Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A market consists of four stocks. The following information is given: Stock 1 : r 1 = 5 % , sigma 1 = 1

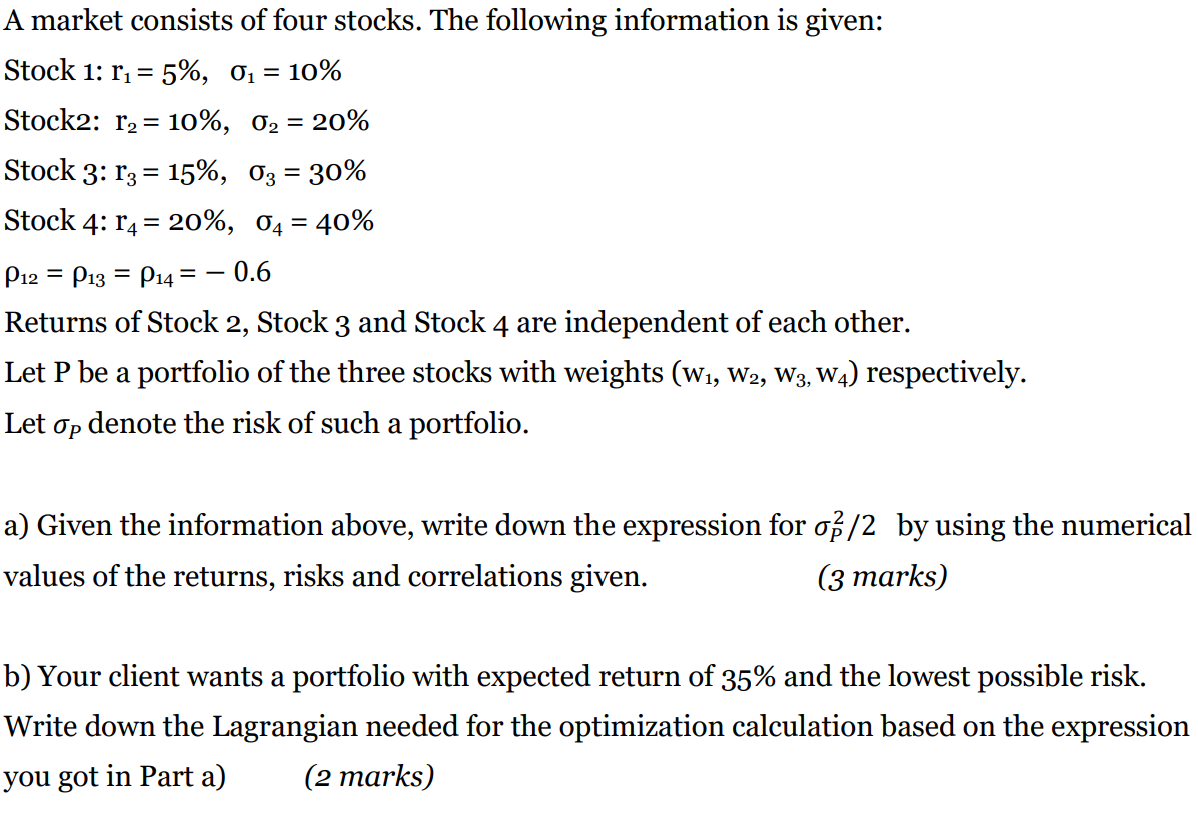

A market consists of four stocks. The following information is given:

Stock : rsigma

Stock: rsigma

Stock : rsigma

Stock : rsigma

rho rho rho

Returns of Stock Stock and Stock are independent of each other.

Let P be a portfolio of the three stocks with weights w w w w respectively.

Let denote the risk of such a portfolio.

a Given the information above, write down the expression for

by using the numerical

values of the returns, risks and correlations givenA market consists of four stocks. The following information is given:

Stock :

Stock:

Stock :

Stock :

Returns of Stock Stock and Stock are independent of each other.

Let P be a portfolio of the three stocks with weights respectively.

Let denote the risk of such a portfolio.

a Given the information above, write down the expression for by using the numerical

values of the returns, risks and correlations given.

marks

b Your client wants a portfolio with expected return of and the lowest possible risk.

Write down the Lagrangian needed for the optimization calculation based on the expression

you got in Part a

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started