Answered step by step

Verified Expert Solution

Question

1 Approved Answer

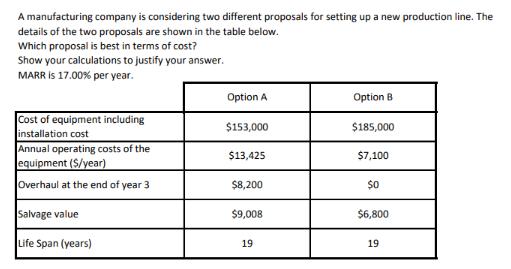

A manufacturing company is considering two different proposals for setting up a new production line. The details of the two proposals are shown in

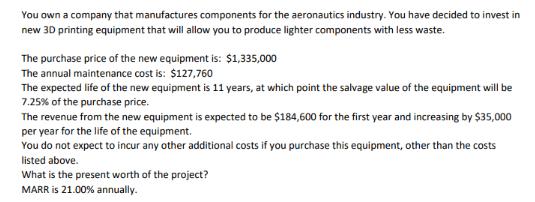

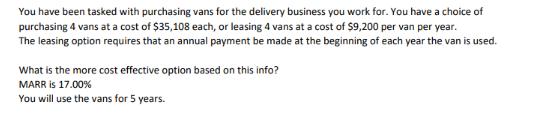

A manufacturing company is considering two different proposals for setting up a new production line. The details of the two proposals are shown in the table below. Which proposal is best in terms of cost? Show your calculations to justify your answer. MARR is 17.00% per year. Cost of equipment including installation cost Annual operating costs of the equipment ($/year) Overhaul at the end of year 3 Salvage value Life Span (years) Option A $153,000 $13,425 $8,200 $9,008 19 Option B $185,000 $7,100 $0 $6,800 19 You own a company that manufactures components for the aeronautics industry. You have decided to invest in new 3D printing equipment that will allow you to produce lighter components with less waste. The purchase price of the new equipment is: $1,335,000 The annual maintenance cost is: $127,760 The expected life of the new equipment is 11 years, at which point the salvage value of the equipment will be 7.25% of the purchase price. The revenue from the new equipment is expected to be $184,600 for the first year and increasing by $35,000 per year for the life of the equipment. You do not expect to incur any other additional costs if you purchase this equipment, other than the costs listed above. What is the present worth of the project? MARR is 21.00% annually. You have been tasked with purchasing vans for the delivery business you work for. You have a choice of purchasing 4 vans at a cost of $35,108 each, or leasing 4 vans at a cost of $9,200 per van per year. The leasing option requires that an annual payment be made at the beginning of each year the van is used. What is the more cost effective option based on this info? MARR is 17.00% You will use the vans for 5 years.

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION For the first problem To determine which proposal is best in terms of cost we need to calculate the present worth of each proposal The presen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started