Question

A new barcode reading device has an installed cost basis of $23,050 and an estimated service life of ten years. It will have a

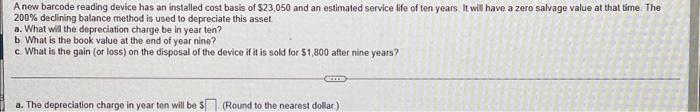

A new barcode reading device has an installed cost basis of $23,050 and an estimated service life of ten years. It will have a zero salvage value at that time. The 200% declining balance method is used to depreciate this asset a. What will the depreciation charge be in year ten? b. What is the book value at the end of year nine? c. What is the gain (or loss) on the disposal of the device if it is sold for $1,800 after nine years? a. The depreciation charge in year ten will be $ (Round to the nearest dollar)

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

150 declining balance depreciation rate 15 10 015 or 15 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

10th edition

978-0077511388, 78034779, 9780077511340, 77511387, 9780078034770, 77511344, 978-0077861759

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App