probabilities of getting E, M, B out of the survey are 0.5, 0.2, 0.3, respectively. Conditional on market state being P, the probabilities of getting E, M, B out of the survey are 0.2, 0.4, 0.4, respectively. What is the value of this survey?

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Project Analysis for New Product Line Heres an analysis of the new product line for the manufacturer ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started