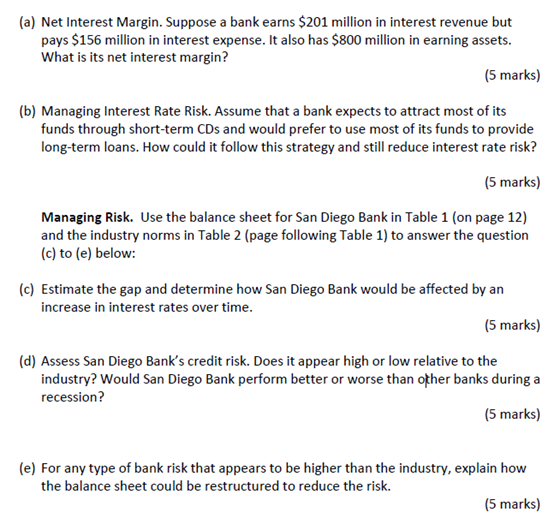

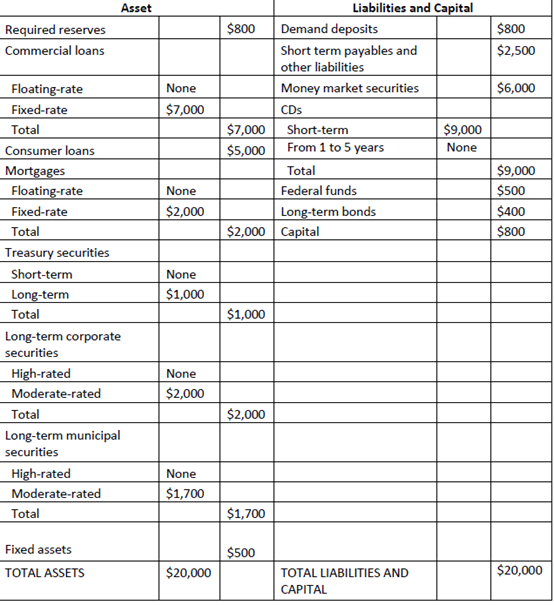

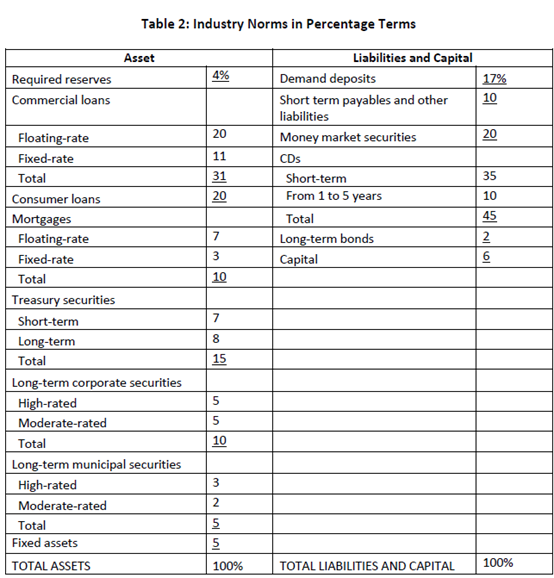

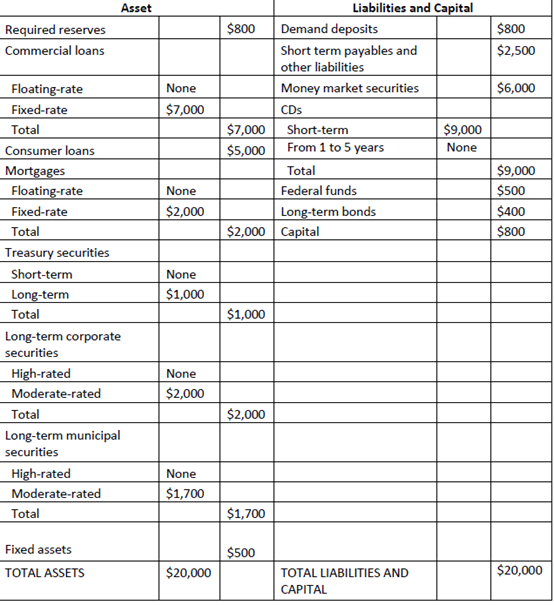

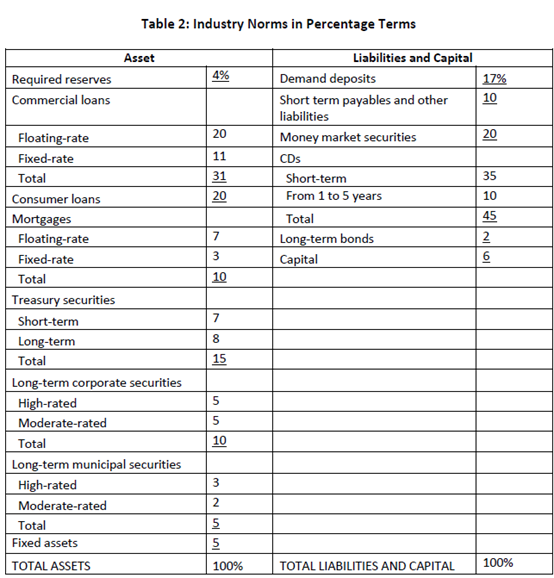

(a) Net Interest Margin. Suppose a bank earns $201 million in interest revenue but pays $156 million in interest expense. It also has $800 million in earning assets. What is its net interest margin? (5 marks) (b) Managing Interest Rate Risk. Assume that a bank expects to attract most of its funds through short-term CDs and would prefer to use most of its funds to provide long-term loans. How could it follow this strategy and still reduce interest rate risk? (5 marks) Managing Risk. Use the balance sheet for San Diego Bank in Table 1 (on page 12) and the industry norms in Table 2 (page following Table 1) to answer the question (c) to (e) below: (c) Estimate the gap and determine how San Diego Bank would be affected by an increase in interest rates over time. (5 marks) (d) Assess San Diego Bank's credit risk. Does it appear high or low relative to the industry? Would San Diego Bank perform better or worse than other banks during a recession? (5 marks) (e) For any type of bank risk that appears to be higher than the industry, explain how the balance sheet could be restructured to reduce the risk. (5 marks) Asset $800 Required