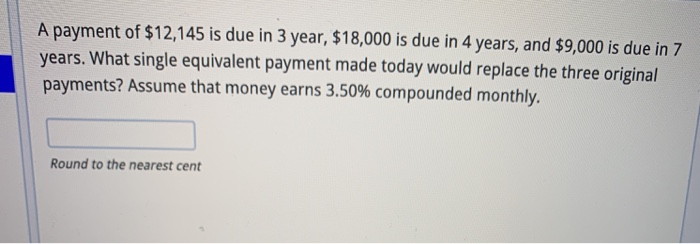

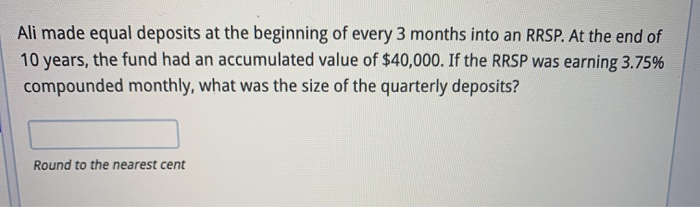

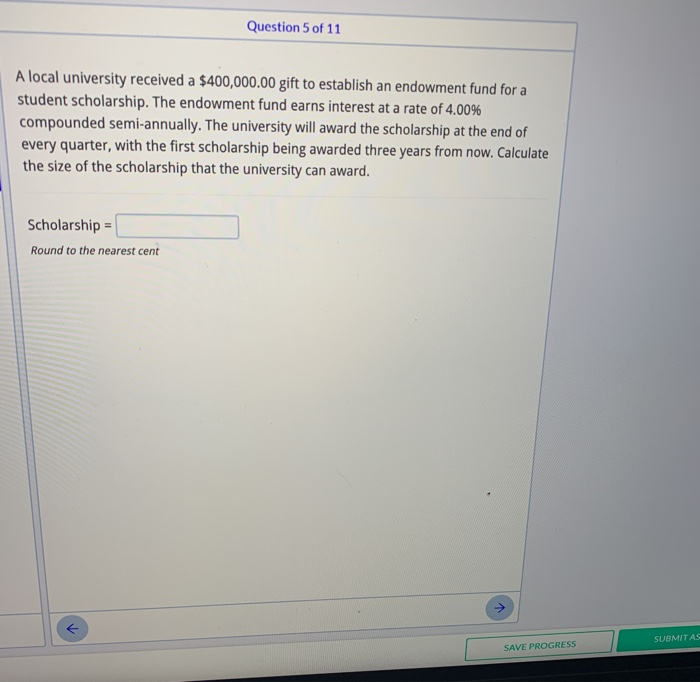

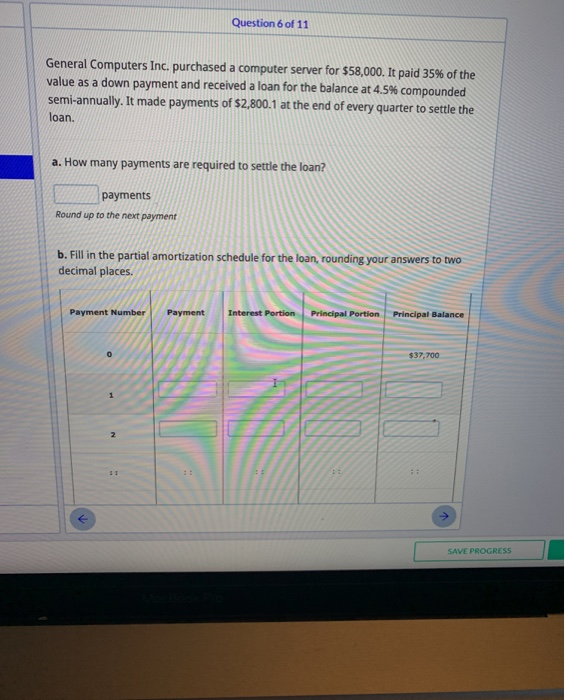

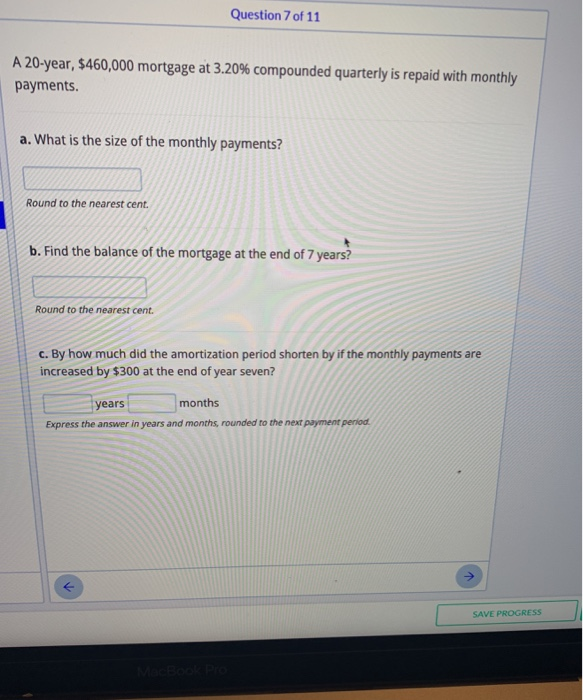

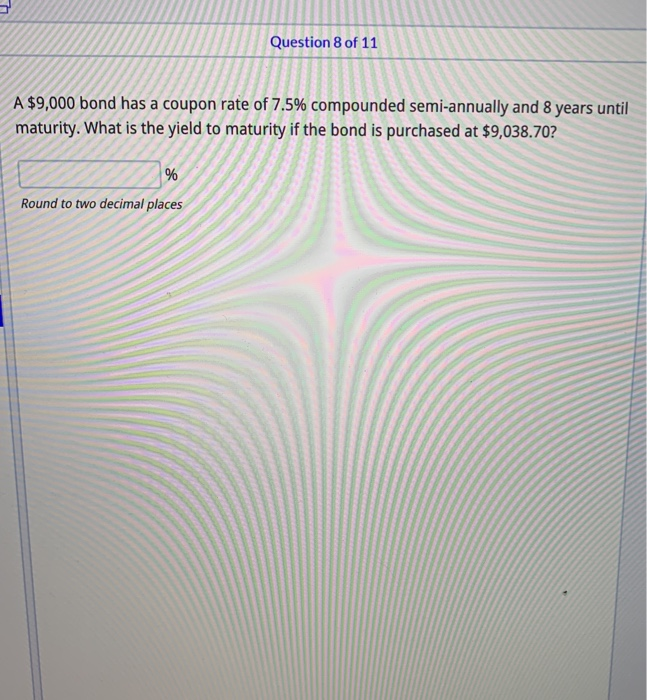

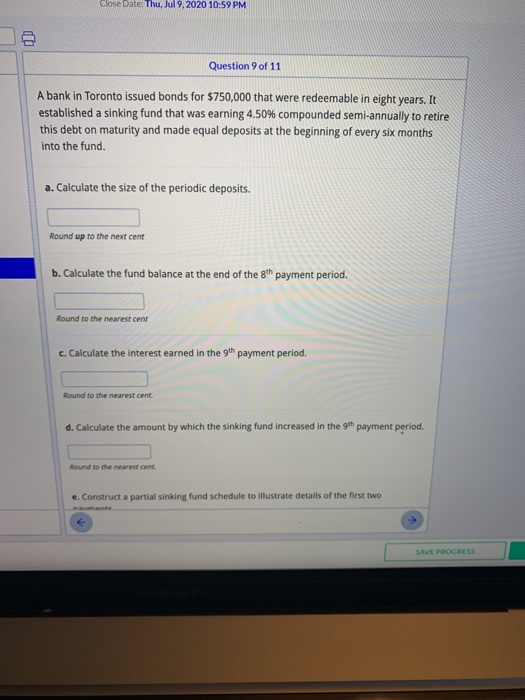

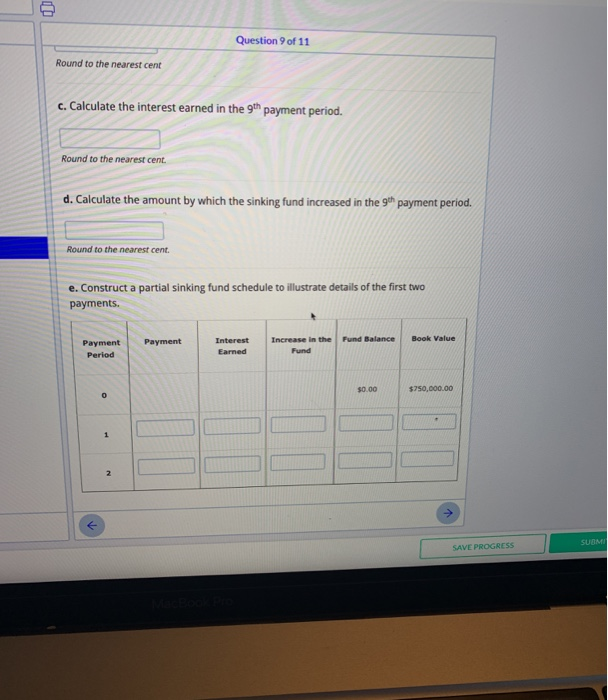

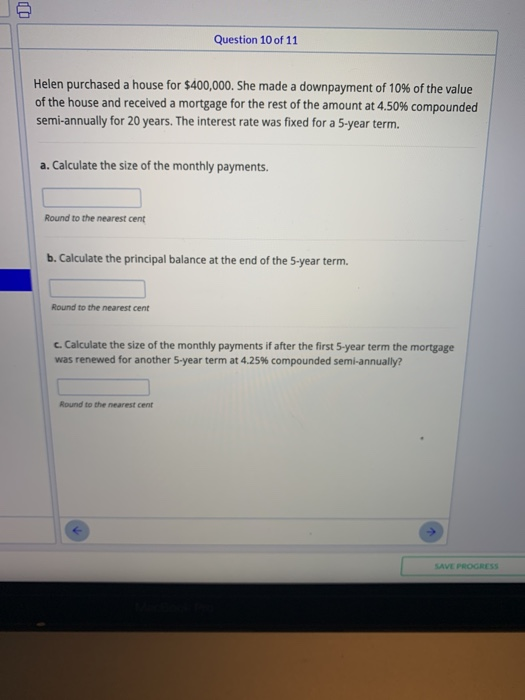

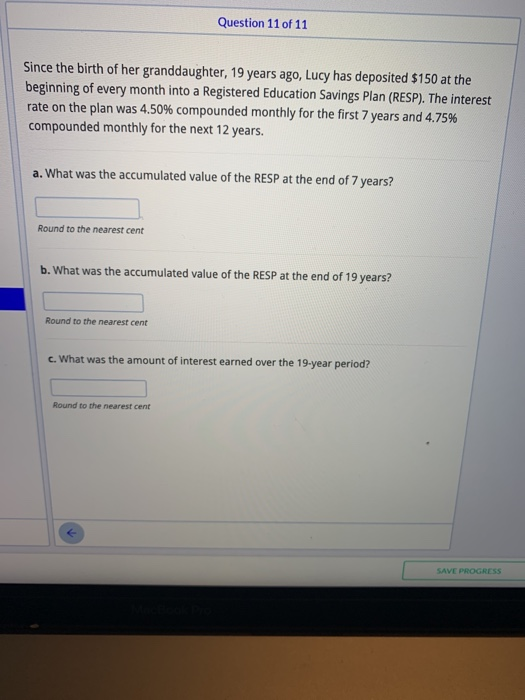

A payment of $12,145 is due in 3 year, $18,000 is due in 4 years, and $9,000 is due in 7 years. What single equivalent payment made today would replace the three original payments? Assume that money earns 3.50% compounded monthly. Round to the nearest cent Ali made equal deposits at the beginning of every 3 months into an RRSP. At the end of 10 years, the fund had an accumulated value of $40,000. If the RRSP was earning 3.75% compounded monthly, what was the size of the quarterly deposits? Round to the nearest cent Question 5 of 11 A local university received a $400,000.00 gift to establish an endowment fund for a student scholarship. The endowment fund earns interest at a rate of 4.00% compounded semi-annually. The university will award the scholarship at the end of every quarter, with the first scholarship being awarded three years from now. Calculate the size of the scholarship that the university can award. Scholarship = Round to the nearest cent SUBMIT AS SAVE PROGRESS Question 6 of 11 General Computers Inc. purchased a computer server for $58,000. It paid 35% of the value as a down payment and received a loan for the balance at 4.5% compounded semi-annually. It made payments of $2,800.1 at the end of every quarter to settle the loan. a. How many payments are required to settle the loan? payments Round up to the next payment b. Fill in the partial amortization schedule for the loan, rounding your answers to two decimal places. Payment Number Payment Interest Portion Principal Portion Principal Balance 0 $37.700 1 2 I! SAVE PROGRESS Question 