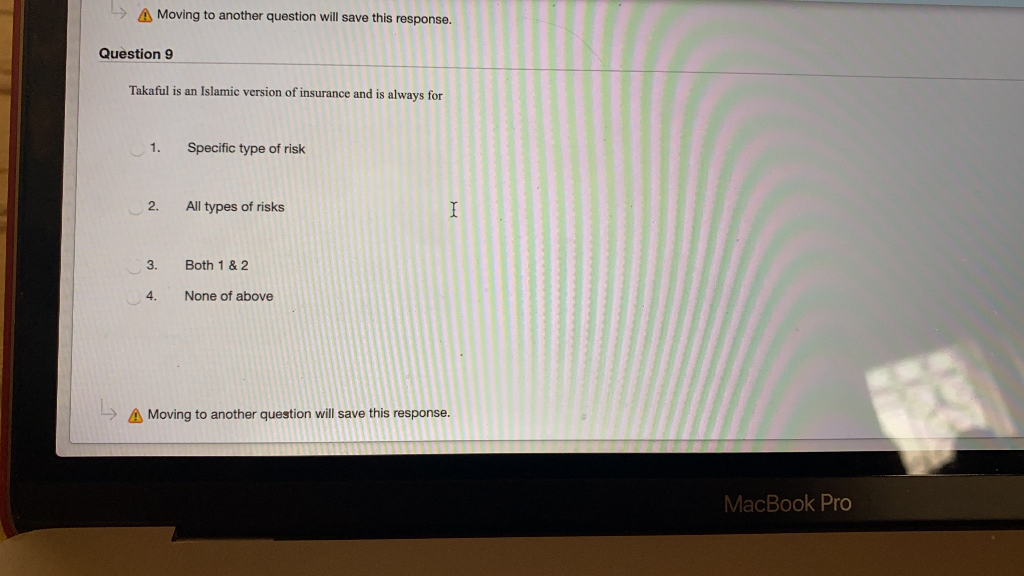

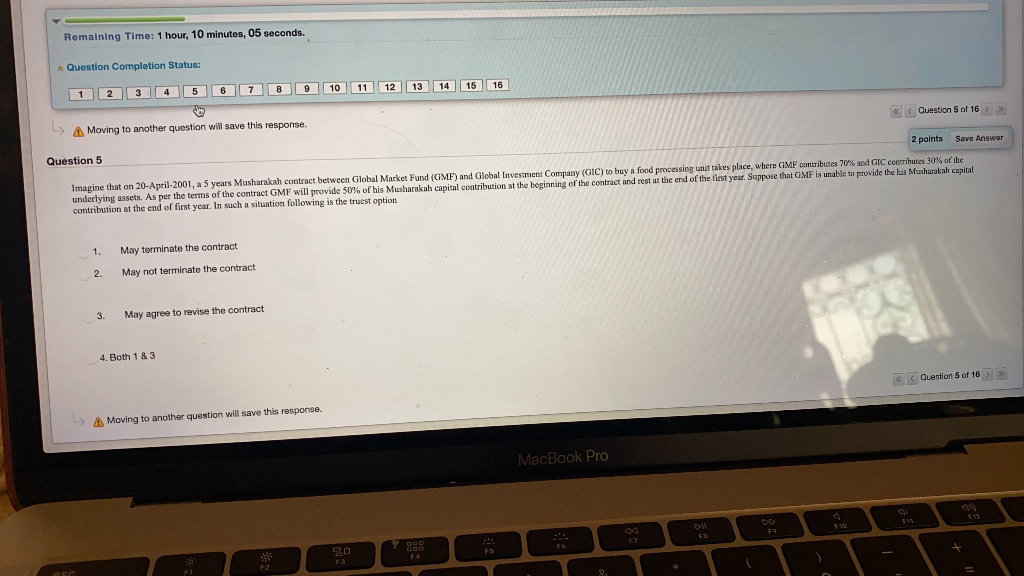

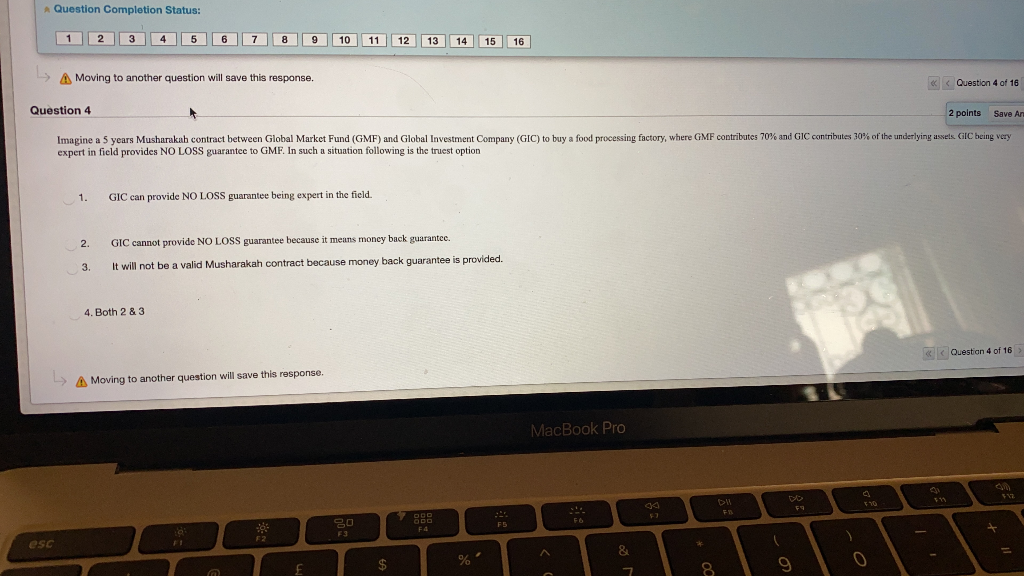

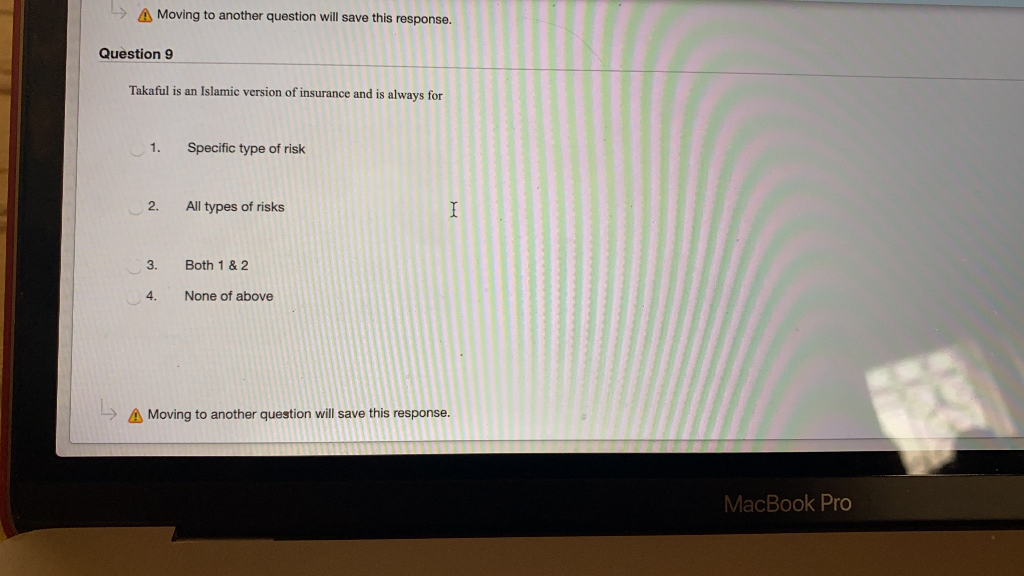

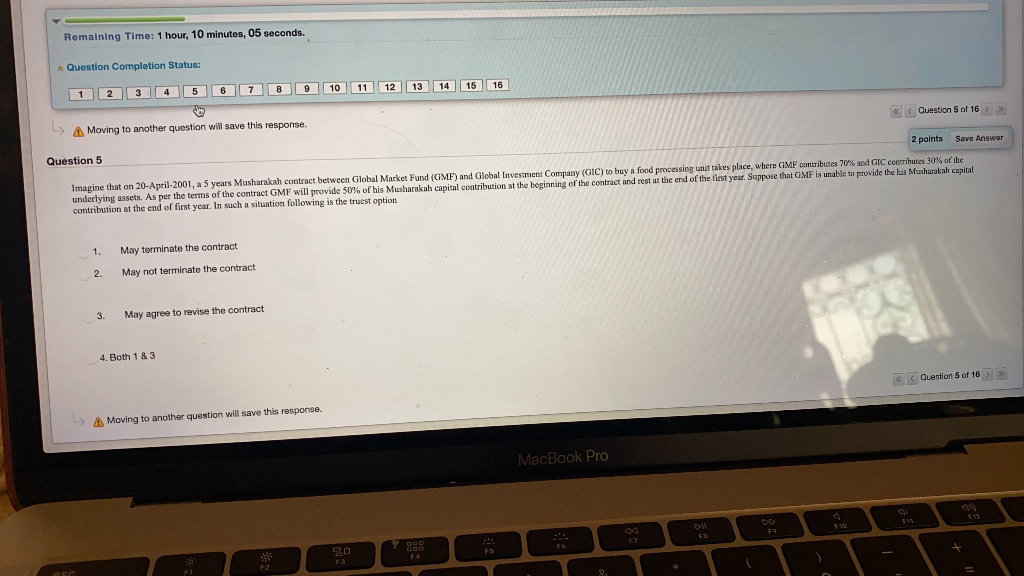

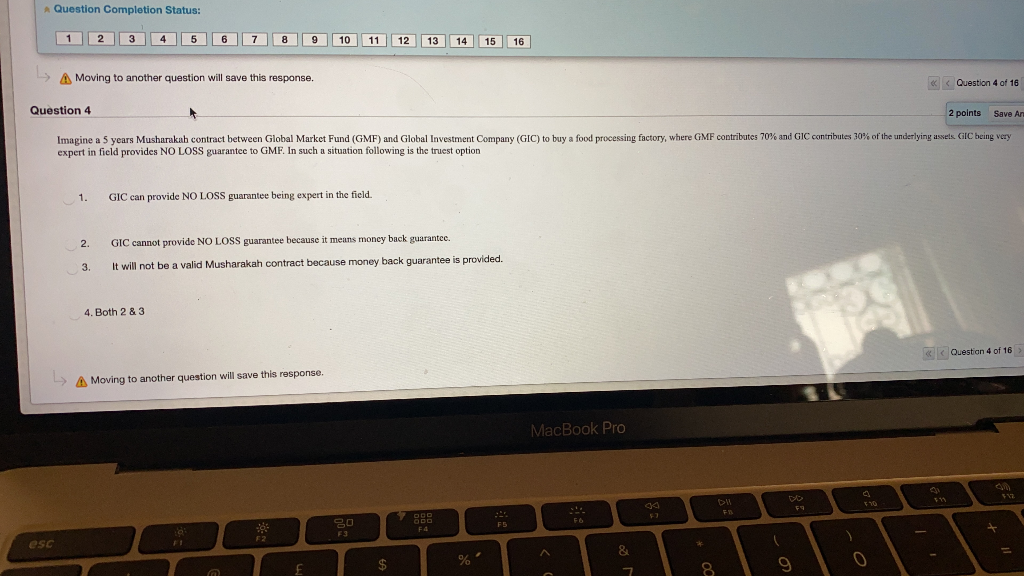

-> A Moving to another question will save this response. Question 9 Takaful is an Islamic version of insurance and is always for 1. Specific type of risk 2. All types of risks 3. Both 1 & 2 4. None of above - A Moving to another question will save this response. MacBook Pro Remaining Time: 1 hour, 10 minutes, 05 seconds. Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Moving to another question will save this response. Question 5 of 16 > >> Question 5 2 points Save Answer Imagine that on 20-April-2001, a 5 years Musharakah contract between Global Market Fund (GMF) and Global Investment Company (GIC) to buy a food processing unit takes place, where GMF contributes 70% and GC contributes 30% of the underlying assets. As per the terms