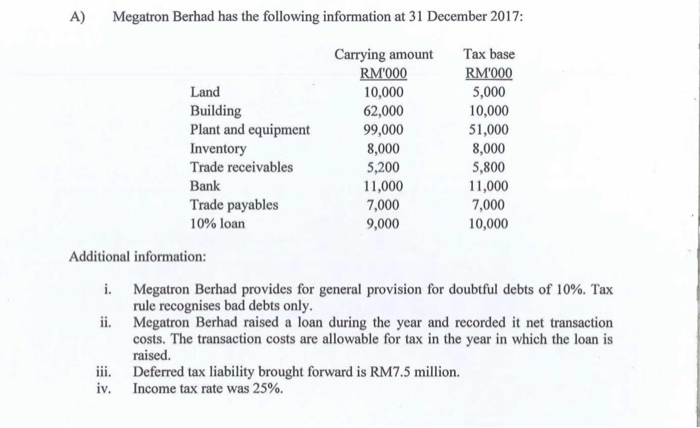

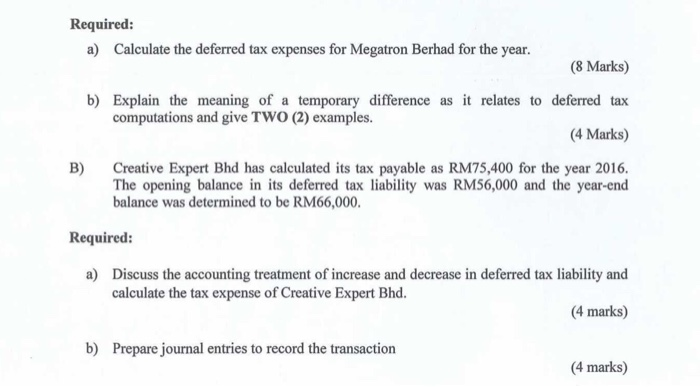

A) Megatron Berhad has the following information at 31 December 2017 Carrying amount RM000 10,000 62,000 99,000 8,000 5,200 11,000 7,000 9,000 Tax Land Building Plant and equipment Inventory Trade receivables Bank Trade payables 10% loan RM 000 5,000 10,000 51,000 8,000 5,800 11,000 7,000 0,000 Additional information: Megatron Berhad provides for general provision for doubtful debts of 10%. Tax rule recognises bad debts only ii. Megatron Berhad raised a loan during the year and recorded it net transaction costs. The transaction costs are allowable for tax in the year in which the loan is raised. Deferred tax liability brought forward is RM7.5 million. Income tax rate was 25%. iii. iv. Required: a) Calculate the deferred tax expenses for Megatron Berhad for the year. (8 Marks) b) Explain the meaning of a temporary difference as it relates to deferred tax (4 Marks) B) Creative Expert Bhd has calculated its tax payable as RM75,400 for the year 2016. computations and give TWO (2) examples. The opening balance in its deferred tax liability was RM56,000 and the year-end balance was determined to be RM66,000. Required: a) Discuss the accounting treatment of increase and decrease in deferred tax liability and calculate the tax expense of Creative Expert Bhd. (4 marks) b) Prepare journal entries to record the transaction 4 marks) A) Megatron Berhad has the following information at 31 December 2017 Carrying amount RM000 10,000 62,000 99,000 8,000 5,200 11,000 7,000 9,000 Tax Land Building Plant and equipment Inventory Trade receivables Bank Trade payables 10% loan RM 000 5,000 10,000 51,000 8,000 5,800 11,000 7,000 0,000 Additional information: Megatron Berhad provides for general provision for doubtful debts of 10%. Tax rule recognises bad debts only ii. Megatron Berhad raised a loan during the year and recorded it net transaction costs. The transaction costs are allowable for tax in the year in which the loan is raised. Deferred tax liability brought forward is RM7.5 million. Income tax rate was 25%. iii. iv. Required: a) Calculate the deferred tax expenses for Megatron Berhad for the year. (8 Marks) b) Explain the meaning of a temporary difference as it relates to deferred tax (4 Marks) B) Creative Expert Bhd has calculated its tax payable as RM75,400 for the year 2016. computations and give TWO (2) examples. The opening balance in its deferred tax liability was RM56,000 and the year-end balance was determined to be RM66,000. Required: a) Discuss the accounting treatment of increase and decrease in deferred tax liability and calculate the tax expense of Creative Expert Bhd. (4 marks) b) Prepare journal entries to record the transaction 4 marks)