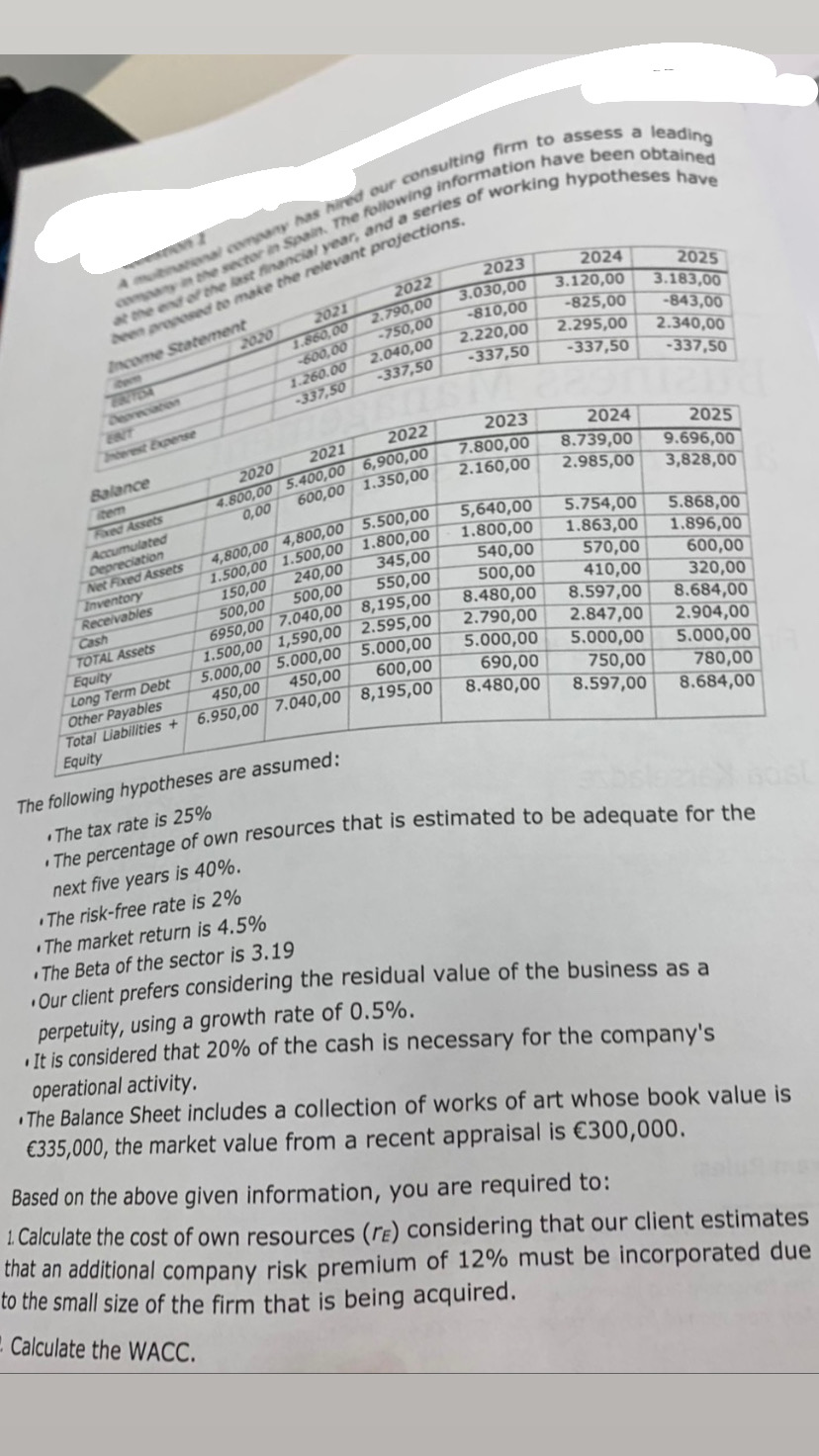

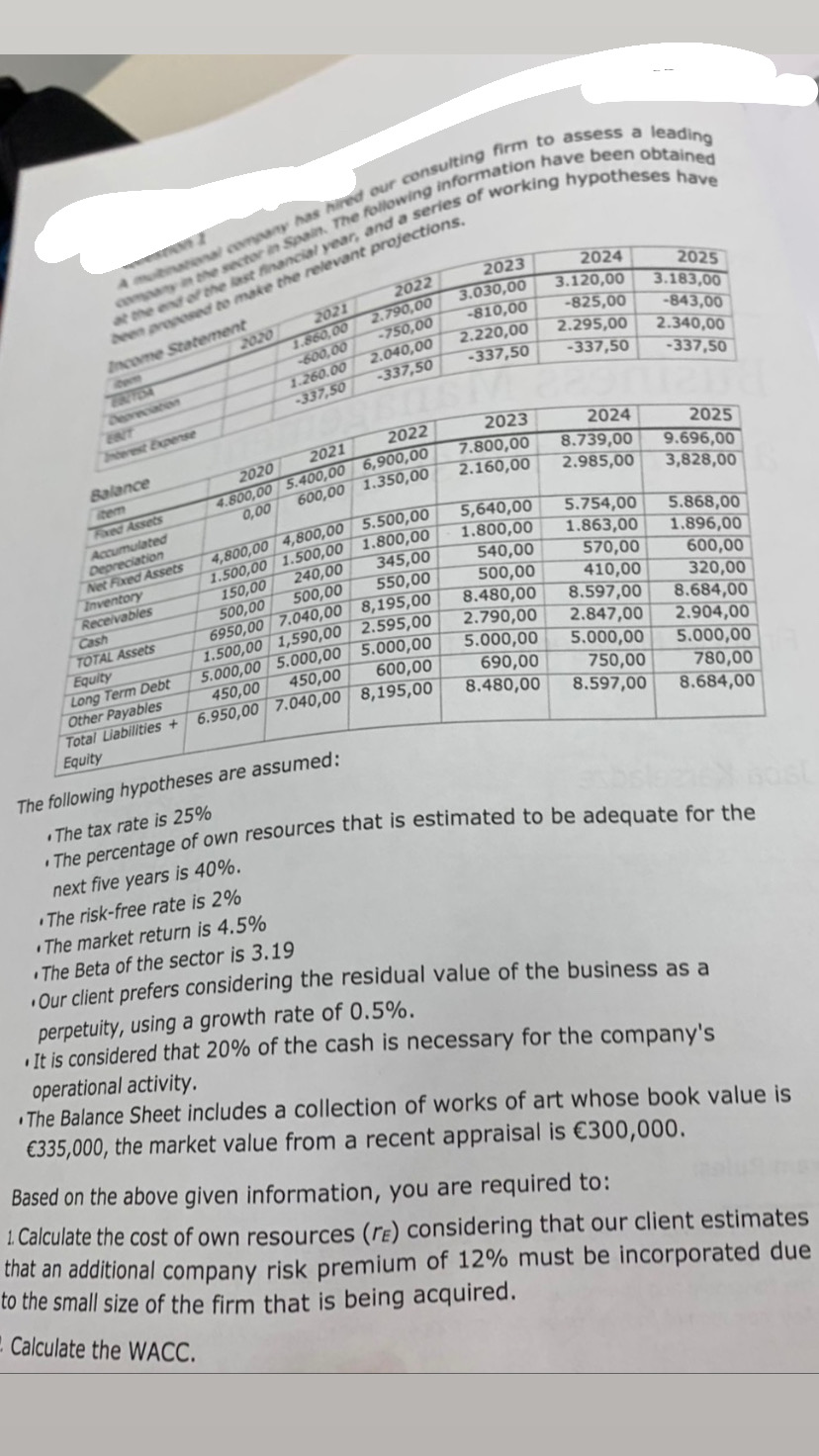

A multinational company has hired our consulting firm to assess a leading company in the sector in Spain. The following information have been obtained at the end of the last financial year, and a series of working hypotheses have been proposed to make the relevant projections. Income Statement ERIYDA Balance item Fixed Assets Accumulated Depreciation Net Fixed Assets Inventory Receivables Cash TOTAL Assets Equity 2020 2021 1.860,00 -600,00 1.260.00 -337,50 2022 2.790,00 -750,00 next five years is 40%. The risk-free rate is 2% 2.040,00 -337,50 2020 2021 2022 4.800,00 5.400,00 6,900,00 0,00 600,00 1.350,00 4,800,00 4,800,00 5.500,00 1.500,00 1.500,00 1.800,00 150,00 240,00 345,00 500,00 550,00 500,00 6950,00 7.040,00 8,195,00 1.500,00 1,590,00 2.595,00 5.000,00 5.000,00 5.000,00 450,00 450,00 600,00 6.950,00 7.040,00 8,195,00 2023 3.030,00 -810,00 2.220,00 -337,50 2023 7.800,00 2.160,00 5,640,00 1.800,00 540,00 500,00 8.480,00 2.790,00 5.000,00 690,00 8.480,00 2024 3.120,00 -825,00 2.295,00 -337,50 2024 8.739,00 2.985,00 5.754,00 1.863,00 570,00 410,00 2025 3.183,00 -843,00 2.340,00 -337,50 8.597,00 2.847,00 5.000,00 750,00 8.597,00 Ta 2025 9.696,00 3,828,00 5.868,00 1.896,00 600,00 320,00 8.684,00 2.904,00 5.000,00 780,00 8.684,00 Long Term Debt Other Payables Total Liabilities + Equity The following hypotheses are assumed: The tax rate