Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A married decedent who was under absolute community of properties died on October 15, 2018. His estate provided the following information: Real properties inherited

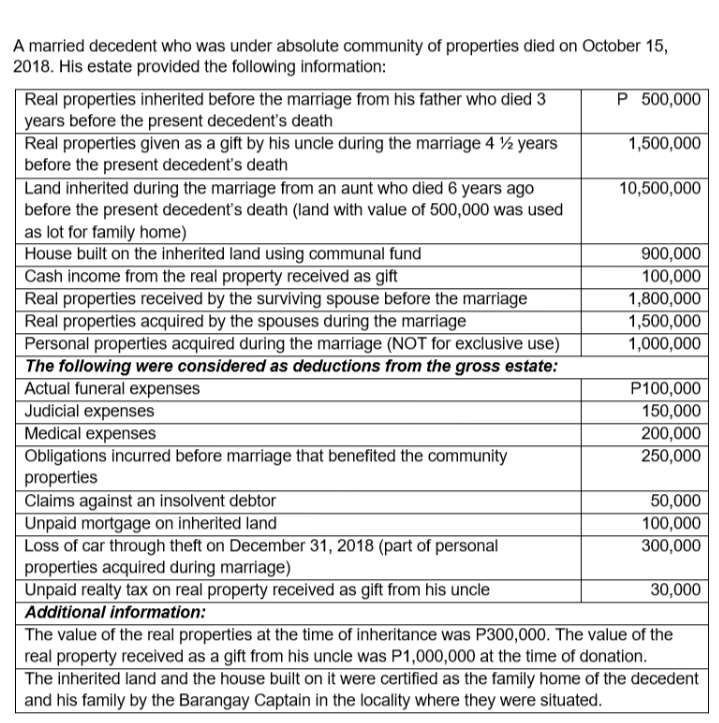

A married decedent who was under absolute community of properties died on October 15, 2018. His estate provided the following information: Real properties inherited before the marriage from his father who died 3 years before the present decedent's death Real properties given as a gift by his uncle during the marriage 4 years before the present decedent's death Land inherited during the marriage from an aunt who died 6 years ago before the present decedent's death (land with value of 500,000 was used as lot for family home) House built on the inherited land using communal fund Cash income from the real property received as gift Real properties received by the surviving spouse before the marriage Real properties acquired by the spouses during the marriage Personal properties acquired during the marriage (NOT for exclusive use) The following were considered as deductions from the gross estate: Actual funeral expenses Judicial expenses Medical expenses Obligations incurred before marriage that benefited the community properties Claims against an insolvent debtor Unpaid mortgage on inherited land Loss of car through theft on December 31, 2018 (part of personal properties acquired during marriage) Unpaid realty tax on real property received as gift from his uncle Additional information: P 500,000 1,500,000 10,500,000 900,000 100,000 1,800,000 1,500,000 1,000,000 P100,000 150,000 200,000 250,000 50,000 100,000 300,000 30,000 The value of the real properties at the time of inheritance was P300,000. The value of the real property received as a gift from his uncle was P1,000,000 at the time of donation. The inherited land and the house built on it were certified as the family home of the decedent and his family by the Barangay Captain in the locality where they were situated.

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided the gross estate of the deceased person would be calculated as fol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started