Answered step by step

Verified Expert Solution

Question

1 Approved Answer

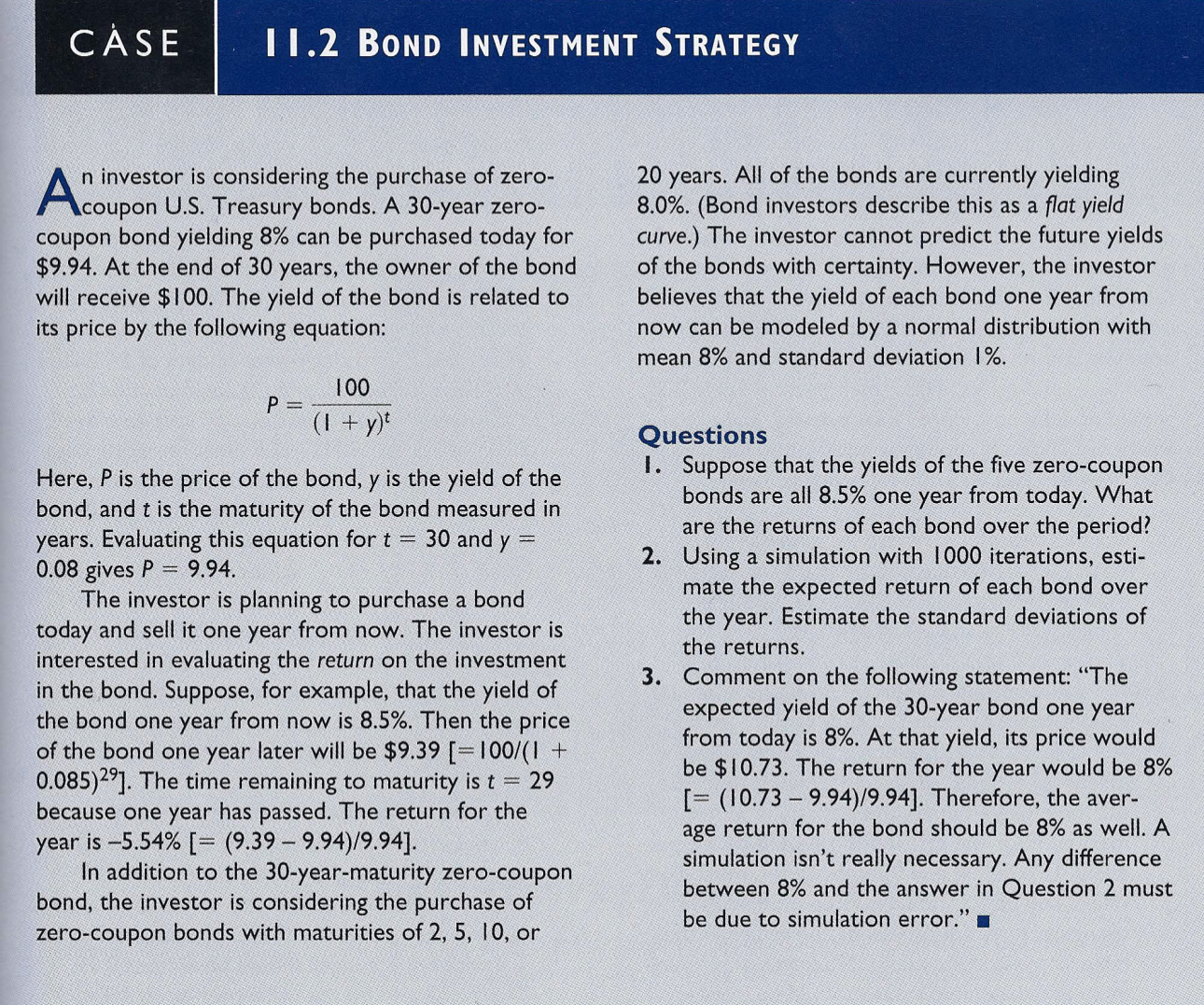

A n investor i s considering the purchase o f zero - coupon U . S . Treasury bonds. A 3 0 - year zero

investor considering the purchase zero

coupon Treasury bonds. year zero

coupon bond yielding can purchased today for

$ the end years, the owner the bond

will receive $ The yield the bond related

its price the following equation:

Here, the price the bond, the yield the

bond, and the maturity the bond measured

years. Evaluating this equation for and

gives

The investor planning purchase a bond

today and sell one year from now. The investor

interested evaluating the return the investment

the bond. Suppose, for example, that the yield

the bond one year from now Then the price

the bond one year later will

: The time remaining maturity

because one year has passed. The return for the

year

addition the yearmaturity zerocoupon

bond, the investor considering the purchase

zerocoupon bonds with maturities

years. All the bonds are currently yielding

investors describe this a flat yield

curve. The investor cannot predict the future yields

the bonds with certainty. However, the investor

believes that the yield each bond one year from

now can modeled a normal distribution with

mean and standard deviation

Questions

I. Suppose that the yields the five zerocoupon

bonds are all one year from today. What

are the returns each bond over the period?

Using a simulation with iterations, esti

mate the expected return each bond over

the year. Estimate the standard deviations

the returns.

Comment the following statement: "The

expected yield the year bond one year

from today that yield, its price would

$ The return for the year would Therefore, the aver

age return for the bond should well.

simulation isn't really necessary. Any difference

between and the answer Question must

due simulation error."

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started