7 of 11 A 20-year, $460,000 mortgage at 3.20% compounded quarterly is repaid with monthly payments. a. What is the size of the monthly payments? Round to the nearest cent. b. Find the balance of the mortgage at the end of 7 years? Round to the nearest cent C. By how much did the amortization period shorten by if the monthly payments are increased by $300 at the end of year seven? years months Express the answer in years and months, rounded to the next payment period. SAVE PROGRESS MacBook Pro Question 8 of 11 A $9,000 bond has a coupon rate of 7.5% compounded semi-annually and 8 years until maturity. What is the yield to maturity if the bond is purchased at $9,038.70? % Round to two decimal places Close Date: Thu, Jul 9, 2020 10:59 PM 0 0 Question 9 of 11 A bank in Toronto issued bonds for $750,000 that were redeemable in eight years. It established a sinking fund that was earning 4.50% compounded semi-annually to retire this debt on maturity and made equal deposits at the beginning of every six months into the fund. a. Calculate the size of the periodic deposits. Round up to the next cent b. Calculate the fund balance at the end of the 8th payment period. Round to the nearest cent c. Calculate the interest earned in the 9th payment period. Round to the nearest cent d. Calculate the amount by which the sinking fund increased in the 9th payment period. Round to the nearest cent. e. Construct a partial sinking fund schedule to illustrate details of the first two SAVE PROGRESS Question 9 of 11 Round to the nearest cent c. Calculate the interest earned in the 9th payment period. Round to the nearest cent. d. Calculate the amount by which the sinking fund increased in the 9th payment period. Round to the nearest cent e. Construct a partial sinking fund schedule to illustrate details of the first two payments. Payment Fund Balance Book Value Payment Period Interest Earned Increase in the Fund $0.00 $750,000.00 0 1 2 > SUOMI SAVE PROGRESS Question 10 of 11 Helen