is 25% The percentage of own resources that is estimated to be adequate for the The market return is 4.5% The Beta of the sector is 3.19 Our client prefers considering the residual value of the business as a perpetuity, using a growth rate of 0.5%. It is considered that 20% of the cash is necessary for the company's operational activity. The Balance Sheet includes a collection of works of art whose book value is 335,000, the market value from a recent appraisal is 300,000. Based on the above given information, you are required to: 1. Calculate the cost of own resources (re) considering that our client estimates that an additional company risk premium of 12% must be incorporated due to the small size of the firm that is being acquired. Calculate the WACC. A multinational company has hired our consulting firm to assess a leading company in the sector in Spain. The following information have been obtained at the end of the last financial year, and a series of working hypotheses have been proposed to make the relevant projections. Income Statement ERIYDA Balance item Fixed Assets Accumulated Depreciation Net Fixed Assets Inventory Receivables Cash TOTAL Assets Equity 2020 2021 1.860,00 -600,00 1.260.00 -337,50 2022 2.790,00 -750,00 next five years is 40%. The risk-free rate is 2% 2.040,00 -337,50 2020 2021 2022 4.800,00 5.400,00 6,900,00 0,00 600,00 1.350,00 4,800,00 4,800,00 5.500,00 1.500,00 1.500,00 1.800,00 150,00 240,00 