of the contract GMF will provide 50% of his Musharakah capital contribution at the beginning of the contract and rest at the end of the first year. Suppose that GMF is unable to provide the has Mashrah capital contribution at the end of first year. In such a situation following is the truest option 1. May terminate the contract 2. May not terminate the contract 3. May agree to revise the contract 4. Both 1 & 3 Question 5 of 16 > >> -> Moving to another question will save this response. MacBook Pro Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 A Moving to another question will save this response. A Moving to another question will save this response. Question 9 Takaful is an Islamic version of insurance and is always for 1. Specific type of risk 2. All types of risks 3. Both 1 & 2 4. None of above - A Moving to another question will save this response. MacBook Pro Remaining Time: 1 hour, 10 minutes, 05 seconds. Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Moving to another question will save this response. Question 5 of 16 > >> Question 5 2 points Save Answer Imagine that on 20-April-2001, a 5 years Musharakah contract between Global Market Fund (GMF) and Global Investment Company (GIC) to buy a food processing unit takes place, where GMF contributes 70% and GC contributes 30% of the underlying assets. As per the terms of the contract GMF will provide 50% of his Musharakah capital contribution at the beginning of the contract and rest at the end of the first year. Suppose that GMF is unable to provide the has Mashrah capital contribution at the end of first year. In such a situation following is the truest option 1. May terminate the contract 2. May not terminate the contract 3. May agree to revise the contract 4. Both 1 & 3 Question 5 of 16 > >> -> Moving to another question will save this response. MacBook Pro Question Completion Status: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 A Moving to another question will save this response.