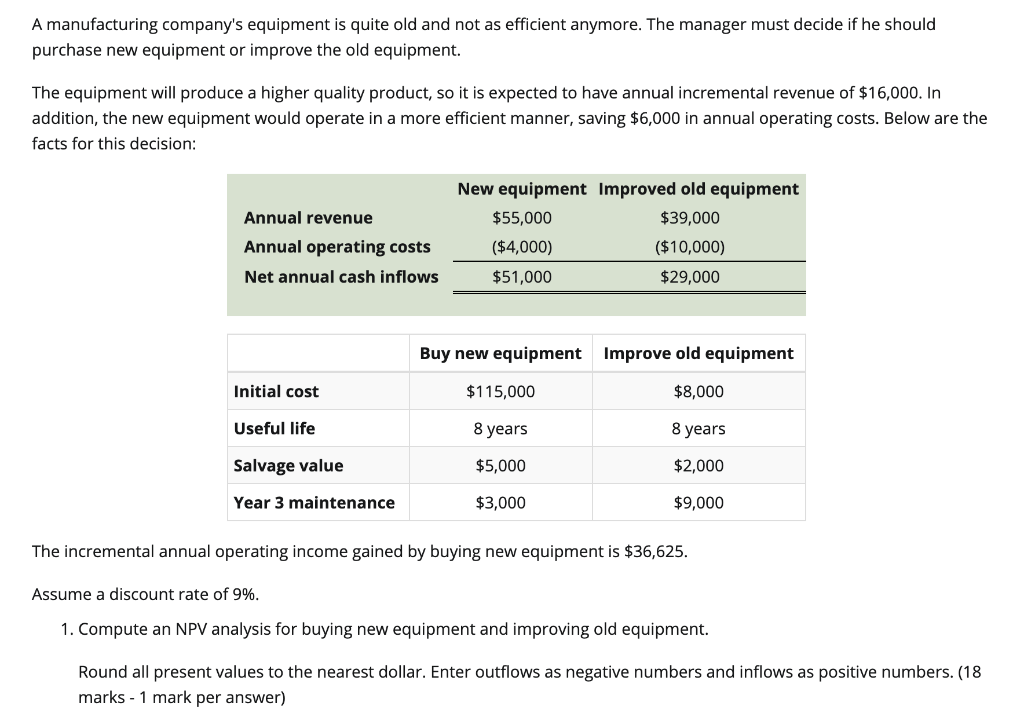

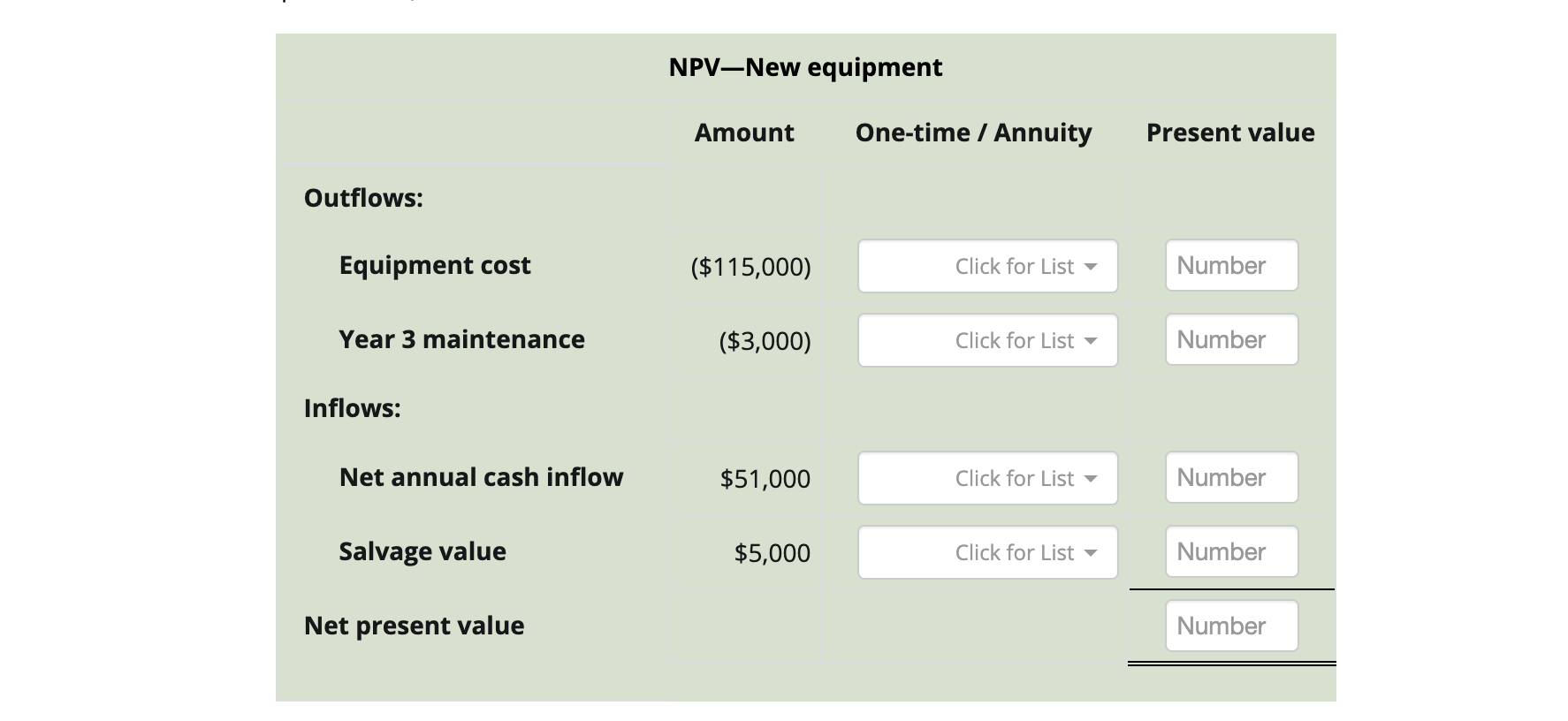

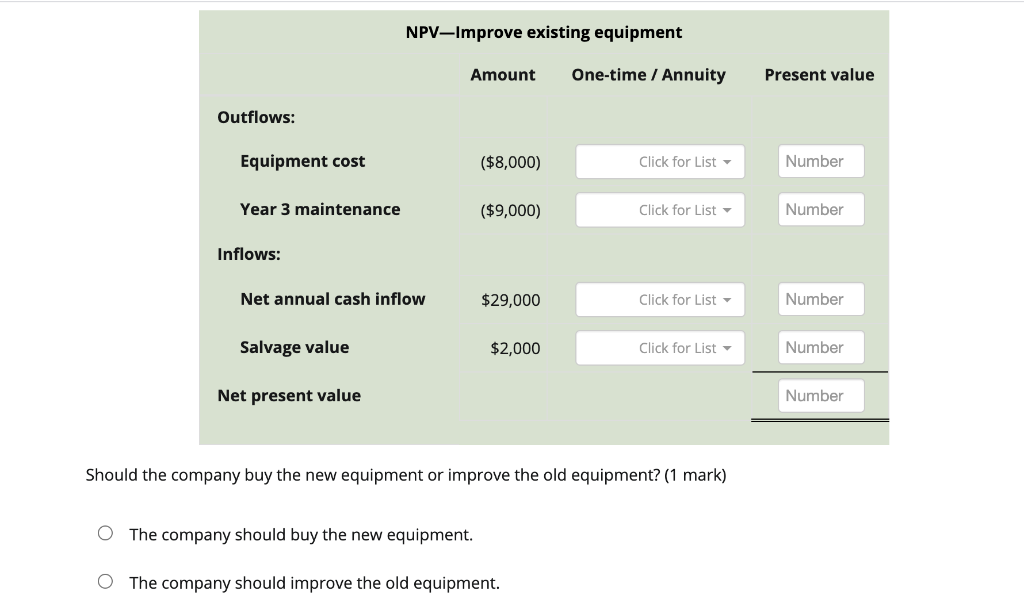

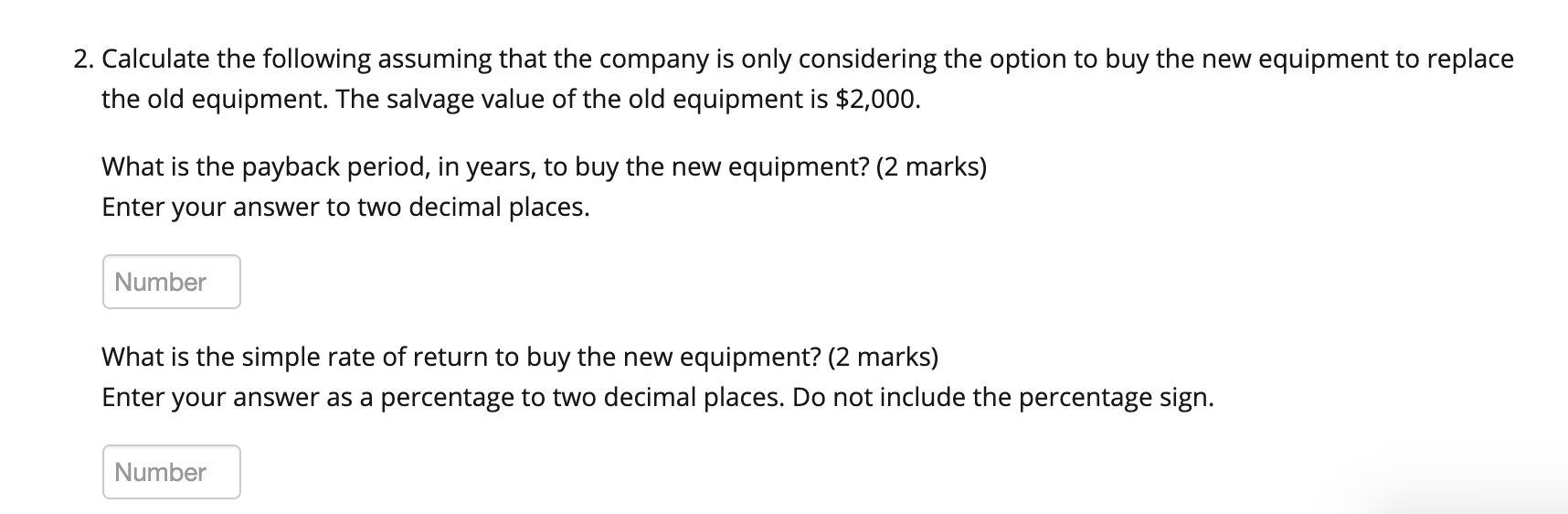

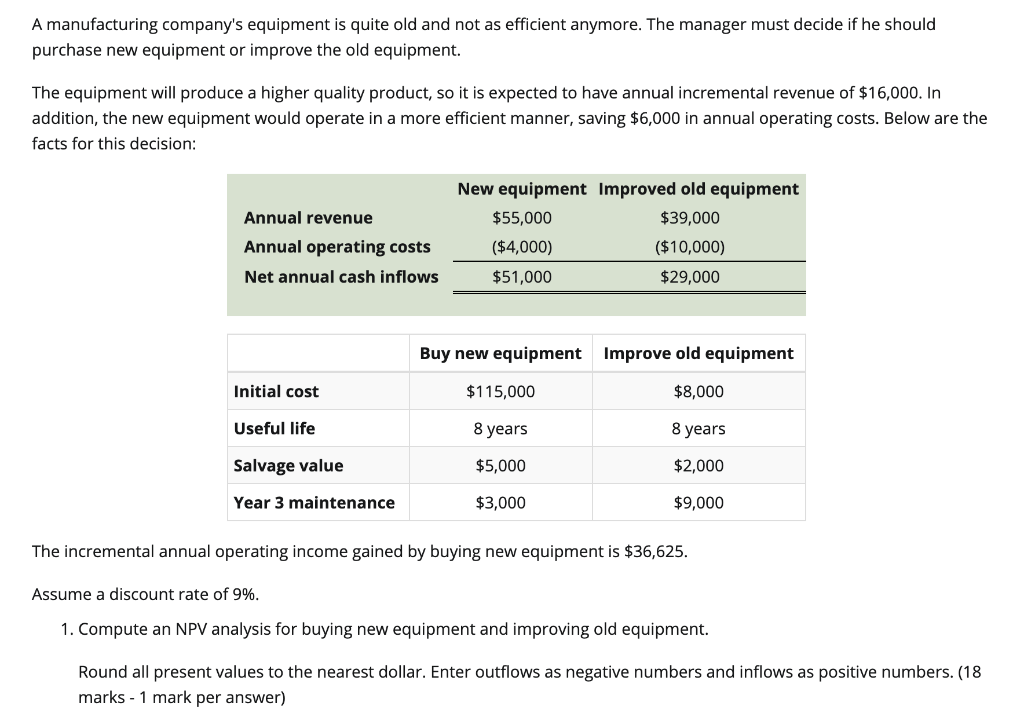

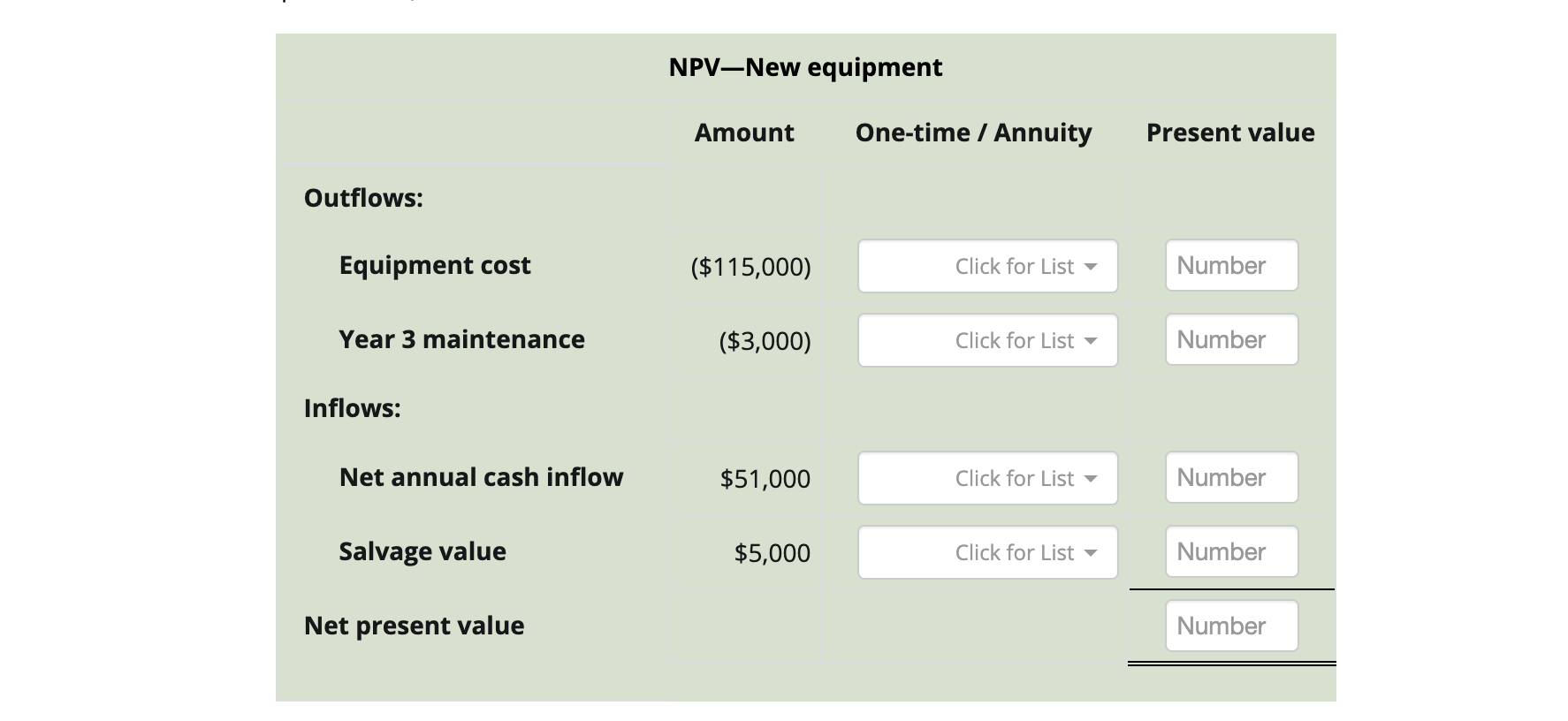

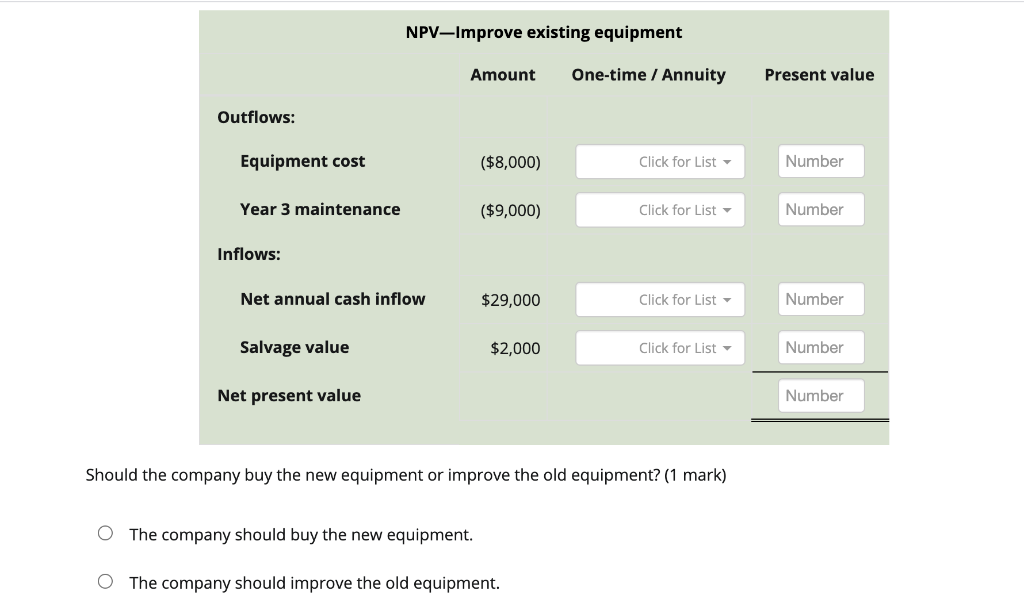

A manufacturing company's equipment is quite old and not as efficient anymore. The manager must decide if he should purchase new equipment or improve the old equipment. The equipment will produce a higher quality product, so it is