345,00 500,00 550,00 500,00 6950,00 7.040,00 8,195,00 1.500,00 1,590,00 2.595,00 5.000,00 5.000,00 5.000,00 450,00 450,00 600,00 6.950,00 7.040,00 8,195,00 2023 3.030,00 -810,00 2.220,00 -337,50 2023 7.800,00 2.160,00 5,640,00 1.800,00 540,00 500,00 8.480,00 2.790,00 5.000,00 690,00 8.480,00 2024 3.120,00 -825,00 2.295,00 -337,50 2024 8.739,00 2.985,00 5.754,00 1.863,00 570,00 410,00 2025 3.183,00 -843,00 2.340,00 -337,50 8.597,00 2.847,00 5.000,00 750,00 8.597,00 Ta 2025 9.696,00 3,828,00 5.868,00 1.896,00 600,00 320,00 8.684,00 2.904,00 5.000,00 780,00 8.684,00 Long Term Debt Other Payables Total Liabilities + Equity The following hypotheses are assumed: The tax rate is 25% The percentage of own resources that is estimated to be adequate for the The market return is 4.5% The Beta of the sector is 3.19 Our client prefers considering the residual value of the business as a perpetuity, using a growth rate of 0.5%. It is considered that 20% of the cash is necessary for the company's operational activity. The Balance Sheet includes a collection of works of art whose book value is 335,000, the market value from a recent appraisal is 300,000. Based on the above given information, you are required to: 1. Calculate the cost of own resources (re) considering that our client estimates that an additional company risk premium of 12% must be incorporated due to the small size of the firm that is being acquired. Calculate the WACC