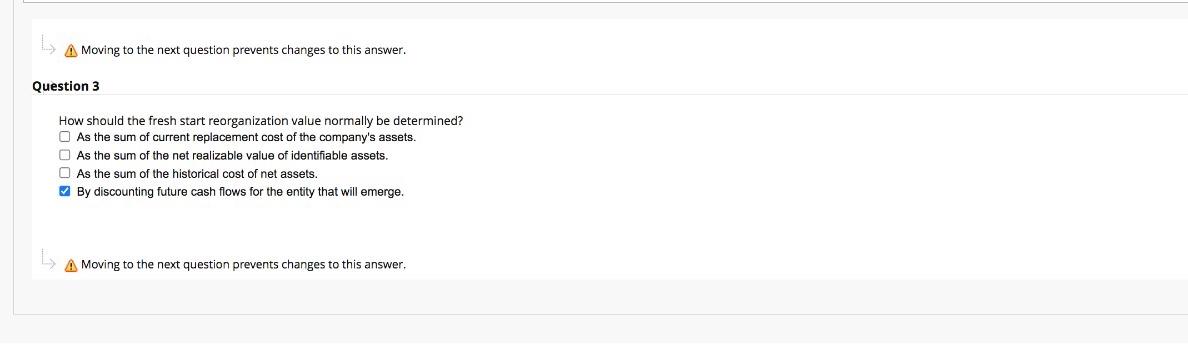

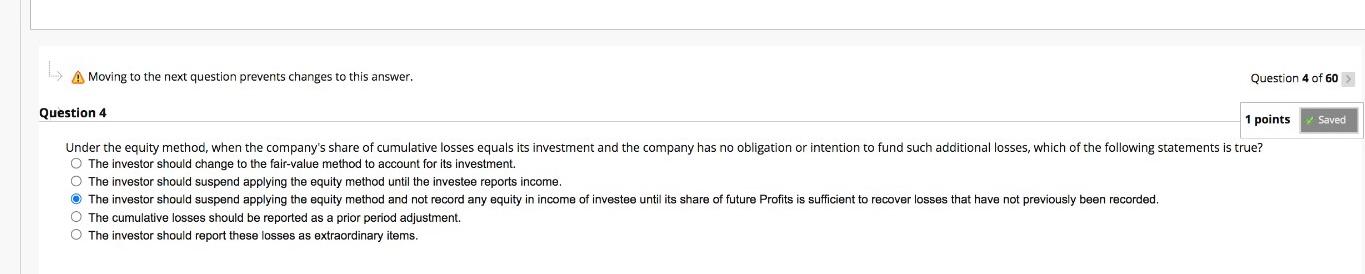

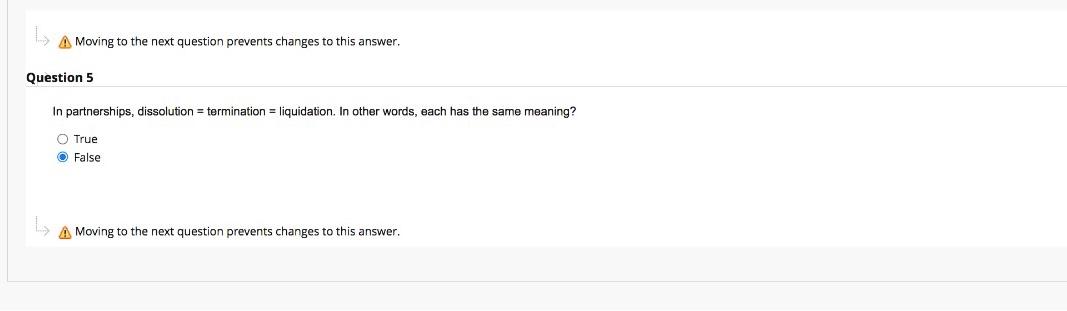

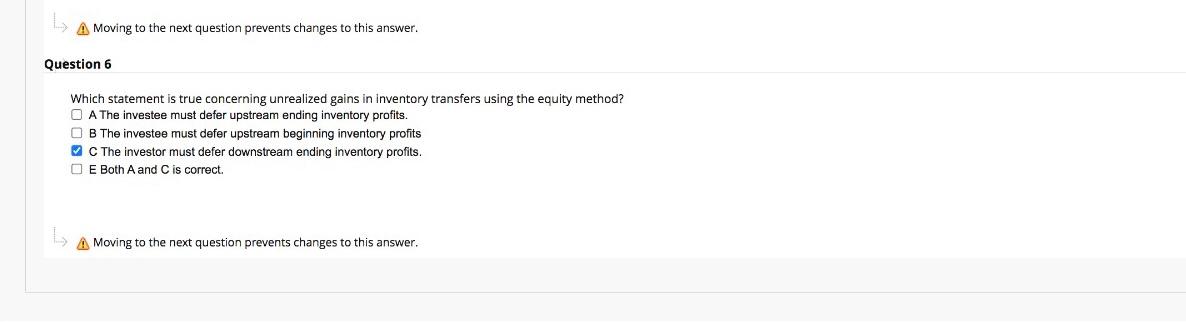

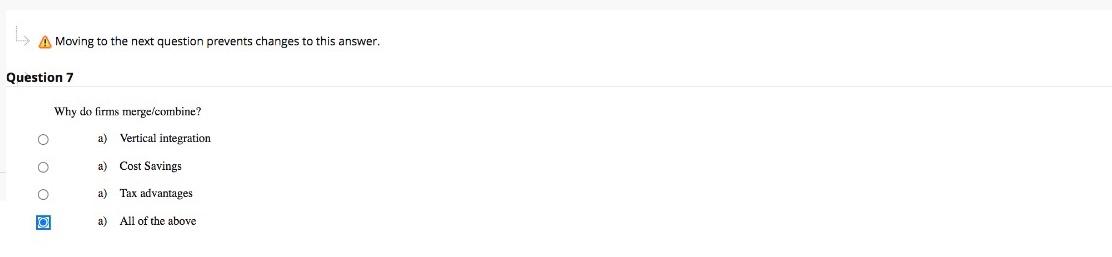

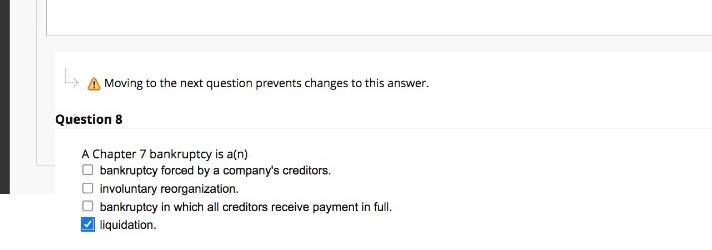

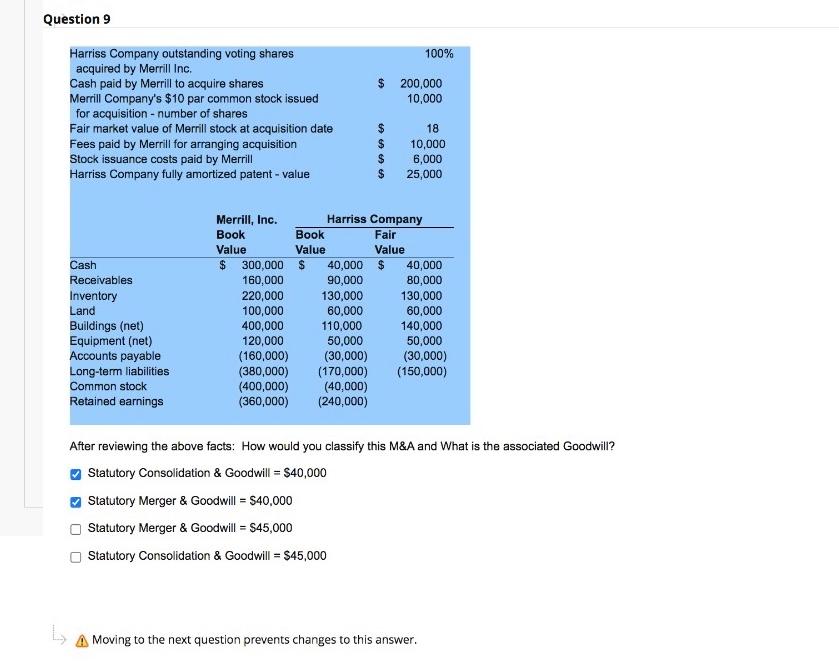

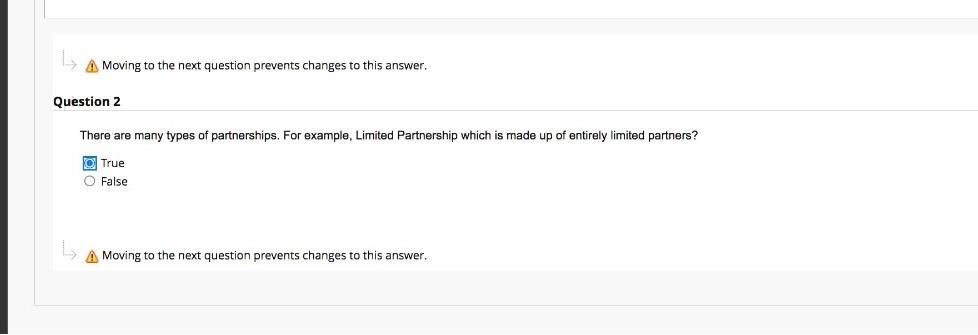

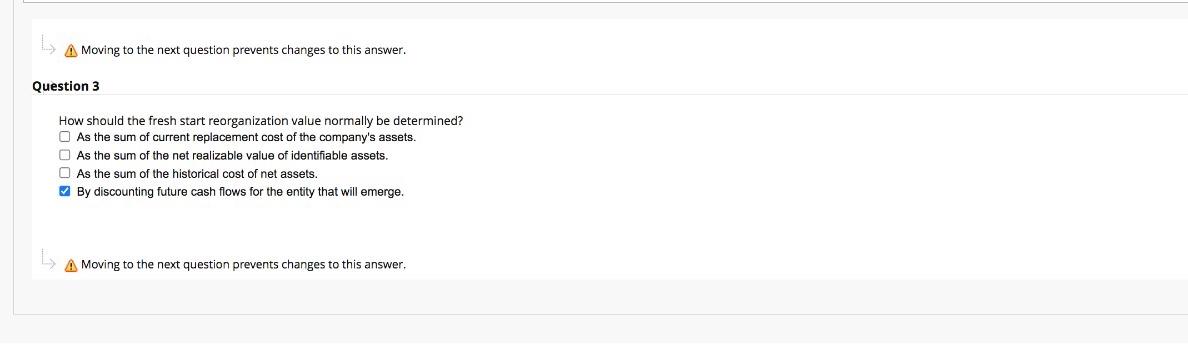

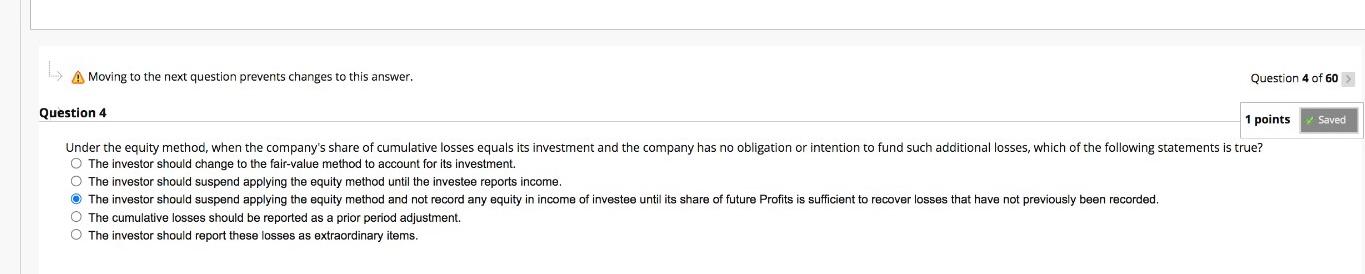

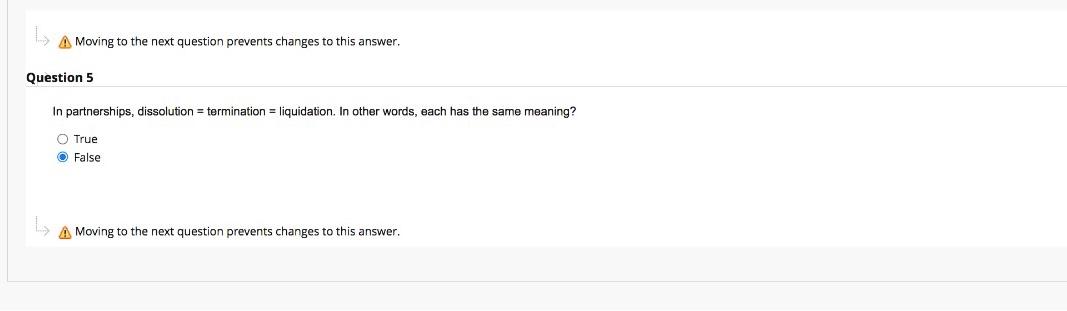

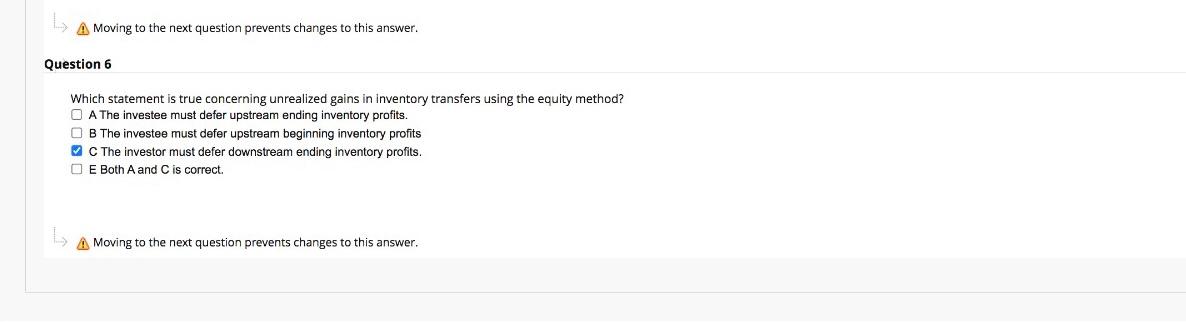

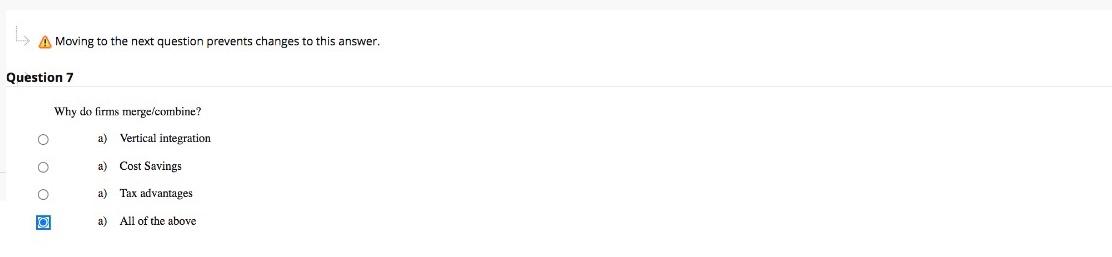

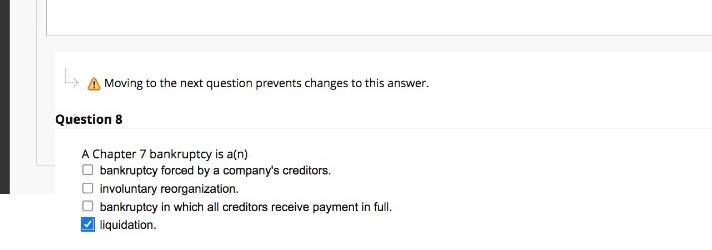

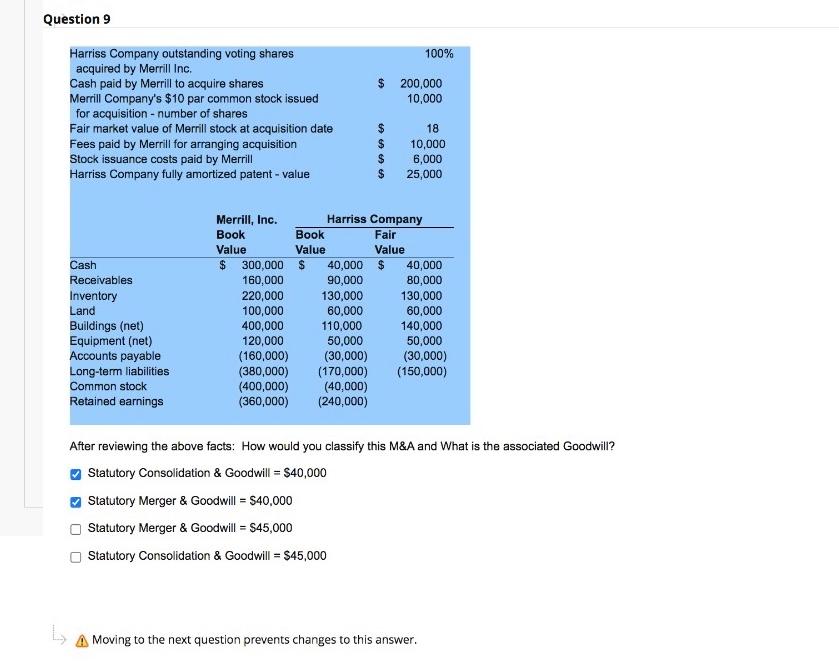

A Moving to the next question prevents changes to this answer. Question 3 How should the fresh start reorganization value normally be determined? As the sum of current replacement cost of the company's assets. As the sum of the net realizable value of identifiable assets. As the sum of the historical cost of net assets. By discounting future cash flows for the entity that will emerge. L A Moving to