Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Manufacturing company is considering expanding its production capacity to meet a growing demand for its product line of air fresheners. The alternatives are to

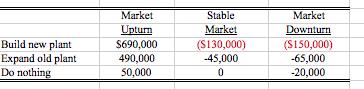

A Manufacturing company is considering expanding its production capacity to meet a growing demand for its product line of air fresheners. The alternatives are to build a new plant, expand the old plant, or do nothing. The marketing department estimates a 35 percent probability of a market upturn, a 40 percent probability of a stable market, and a 25 percent probability of a market downturn. Georgia Swain, the firm's capital appropriations analyst, estimates the following annual returns for these alternatives:

| |||||||||||||||

Build new plant Expand old plant Do nothing Market Upturn $690,000 490,000 50,000 Stable Market ($130,000) -45,000 0 Market Downturn ($150,000) -65,000 -20,000

Step by Step Solution

★★★★★

3.59 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Let us do decision tree analysis for all the 3 options In decision tr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started