reserves Commercial loans $2,500 None $6,000 $7,000 Floating-rate Fixed-rate Total Consumer loans Liabilities and Capital $800 Demand deposits Short term payables and other liabilities Money market securities CDs $7,000 Short-term $9,000 $5,000 From 1 to 5 years Total Federal funds Long-term bonds $2,000 Capital None None Mortgages Floating-rate Fixed-rate Total Treasury securities $9,000 $500 $400 $800 $2,000 Short-term None $1,000 $1,000 Long-term Total Long-term corporate securities None High-rated Moderate-rated Total $2,000 $2,000 Long-term municipal securities None High-rated Moderate-rated Total $1,700 $1,700 Fixed assets $500 TOTAL ASSETS $20,000 TOTAL LIABILITIES AND $20,000 CAPITAL Table 2: Industry Norms in Percentage Terms Asset Liabilities and Capital Demand deposits Required reserves 4% 17% Commercial loans 10 Short term payables and other liabilities 20 Money market securities 20 11 CDs 31 35 20 Short-term From 1 to 5 years 10 45 7 Total Long-term bonds Capital 2 6 3 10 Floating-rate Fixed-rate Total Consumer loans Mortgages Floating-rate Fixed-rate Total Treasury securities Short-term Long-term Total Long-term corporate securities High-rated Moderate-rated Total Long-term municipal securities High-rated Moderate-rated Total Fixed assets NO 15 ulun 10 | | | | | | 5 TOTAL ASSETS 100% TOTAL LIABILITIES AND CAPITAL 100%