purchased a house for $400,000. She made a downpayment of 10% of the value of the house and received a mortgage for the rest of the amount at 4.50% compounded semi-annually for 20 years. The interest rate was fixed for a 5-year term. a. Calculate the size of the monthly payments. Round to the nearest cent b. Calculate the principal balance at the end of the 5-year term. Round to the nearest cent c. Calculate the size of the monthly payments if after the first 5-year term the mortgage was renewed for another 5-year term at 4.25% compounded semi-annually? Round to the nearest cent SAVE PROGRESS Question 11 of 11 Since the birth of her granddaughter, 19 years ago, Lucy has deposited $150 at the beginning of every month into a Registered Education Savings Plan (RESP). The interest rate on the plan was 4.50% compounded monthly for the first 7 years and 4.75% compounded monthly for the next 12 years. a. What was the accumulated value of the RESP at the end of 7 years? Round to the nearest cent b. What was the accumulated value of the RESP at the end of 19 years? Round to the nearest cent c. What was the amount of interest earned over the 19-year period? Round to the nearest cent SAVE PROGRESS A payment of $12,145 is due in 3 year, $18,000 is due in 4 years, and $9,000 is due in 7 years. What single equivalent payment made today would replace the three original payments? Assume that money earns 3.50% compounded monthly. Round to the nearest cent Ali made equal deposits at the beginning of every 3 months into an RRSP. At the end of 10 years, the fund had an accumulated value of $40,000. If the RRSP was earning 3.75% compounded monthly, what was the size of the quarterly deposits? Round to the nearest cent Question 5 of 11 A local university received a $400,000.00 gift to establish an endowment fund for a student scholarship. The endowment fund earns interest at a rate of 4.00% compounded semi-annually. The university will award the scholarship at the end of every