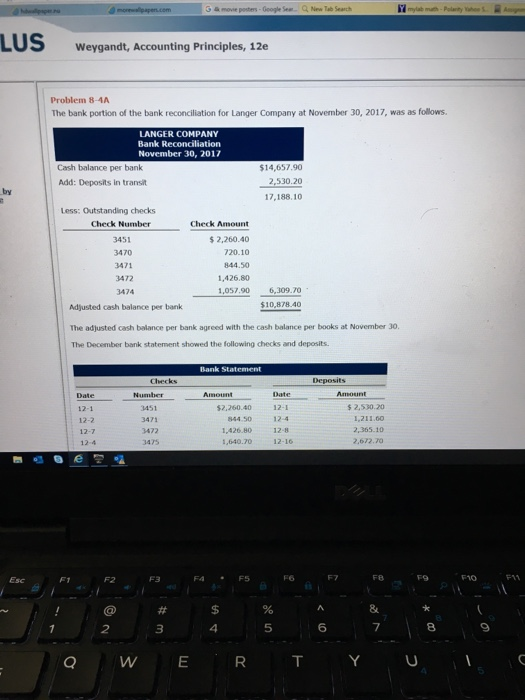

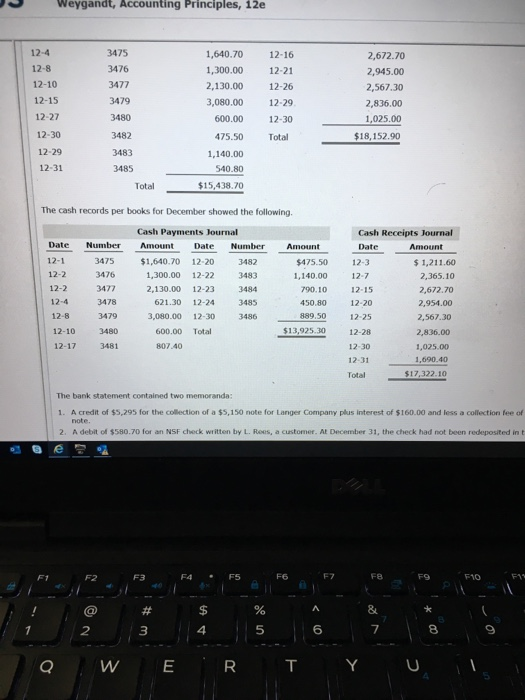

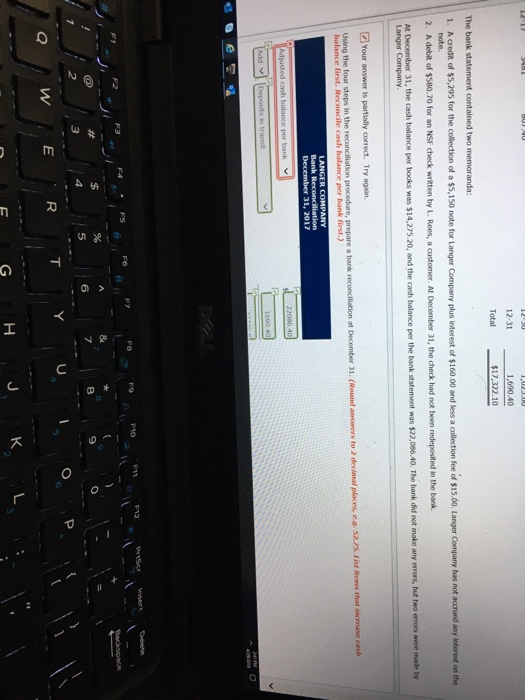

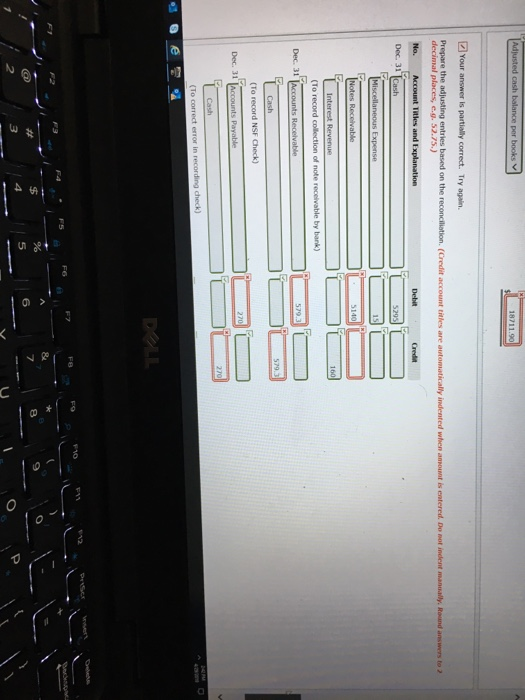

a move posters-Google Se. New Tab Search LUS weygandt, Accounting Principles, 12e Problem 8-4A The bank portion of the bank reconciliation for Langer Company at November 30, 2017, was as follows LANGER COMPANY Bank Reconciliation November 30, 2017 Cash balance per bank $14,657.90 2,530.20 17,188.10 Add: Deposits in transit Less: Outstanding checks Check Number Check Amount $2,260.40 720.10 844.50 1,426.80 3451 3470 3471 3472 3474 Adjusted cash balance per bank 1,057.90 6,309.70 $10,878.40 The adjusted cash balance per bank agreed with the cash balance per books at November 30 The December bank statement showed the following checks and deposits. Deposits Checks $ 2,530.20 1,211.60 2,365.10 2,672.70 12-1 12-2 1451 3471 3472 475 52,260.40 12-I 44. 50 12-4 1,426.80 1,640.70 12-16 12-4 F4 F5 F8 F10 F11 F3 F1 8 5 6 4 3 Weygandt, Accounting Principles, 12e 12-4 12-8 12-10 12-15 12-27 12-30 3475 3476 3477 3479 3480 3482 3483 3485 1,640.70 12-16 1,300.00 12-21 2,130.00 12-26 3,080.00 12-29 600.00 12-30 475.50 Total 2,672.70 2,945.00 2,567.30 2,836.00 1,025.00 $18,152.90 12-29 1,140.00 540.80 70 12-31 Total The cash records per books for December showed the following. Cash Payments Journal Cash Receipts Journal Date Number Amount Date Number AmountDate Amount 12-1 3475 $1,640.70 12-20 3482 1,300.00 12-22 3483 2,130.00 12-23 