Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturing company wants to expand its business, for this it has 4 investment alternatives A, B, C and D, all of them with a

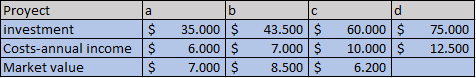

A manufacturing company wants to expand its business, for this it has 4 investment alternatives A, B, C and D, all of them with a planning horizon of 10 years. A and B are mutually exclusive, while project C depends on the completion of project A, and project D depends on B. Below are the values according to a market study for each oneof the proyects

With a rate of return of 10%.

a) With an unlimited budget. which project should be chosen?

b)With a budget of $50,000, does the option taken in (b) change?

please prove with calculation table

\begin{tabular}{|l|lr|lr|ll|ll|} \hline Proyect & a & & b & & c & & d & \\ \hline investment & $ & 35.000 & $ & 43.500 & $ & 60.000 & $ & 75.000 \\ \hline Costs-annual income & $ & 6.000 & $ & 7.000 & $ & 10.000 & $ & 12.500 \\ \hline Market value & $ & 7.000 & $ & 8.500 & $ & 6.200 & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started