quarter, with the first scholarship being awarded three years from now. Calculate the size of the scholarship that the university can award. Scholarship = Round to the nearest cent SUBMIT AS SAVE PROGRESS Question 6 of 11 General Computers Inc. purchased a computer server for $58,000. It paid 35% of the value as a down payment and received a loan for the balance at 4.5% compounded semi-annually. It made payments of $2,800.1 at the end of every quarter to settle the loan. a. How many payments are required to settle the loan? payments Round up to the next payment b. Fill in the partial amortization schedule for the loan, rounding your answers to two decimal places. Payment Number Payment Interest Portion Principal Portion Principal Balance 0 $37.700 1 2 I! SAVE PROGRESS Question 7 of 11 A 20-year, $460,000 mortgage at 3.20% compounded quarterly is repaid with monthly payments. a. What is the size of the monthly payments? Round to the nearest cent. b. Find the balance of the mortgage at the end of 7 years? Round to the nearest cent C. By how much did the amortization period shorten by if the monthly payments are increased by $300 at the end of year seven? years months Express the answer in years and months, rounded to the next payment period. SAVE PROGRESS MacBook Pro Question 8 of 11 A $9,000 bond has a coupon rate of 7.5% compounded semi-annually and 8 years until maturity. What is the yield to maturity if the bond is purchased at $9,038.70? % Round to two decimal places Close Date: Thu, Jul 9, 2020 10:59 PM 0 0 Question 9 of 11 A bank in Toronto issued bonds for $750,000 that were redeemable in eight years. It established a sinking fund that was earning 4.50% compounded semi-annually to retire this debt on maturity and made equal deposits at the beginning of every six months into the fund. a. Calculate the size of the periodic deposits. Round up to the next cent b. Calculate the fund balance at the end of the 8th payment period. Round to the nearest cent