the next question prevents changes to this answer, A Moving to the next question prevents changes to this answer. Question 4 of 60 > Question 4 1 points Saved Under the equity method, when the company's share of cumulative losses equals its investment and the company has no obligation or intention to fund such additional losses, which of the following statements is true? The investor should change to the fair-value method to account for its investment. The investor should suspend applying the equity method until the investee reports income. The investor should suspend applying the equity method and not record any equity in income of investee until its share of future Profits is sufficient to recover losses that have not previously been recorded. The cumulative losses should be reported as a prior period adjustment. The investor should report these losses as extraordinary items. A Moving to the next question prevents changes to this answer, Question 5 In partnerships, dissolution = termination = liquidation. In other words, each has the same meaning? True False A Moving to the next question prevents changes to this answer. A Moving to the next question prevents changes to this answer. Question 6 Which statement is true concerning unrealized gains in inventory transfers using the equity method? O A The investee must defer upstream ending inventory profits. O B The investee must defer upstream beginning inventory profits The investor must defer downstream ending inventory profits. O E Both A and C is correct. A Moving to the next question prevents changes to this answer. A Moving to the next question prevents changes to this answer. Question 7 Why do firms merge/combine? O a) Vertical integration a) Cost Savings a) Tax advantages O a) All of the above L A Moving to the next question prevents changes to this answer. Question 8 A Chapter 7 bankruptcy is a(n) bankruptcy forced by a company's creditors. involuntary reorganization. bankruptcy in which all creditors receive payment in full. liquidation. Question 9 100% $ 200,000 10,000 