expected to have annual incremental revenue of $16,000. In addition, the new equipment would operate in a more efficient manner, saving $6,000 in annual operating costs. Below are the facts for this decision: Annual revenue Annual operating costs Net annual cash inflows New equipment Improved old equipment $55,000 $39,000 ($4,000) ($10,000) $51,000 $29,000 Buy new equipment Improve old equipment Initial cost $115,000 $8,000 Useful life 8 years 8 years Salvage value $5,000 $2,000 Year 3 maintenance $3,000 $9,000 The incremental annual operating income gained by buying new equipment is $36,625. Assume a discount rate of 9%. 1. Compute an NPV analysis for buying new equipment and improving old equipment. Round all present values to the nearest dollar. Enter outflows as negative numbers and inflows as positive numbers. (18 marks - 1 mark per answer) NPV-New equipment Amount One-time / Annuity Present value Outflows: Equipment cost ($115,000) Click for List Number Year 3 maintenance ($3,000) Click for List Number Inflows: Net annual cash inflow $51,000 Click for List Number Salvage value $5,000 Click for List - Number Net present value Number NPV-Improve existing equipment Amount One-time / Annuity Present value Outflows: Equipment cost ($8,000) Click for List Number Year 3 maintenance ($9,000) Click for List Number Inflows: Net annual cash inflow $29,000 Click for List - Number Salvage value $2,000 Click for List Number Net present value Number Should the company buy the new equipment or improve the old equipment? (1 mark) The company should buy the new equipment. O The company should improve the old equipment. 2. Calculate the following assuming that the company is only considering the option to buy the new equipment to replace the old equipment. The salvage value of the old equipment is $2,000. What is the payback period, in years, to buy the new equipment? (2 marks) Enter your answer to two decimal places. Number What is the simple rate of return to buy the new equipment? (2 marks) Enter your answer as a percentage to two decimal places. Do not include the percentage sign. Number