Answered step by step

Verified Expert Solution

Question

1 Approved Answer

X Company is considering producing and selling a new product. After conducting a market research study that cost $4,000, company estimates are that sales

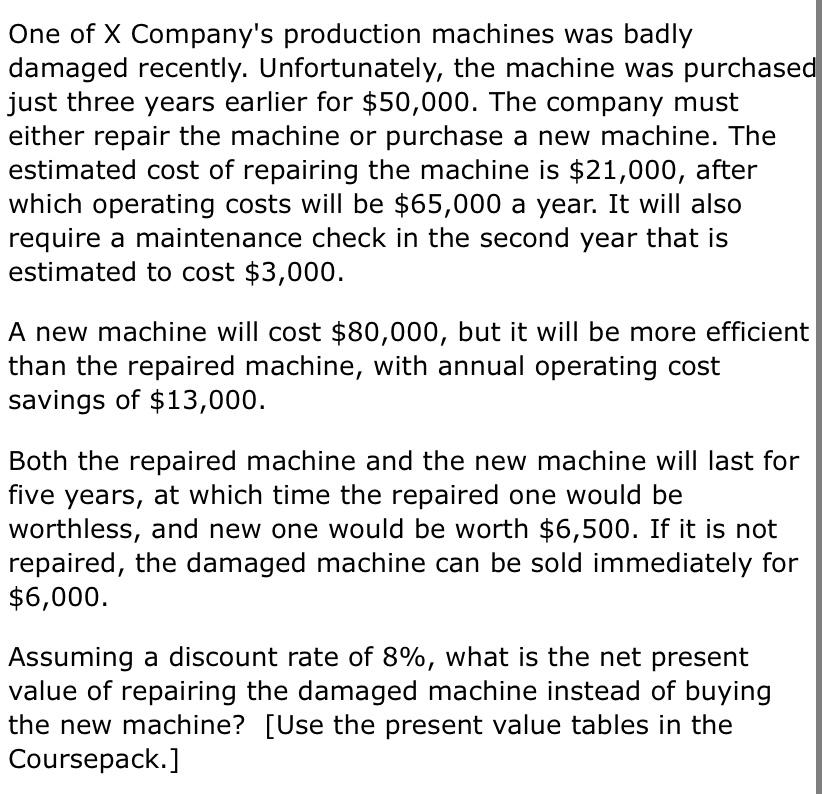

X Company is considering producing and selling a new product. After conducting a market research study that cost $4,000, company estimates are that sales of the product will be 8,400 units in each of the next four years, contribution margin per unit will be $6.10, and annual fixed costs will be $18,182. In order to produce the new product, additional equipment would have to be purchased, costing $120,000, with no salvage value at the end of four years. What is the internal rate of return of producing and selling this new product? [Submit your rate as a decimal: .XX] One of X Company's production machines was badly damaged recently. Unfortunately, the machine was purchased just three years earlier for $50,000. The company must either repair the machine or purchase a new machine. The estimated cost of repairing the machine is $21,000, after which operating costs will be $65,000 a year. It will also require a maintenance check in the second year that is estimated to cost $3,000. A new machine will cost $80,000, but it will be more efficient than the repaired machine, with annual operating cost savings of $13,000. Both the repaired machine and the new machine will last for five years, at which time the repaired one would be worthless, and new one would be worth $6,500. If it is not repaired, the damaged machine can be sold immediately for $6,000. Assuming a discount rate of 8%, what is the net present value of repairing the damaged machine instead of buying the new machine? [Use the present value tables in the Coursepack.]

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Net annual cash flows 33058 840061018182 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started