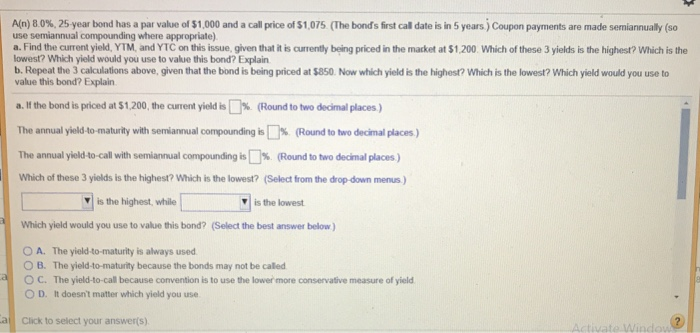

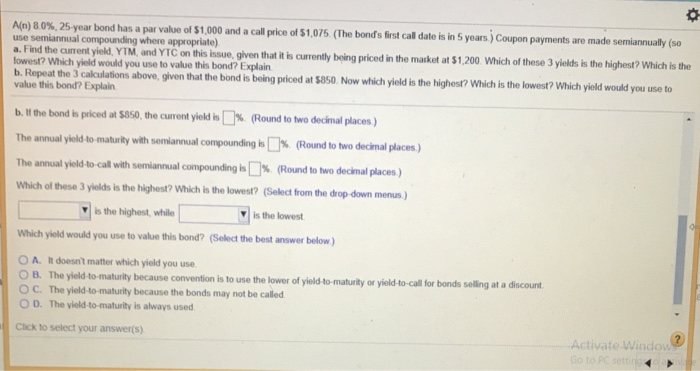

A n 80%, 25 year bond has a par value of $1,000 and a call price of $1,075 The bond's first cal date is in 5 years Coupon payments are made semiannually so use semiannual compounding where appropriate) a. Find the current yield, YTM, and YTC on this issue, given that it is currently being priced in the macket at $1,200. Which of these 3 yields is the highest? Which is the lowest? Which yield would you use to value this bond? Explain b. Repeat the 3 calculations above, given that the bond is being priced at $850. Now which yield is the highest? Which is the lowest? Which yield would you use to value this bond? Explain alf the bond is priced at $1.200, the current yield is % (Round to two decimal places) The annual yield tomaturity with semian ualcompounding is Round to two decimal places) The annual yield-lo-call with semiannual compounding is (Round to two decimal places) Which of these 3 yields is the highest? Which is the lowest? (Select from the drop-down menus) is the highest, while is the lowest Which yield would you use to value this bond? (Select the best answer below) O A. The yield-to-maturity is always used O B. The yield-to-maturity because the bonds may not be called aOC. The yield-to-call because convention is to use the lower more conservative measure of yield It doesn't matter which yield you use O D. a Click to select your answer(s) Activato Wind o: A n) 8 0% 25-year bond has a par value of S 1,000 and a call price of S 1,075 The bonds first cal date is in S years Coupon paym use semiannual compounding where appropriate) a. Find the current yield, YTM, and YTC on this isue, gven that it is curenty being priced in the masket at $1,200 Which of these 3 nents are made semiannually (so lowest? Which yield would you use to value this bond? Explain b. Repeat the 3 calculations above, given that the bond is being priced at $850. Now which yield is value this bond? Explain the highest? Which is the lowest? Which yield would you use to biree bond is priced at$850, the arrent yield is % (Round to two decimal places) The annual yield to maturity with sem annual compound ngk % (Round to two decinal places) The annual yield toal with seniar mai conpourcing is % Round to two decinal places) Which of these 3 yields is the highest? Which is the lowest? (Select from the drop-down menus) is the highest, while is the lowest Which yield would you use to value this bond? (Select the best answer below) O A. It doesn't matter which yield you use OB. The yield-to maturity because convention is to use the lower of yield-to-maturity or yield-to-cll for bonds selling at a discount O C. The yield to-maturily because the bonds may not be called O D. The vield-to-maturity is always used Click to select your answer(s) Activate Winou