Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturing company operates using an old machine with an annual operating cost of $200,000 and annual sales revenue of $250,000. The manager considers

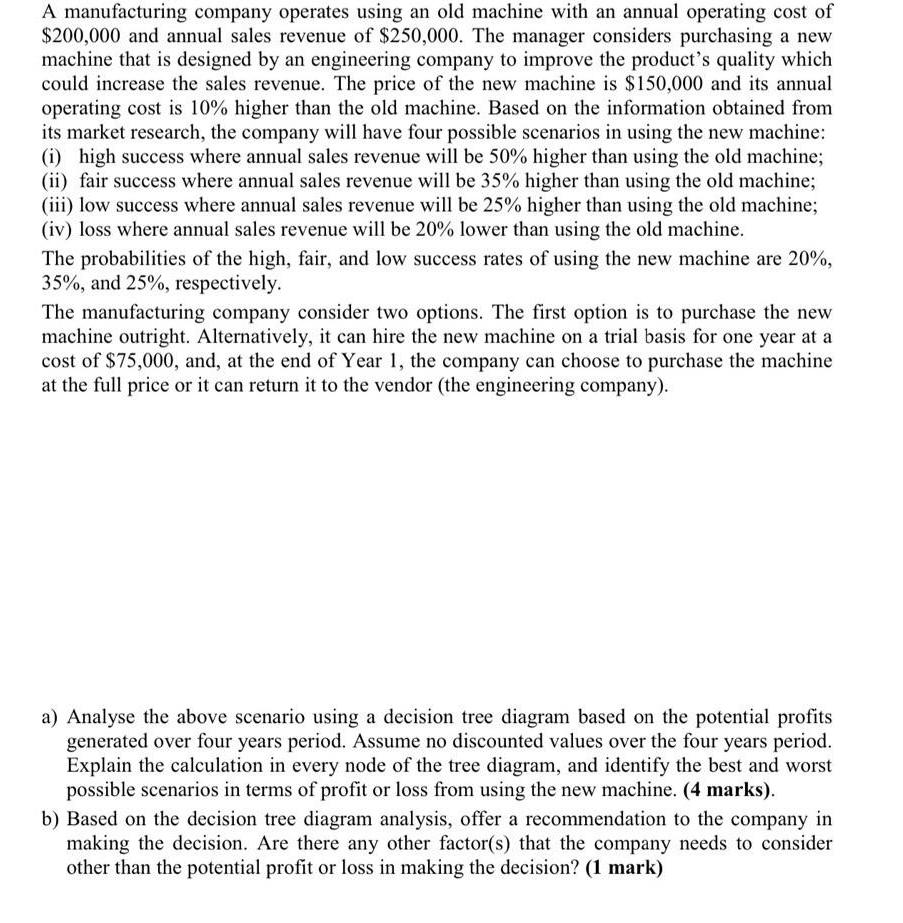

A manufacturing company operates using an old machine with an annual operating cost of $200,000 and annual sales revenue of $250,000. The manager considers purchasing a new machine that is designed by an engineering company to improve the product's quality which could increase the sales revenue. The price of the new machine is $150,000 and its annual operating cost is 10% higher than the old machine. Based on the information obtained from its market research, the company will have four possible scenarios in using the new machine: (i) high success where annual sales revenue will be 50% higher than using the old machine; (ii) fair success where annual sales revenue will be 35% higher than using the old machine; (iii) low success where annual sales revenue will be 25% higher than using the old machine; (iv) loss where annual sales revenue will be 20% lower than using the old machine. The probabilities of the high, fair, and low success rates of using the new machine are 20%, 35%, and 25%, respectively. The manufacturing company consider two options. The first option is to purchase the new machine outright. Alternatively, it can hire the new machine on a trial basis for one year at a cost of $75,000, and, at the end of Year 1, the company can choose to purchase the machine at the full price or it can return it to the vendor (the engineering company). a) Analyse the above scenario using a decision tree diagram based on the potential profits generated over four years period. Assume no discounted values over the four years period. Explain the calculation in every node of the tree diagram, and identify the best and worst possible scenarios in terms of profit or loss from using the new machine. (4 marks). b) Based on the decision tree diagram analysis, offer a recommendation to the company in making the decision. Are there any other factor(s) that the company needs to consider other than the potential profit or loss in making the decision? (1 mark)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started