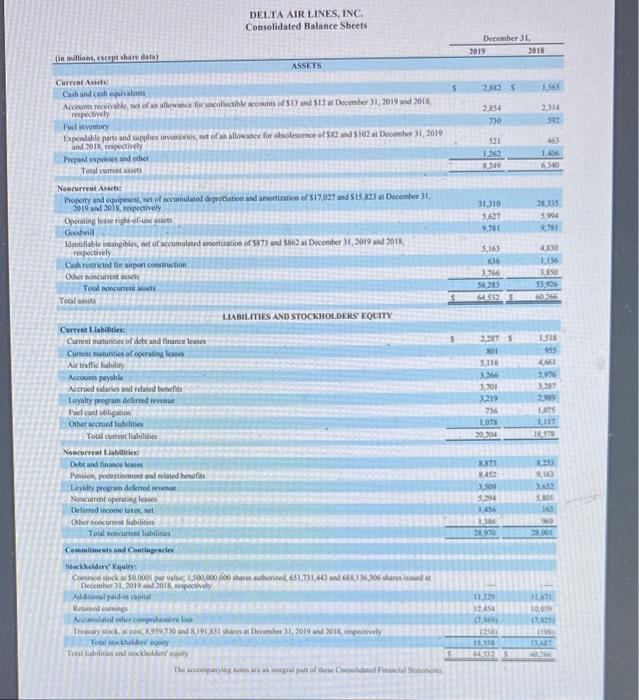

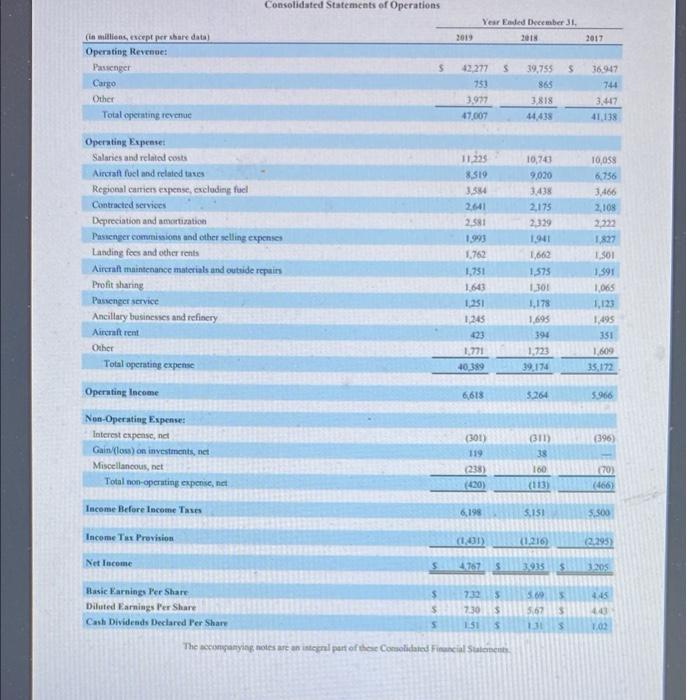

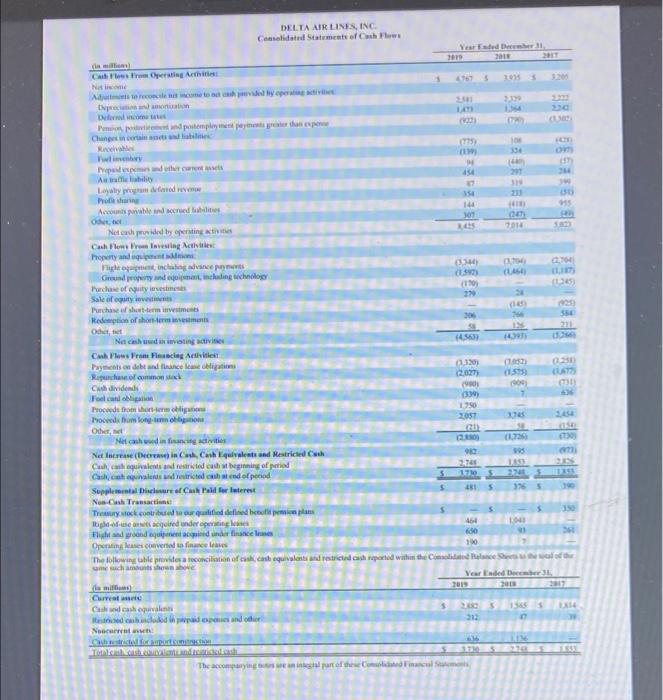

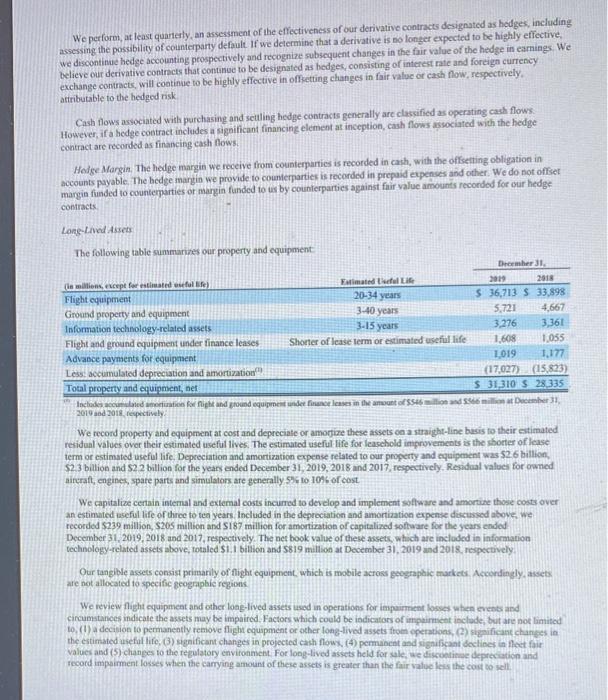

A Moving to another question will save this response. uestion 1 The histoncal cost of Delta Air Lines property and equipment at the most recent balance sheet date was $48,337 (in Millions) O True False DELTA AIRLINES, INC. Consolidated Balance Sheets December 31 2019 2018 5 25 (in millions, scop share data) ASSETS Current And Cash and cash plants Accounts receivable, tofawowe fit collectiblement of 5) and 512 December 31, 2019 and 2018, respectively Folventory Expendable parts and supplies is not of an allowance for obsolescence of 5102 December 11, 2019 and 201% respectively Repaid expenses and other Total 2854 730 2314 390 163 1.263 349 610 31 310 567 . 2.135 5.94 971 5,163 636 3.766 56,20 65125 00 1 3250 51.935 1.312 65 4661 2,976 Noncurrent Assets hoperty and equipment of accumulated detonaturation of $17.037 and 515.21 December 2019 and 2017.pectively Operating tease right-of- Goodwill Identifiable intangible for accumulated artistio of 5873 and 5862 af December 31, 2019 and 2018 respectively Cashestricted for airport triction Other Total noncurrent Total LIABILITIES AND STOCKHOLDERS' EQUITY Carrer Llanities Current matunities of debt and finance lentes Current maturies of operating esses Air traffic liability Accounts payable Accrued salaries and related benefits Loyalty program deferred revne Felcand obligatie Other accredibilities Total care abilitis) Noncurrat Llalities Debt and finance leases Po, potrement and we Loyalty program deferred Noncurrent operates Deferred income, et Other Boncurentabilities Totalcune libilities Commitments and Costinpeace Stocoders quity Commodock 50.000 val.500.000,00 shares shared 651.731,43 and 685.136.306 shared December 31, 2019 and 2016, pectively da capital Het Accused the chosen Thay ko, 59,70 in 1931 shares December 31, 2019 respectively 22175 801 3.116 3. 1.701 3219 736 1.08 20.204 2.09 1.07 15.SE 3:33 2452 3.500 24 1.456 16 3762 200 2001 12.12 12454 (1919 101 10,000 15.15 Toint The coming sean galands Cold Financial Consolidated Statements of Operations Year Ended December 31 2018 2019 2017 42.277 s $ (in millions, except per sbare data) Operating Revenge: Passenger Cargo Other Total operating revenue 751 39,755 863 3.818 44.438 36.947 744 3,447 41,138 3.997 47.007 Operating Expenset Salaries and related costs Aircraft fuel and related taxes Regional carriers expense, excluding fuel Contracted services Depreciation and amortization Passenger commissions and other selling expenses Landing foes and other rents Aircraft maintenance materials and outside repairs Profit sharing Passenger service Ancillary businesses and refinery Aircraft rent Other Total operating expense 11235 8.519 3.534 2641 2.581 1.993 1,762 1.751 1.643 251 1245 423 1,771 40.389 10,743 9,020 3.438 2,175 2.329 1941 1.662 1.575 1.301 1.178 1.695 394 1.723 39,174 