Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A mature levered firm can be valued as a perpetuity of operating free cash flows (OFCF's), the last of which was $9 million paid

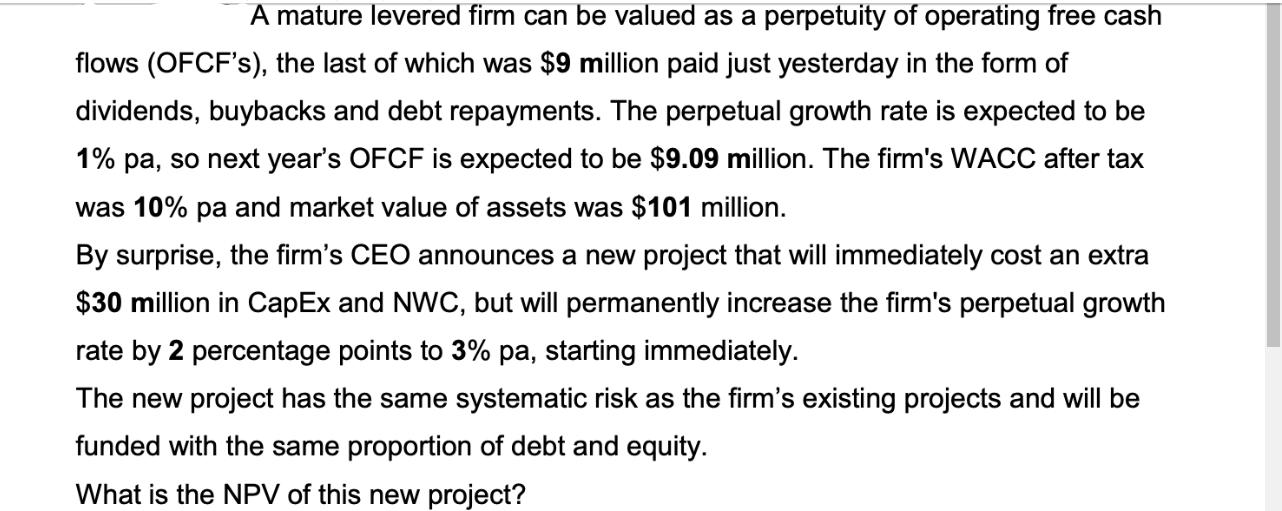

A mature levered firm can be valued as a perpetuity of operating free cash flows (OFCF's), the last of which was $9 million paid just yesterday in the form of dividends, buybacks and debt repayments. The perpetual growth rate is expected to be 1% pa, so next year's OFCF is expected to be $9.09 million. The firm's WACC after tax was 10% pa and market value of assets was $101 million. By surprise, the firm's CEO announces a new project that will immediately cost an extra $30 million in CapEx and NWC, but will permanently increase the firm's perpetual growth rate by 2 percentage points to 3% pa, starting immediately. The new project has the same systematic risk as the firm's existing projects and will be funded with the same proportion of debt and equity. What is the NPV of this new project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the NPV of the new project we need to find the present value of the incremental cash fl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started