Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. multiple choice. (1,500,000 - 1,476,000 - 1,245,600 - 1,026,000 - 795,600 - 750,000) b. multiple choice ( 800 - 600 - 400 - 300

a. multiple choice. (1,500,000 - 1,476,000 - 1,245,600 - 1,026,000 - 795,600 - 750,000)

b. multiple choice ( 800 - 600 - 400 - 300 - 200 - 0 )

c. multiple choice ( cash outflow - cash inflow - neither)

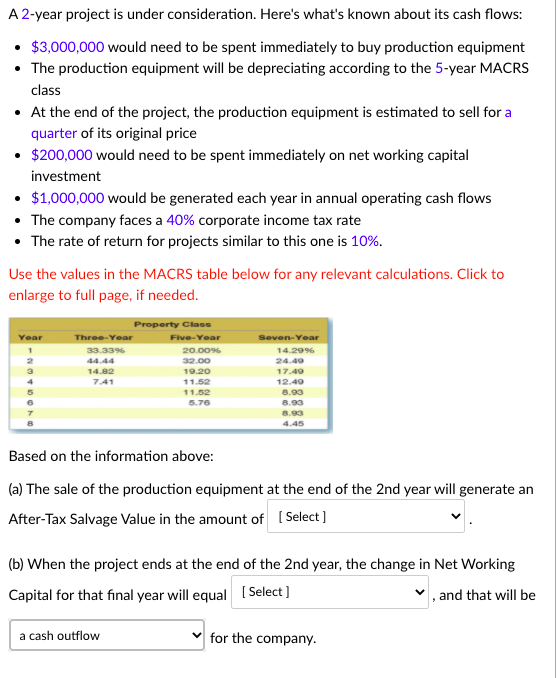

A 2-year project is under consideration. Here's what's known about its cash flows: $3,000,000 would need to be spent immediately to buy production equipment The production equipment will be depreciating according to the 5-year MACRS class At the end of the project, the production equipment is estimated to sell for a quarter of its original price $200,000 would need to be spent immediately on net working capital investment $1,000,000 would be generated each year in annual operating cash flows The company faces a 40% corporate income tax rate The rate of return for projects similar to this one is 10%. Use the values in the MACRS table below for any relevant calculations. Click to enlarge to full page, if needed. Year -NON Property Class Three-Year Five-Year 33.33% 20.00% 32.00 14.82 19.20 7.41 11.52 11.52 5.76 Seven-Year 14.29% 24.40 17.40 12.40 8.93 8.93 4.45 Based on the information above: (a) The sale of the production equipment at the end of the 2nd year will generate an After-Tax Salvage Value in the amount of [Select] (b) When the project ends at the end of the 2nd year, the change in Net Working Capital for that final year will equal [ Select ] , and that will be a cash outflow for the companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started