10,058 6756 3.466 2,108 2722 1827 1.501 1,591 1.065 1.123 1,495 351 1.609 35,172 Operating Income 6,618 3.264 5.966 (396) Non-Operating Expenses Interest expense, nd Gain (los) on investments, net Miscellaneous, net Total non-operating expense, net (311) 18 (301) 119 (238) (420) 100 (70) (113) (466) Income Before Income Taxes 6,198 5.151 3.500 Income Tax Provision (101) (1.216) 2.295) Net Income 5 4767 S3035 $ 120 445 Basic Earnings Per Share Diluted Earnings Per Share Cash Dividends Declared Per Share 7325 7.30 $ 151 5 5.695 5.625 1.115 14 1.00 The companying notes are an integral part of the Comlined Facial Stones DELTA AIRLINES, INC Consolidated States of the Yearded 2014 Cailer Operating Act NA M to help 31 Dvere Chings in Roche web 334 posted on A tiety 454 Lolly 319 Polering 15 30 144 15 Accounts and credits 307 O. Nel cas de resting the 7014 SA Cash Flow From Investing Activities hot and Flight in avance payment 0.714 Grundry and gent, including cho (139 Purchase of quity investmes (170 (1265 Sale of out 2 Purchase of short-term Redemption of short 306 314 Other, tact 211 Nacisin van die 4633 Cash Flows From Fascing Acties Payments and and face la obligations (1.330 (10 250 Lupucaocoon (2007) (1.575 CUTT Cuh divided 000 Folcano 7 Proceeds from horrow 1.750 Food bombo 2057 Od Netcash dictivities Net Increase in Cash Cash Equivalents and Restricted with 90 Cu can equivalented cast beginning of pied 2740 18 Cachels dretrica and openie 51752711 Supplemental Del Cul Polid for laterest $ 5 359 Nosa Transaction To contributed to find defined his 150 light-of-use acquired under operating 464 Bighal padalganeri wind man and has 650 360 Operases converted to finance 100 The following table provides a reconciliation of cash equivalented cash reported within the Cowlane amants shown Year Ended ever mima Correo Cashop 15 doked in a pies and our 33 Nocare help Total Video The acconsent of the Comcil 3 39 We perform, at least quarterly, an assessment of the effectiveness of our derivative contracts designated as hedges, including assessing the possibility of counterparty default If we determine that a derivative is no longer expected to be highly effective, we discontinue hedge accounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. We believe our derivative contracts that continue to be designated as hedges, consisting of interest rate and foreign currency exchange contracts will continue to be highly effective in offsetting changes in fair value or cash flow, respectively. attributable to the hedged risk Cash flows associated with purchasing and selling hedge contracts generally are classified as operating cash flows. However, if a hedge contract includes a significant financing elementat inception, cash flows associated with the hedge contract are recorded as financing cash nows Helge Margin. The hedge margin we receive from counterparties is recorded in cash, with the offsetting obligation in accounts payable. The hedge marin we provide