c. Calculate the interest earned in the 9th payment period. Round to the nearest cent d. Calculate the amount by which the sinking fund increased in the 9th payment period. Round to the nearest cent. e. Construct a partial sinking fund schedule to illustrate details of the first two SAVE PROGRESS Question 9 of 11 Round to the nearest cent c. Calculate the interest earned in the 9th payment period. Round to the nearest cent. d. Calculate the amount by which the sinking fund increased in the 9th payment period. Round to the nearest cent e. Construct a partial sinking fund schedule to illustrate details of the first two payments. Payment Fund Balance Book Value Payment Period Interest Earned Increase in the Fund $0.00 $750,000.00 0 1 2 > SUOMI SAVE PROGRESS Question 10 of 11 Helen purchased a house for $400,000. She made a downpayment of 10% of the value of the house and received a mortgage for the rest of the amount at 4.50% compounded semi-annually for 20 years. The interest rate was fixed for a 5-year term. a. Calculate the size of the monthly payments. Round to the nearest cent b. Calculate the principal balance at the end of the 5-year term. Round to the nearest cent c. Calculate the size of the monthly payments if after the first 5-year term the mortgage was renewed for another 5-year term at 4.25% compounded semi-annually? Round to the nearest cent SAVE PROGRESS Question 11 of 11 Since the birth of her granddaughter, 19 years ago, Lucy has deposited $150 at the beginning of every month into a Registered Education Savings Plan (RESP). The interest rate on the plan was 4.50% compounded monthly for the first 7 years and 4.75% compounded monthly for the next 12 years. a. What was the accumulated value of the RESP at the end of 7 years? Round to the nearest cent b. What was the accumulated value of the RESP at the end of 19 years? Round to the nearest cent c. What was the amount of interest earned over the 19-year period? Round to the nearest cent SAVE PROGRESS