Harriss Company outstanding voting shares acquired by Merrill Inc, Cash paid by Merrill to acquire shares Merrill Company's $10 par common stock issued for acquisition - number of shares Fair market value of Merrill stock at acquisition date Fees paid by Merrill for arranging acquisition Stock issuance costs paid by Merrill Harriss Company fully amortized patent - value 444 4 18 $ 10,000 $ 6,000 $ 25,000 Cash Receivables Inventory Land Buildings (net) Equipment (net) Accounts payable Long-term liabilities Common stock Retained earnings Merrill, Inc. Harriss Company Book Book Fair Value Value Value $ 300,000 $ 40,000 $ 40,000 160,000 90,000 80,000 220,000 130,000 130,000 100,000 60,000 60,000 400,000 110,000 140,000 120,000 50,000 50,000 (160,000) (30,000) (30,000) (380,000) (170,000) (150,000) (400,000) (40,000) (360,000) (240,000) After reviewing the above facts: How would you classify this M&A and What is the associated Goodwill? Statutory Consolidation & Goodwill = $40,000 Statutory Merger & Goodwill = 540,000 Statutory Merger & Goodwill = $45,000 Statutory Consolidation & Goodwill = $45,000 A Moving to the next question prevents changes to this answer. A Moving to the next question prevents changes to this answer. Question 10 of 60 Question 10 2 points Save Answer The first step in producing a set of consolidated results is to use a process to post all completed or closed subs books along with the parent, (P+Ss+Adjustments=Consol). The most important elimination entry is to CR the individual Sub's Equity and DR the respective investment to zero out the investment for consolidation purposes (referred to as removal of investments for consolidation). Is this statement True or False? OF A Moving to the next question prevents changes to this answer. Question 10 of 60 A Moving to the next question prevents changes to this answer. Question 2 There are many types of partnerships. For example, Limited Partnership which is made up of entirely limited partners? a True O False A Moving to the next question prevents changes to this