to counterparties is recorded in prepaid expenses and other. We do not offset margin funded to counterparties or margin funded to us by counterparties against fair value amounts recorded for our hedge contracts Lone Lived Assets The following table summanues our property and equipment December Fimated Life 2011 2018 la milioncept for estimated fil) Flight equipment 20-34 years S 36,713 S 33.898 Ground property and equipment 3:40 years 5.721 4,667 Information technology-related assets 3-15 years 3.276 3,361 Flight and ground equipment under finance leases Shorter of lease term or estimated useful life 1,608 1.035 Advance payments for equipment 1,019 1.177 Less: accumulated depreciation and amortization (17.027) (15.823) Total property and equipment, net $ 31,310 S 28 335 Includes condition for hight and ground equipment de releases in the wont of $546 million and simili at December 31, 2019 2018 respectively We record property and equipment at cost and depreciate or amorize these assets on a straight-line basis to their estimated residual values over their estimated useful lives. The estimated useful life for leasehold improvements is the shorter of lease term or estimated useful life, Depreciation and amortization expense related to our property and equipment was $2.6 billion $2.3 billion and $2.2 billion for the years ended December 31, 2019, 2018 and 2017, respectively. Residual values for owned aircraft, engines, spare parts and simulators are generally 5% to 10% of cost We capitalize certain internal and external costs incurred to develop and implement software and amortize those costs over an estimated useful life of three to ten years. Included in the depreciation and amortization expense discussed above, we recorded 5239 million, S205 million and S187 million for amortization of capitalized software for the years ended December 31, 2019, 2018 and 2017, respectively. The net book value of these assets, which are included in information technology-related assets above, totaled $1.1 billion and 5819 million at December 31, 2019 and 2018, respectively Our tangible assets consist primarily of flight equipment, which is mobile across geographic markets. Accordingly, assets are not allocated to specific geographic regions We review flight equipment and other long-lived assets used in operations for impairment losses when events and circumstances indicate the assets may be impaired. Factors which could be indicators of impairment include, but are not limited to, (l) decision to permanently remove flight equipment or other long-lived assets from operations, (2) signi changes in the estimated useful life ) significant changes in projected cash flows, (4) permanent and significant declines in fleet fair values and (5) changes to the regulatory environment. For long-lived assets held for sale, we discutie depreciation and record impairment losses when the carrying amount of these assets is greater than the fair value less the cost to sell