3484 621.30 12-24 3485 3,080.00 12-30 3486 $475.50 12-3 1,140.00 12-7 790.10 12-15 450.80 12-20 12-25 12-28 12-30 12-31 $1,211.60 2,365.10 2,672.70 2,954.00 2,567.30 2,836.00 1,025.00 1,690.40 12-2 12-2 3476 3477 12-4 3478 3479 12-10 3480 12-17 3481 12-8 889.50 $13,925.30 600.00 Total 807.40 $17,322.10 Total The bank statement contained two memoranda: 1. A credit of $5,295 for the collection of a $5,150 note for Langer Company plus interest of $160.00 and less a collection fee of 2. A debit of $580.70 for an NSF check written by L. Rees, a customer. At December 31, the check had not been redeposited in t o S e F4F5 F7 F6 Fe F1 F3 6 5 4 Q W E R T Y U 1,690.40 12-31 $17,322.10 Total The bank statement contained two memoranda: 1. A credit of $5,295 for the collection of a $5,150 note for Langer Company plus interest of $160.00 and less a collection fee of $15.00. Langer Company has not accrued any lnterest on the 2. A debit of $580.70 for an NSF check written by L. Rees, a customer. At December 31, the check had not been redeposited in the bank At December 31, the cash balance per books was $14,275.20, and the cash balance per the bank s statement was $22,086.40. The bank did not imake any errors, but two errors were made by Langer Company Your answer is partially correct. Try again at December 31. (Round answers to 2 decianal places e-a. 52.75. List Rems that increase cash balance first. Reconcile cash balance per bank first.) 31, 2017 Adjusted cash balance per bank F4FS e.g. 52.75)