Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A multifamily property is for sale for $2,000,000. It is estimated that the property will earn $250,000 a year for the next 15 years. At

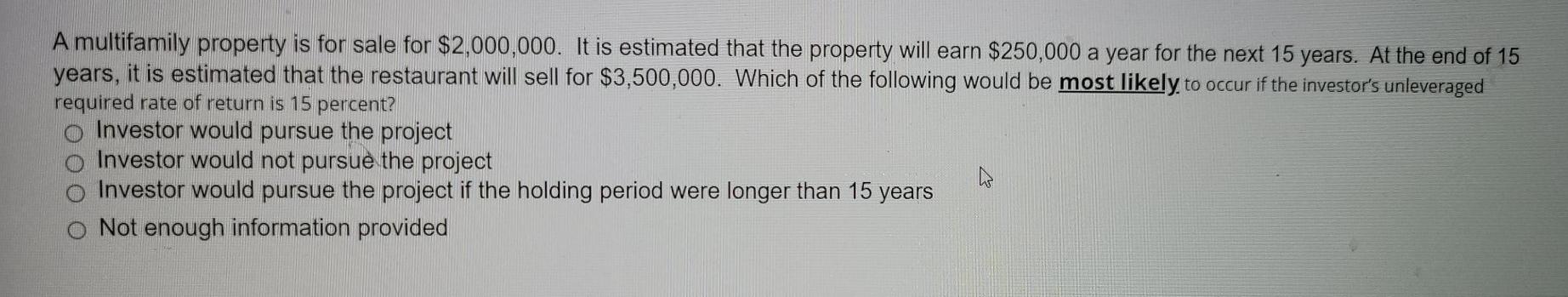

A multifamily property is for sale for $2,000,000. It is estimated that the property will earn $250,000 a year for the next 15 years. At the end of 15 years, it is estimated that the restaurant will sell for $3,500,000. Which of the following would be most likely to occur if the investor's unleveraged required rate of return is 15 percent? Investor would pursue the project Investor would not pursue the project Investor would pursue the project if the holding period were longer than 15 years Not enough information provided

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started