Answered step by step

Verified Expert Solution

Question

1 Approved Answer

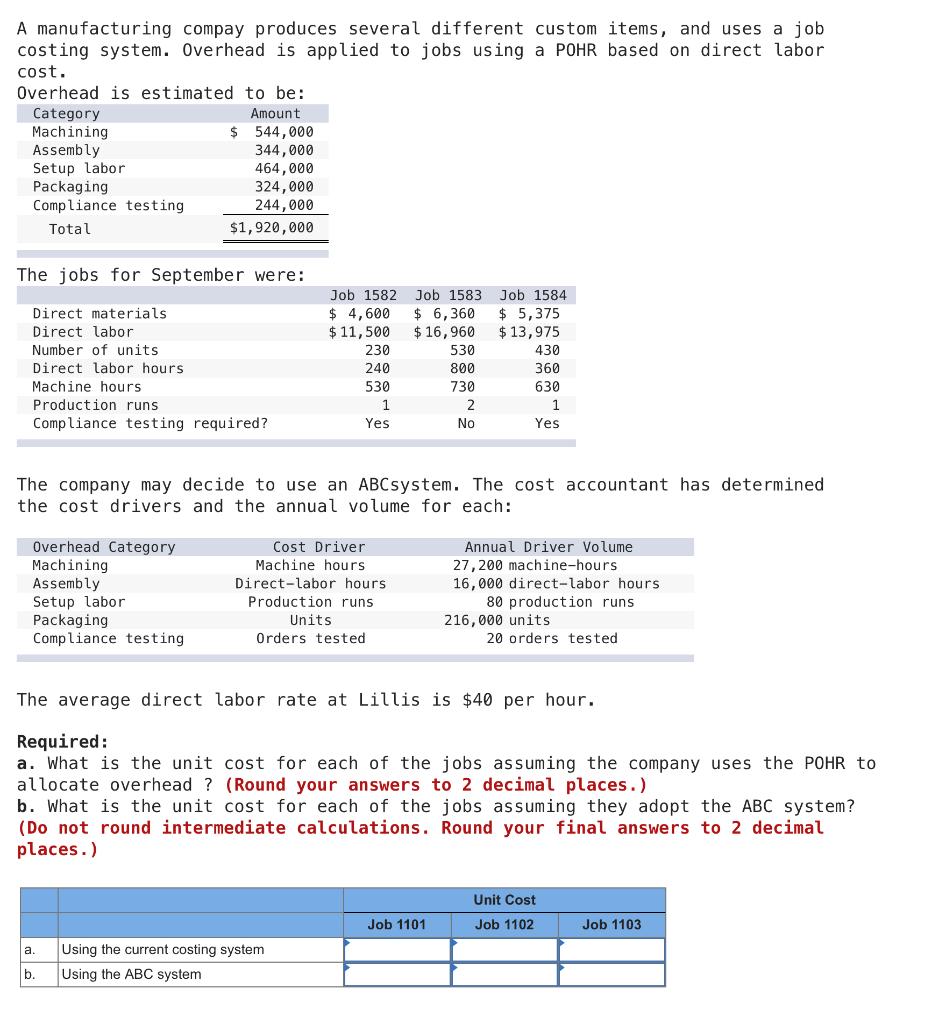

A manufacturing compay produces several different custom items, and uses a job costing system. Overhead is applied to jobs using a POHR based on

A manufacturing compay produces several different custom items, and uses a job costing system. Overhead is applied to jobs using a POHR based on direct labor cost. Overhead is estimated to be: Amount Category Machining Assembly Setup labor Packaging Compliance testing 2$ 544,000 344,000 464,000 324,000 244,000 Total $1,920,000 The jobs for September were: Job 1584 $ 5,375 $ 13,975 Job 1582 Job 1583 $ 4,600 $ 11,500 $ 6,360 $ 16,960 Direct materials Direct labor Number of units 230 530 430 Direct labor hours Machine hours Production runs 240 800 360 530 730 630 1 2 1 Compliance testing required? Yes No Yes The company may decide to use an ABCsystem. The cost accountant has determined the cost drivers and the annual volume for each: Overhead Category Machining Assembly Setup labor Cost Driver Annual Driver Volume 27,200 machine-hours 16,000 direct-labor hours 80 production runs Machine hours Direct-labor hours Production runs Units Packaging Compliance testing 216,000 units Orders tested 20 orders tested The average direct labor rate at Lillis is $40 per hour. Required: a. What is the unit cost for each of the jobs assuming the company uses the POHR to allocate overhead ? (Round your answers to 2 decimal places.) b. What is the unit cost for each of the jobs assuming they adopt the ABC system? (Do not round intermediate calculations. Round your final answers to 2 decimal places.) Unit Cost Job 1101 Job 1102 Job 1103 a. Using the current costing system b. Using the ABC system

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Unit Cost Job 1101 Job 1102 Job 1103 a using the Current Costing system p Using the ABC system 14000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started