Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A married couple files a joint return. The husband is self-employed and fails to report $250,000 of his income. His wife knew of the underreporting,

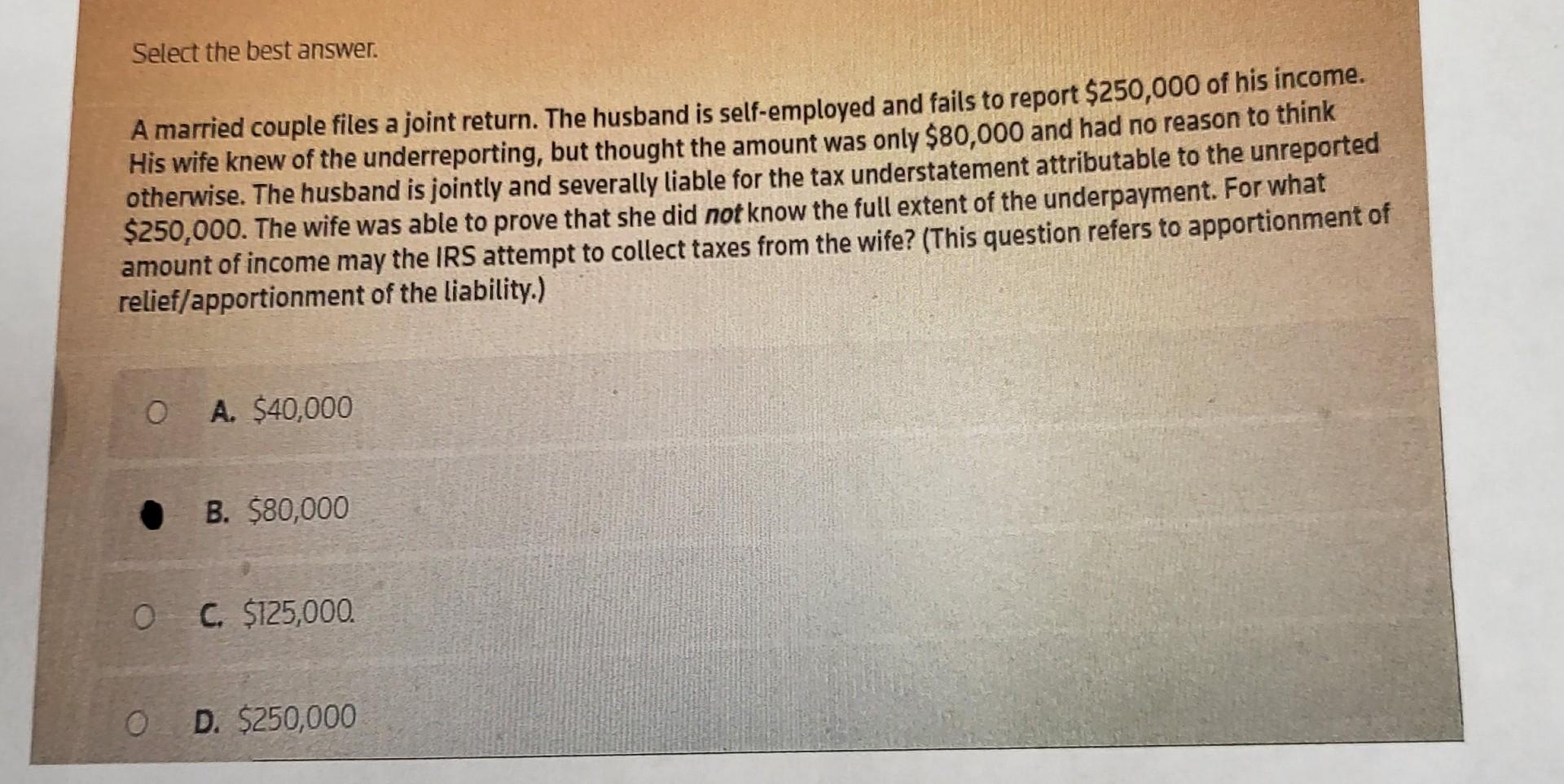

A married couple files a joint return. The husband is self-employed and fails to report $250,000 of his income. His wife knew of the underreporting, but thought the amount was only $80,000 and had no reason to think otherwise. The husband is jointly and severally liable for the tax understatement attributable to the unreported $250,000. The wife was able to prove that she did not know the full extent of the underpayment. For what amount of income may the IRS attempt to collect taxes from the wife? (This question refers to apportionment of relief/apportionment of the liability.) A. $40,000 B. $80,000 C. $125,000 D. $250,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started