Answered step by step

Verified Expert Solution

Question

1 Approved Answer

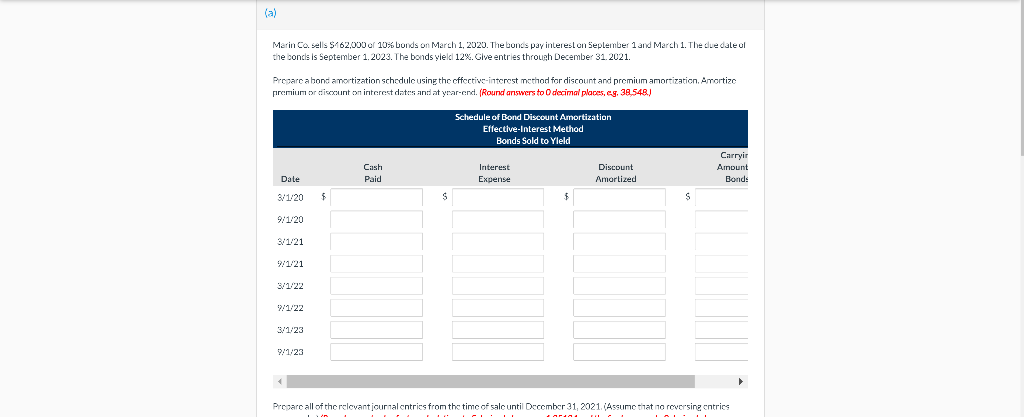

(a) Marin Co. sells $462,000 of 10% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due daleal

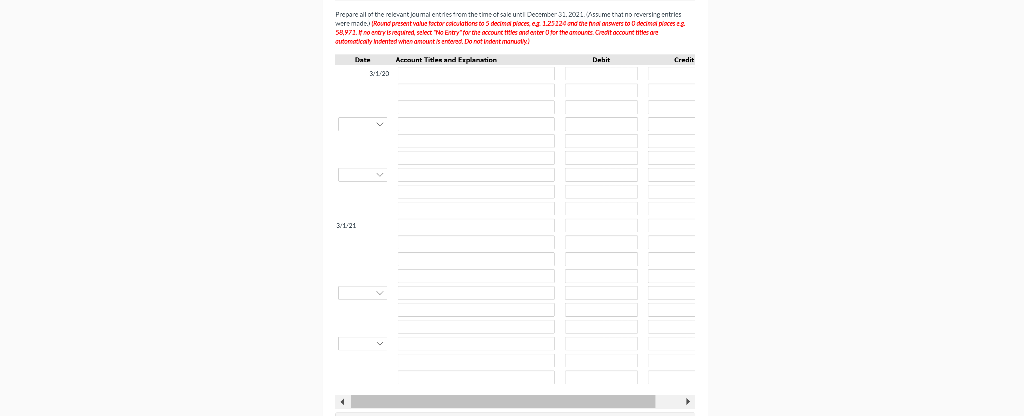

(a) Marin Co. sells $462,000 of 10% bonds on March 1, 2020. The bonds pay interest on September 1 and March 1. The due daleal the bonds is September 1.2023. The bonds yield 12%. Give entries through December 31, 2021. Preoarca bond amortization schedulc using the effective interest method for discount and premium amortization. Amortize premium or discount on interest dates and at year-end. (Round answers to decimal places.eg, 38.548) Schedule of Bond Discount Amortization Effective Interest Method Bonds Sold to Yleld Cash Paid Interest Expense Discount Amortized Carryir Annount Bonds Dale 8/1/20 $ S S 9/1/20 3/1/21 9/1/21 3/1/22 9/1/22 3/1/23 9/1/23 Prepare all of the relevant curnal entries from the time of sale until December 31, 2021. Assuno sinat 10 reversing entries Prepare all the relevant jumalente cm the timectacul December 30.2021.7.5. mchancerscentries worem. Bound present value tctor calculation to decimal places, s 1.25224 and the manswers to decinal places 58.971. no erary is required, select To Entry for the account ttles and enter for the amounes. Creditoccountles are Gudmurdity Indented when amount is endered. Do not indent manusly! Arraunt Titles and Explanation Dahit Credit 3:1:20 3:1:21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started