Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new client has come to you for tax preperation services for 2020. Brady LLC wants to file as an S Corporation. They provided you

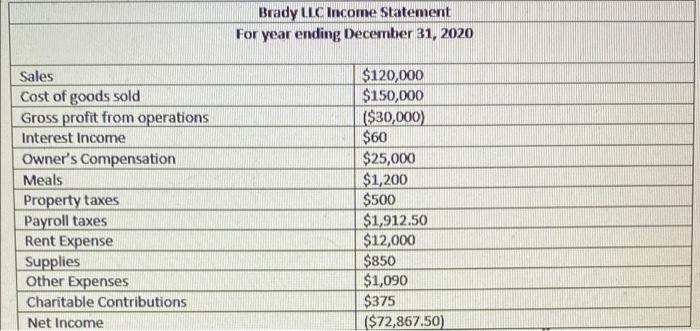

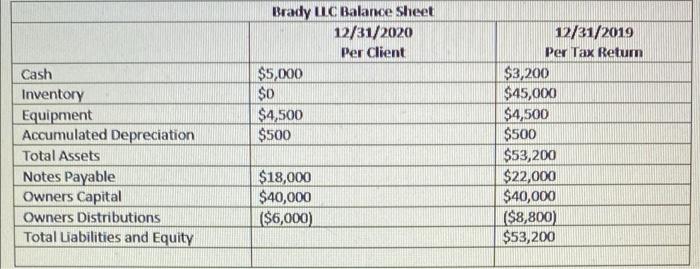

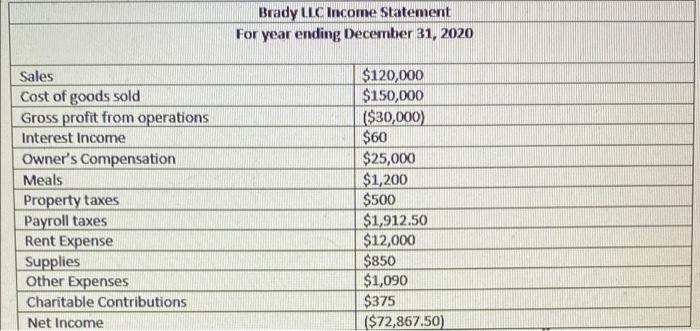

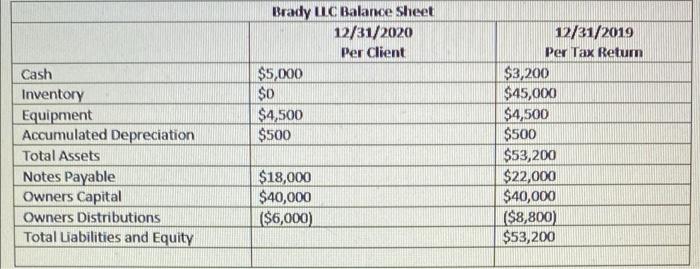

A new client has come to you for tax preperation services for 2020. Brady LLC wants to file as an S Corporation. They provided you with the following Income Statement and Balance Sheet.

Brady LLC Income Statement For year ending December 31, 2020 Sales Cost of goods sold Gross profit from operations Interest Income Owner's Compensation Meals Property taxes Payroll taxes Rent Expense Supplies Other Expenses Charitable Contributions Net Income $120,000 $150,000 ($30,000) $60 $25,000 $1,200 $500 $1,912.50 $12,000 $850 $1,090 $375 ($72,867.50) Brady LLC Balance Sheet 12/31/2020 Per Client $5,000 $0 $4,500 $500 Cash Inventory Equipment Accumulated Depreciation Total Assets Notes Payable Owners Capital Owners Distributions Total Liabilities and Equity 12/31/2019 Per Tax Retum $3,200 $45,000 $4,500 $500 $53,200 $22,000 $40,000 ($8,800) $53,200 $18,000 $40,000 ($6,000) This assignment is less about putting the vlaues into a tax return software and more about testing your critical thinking skills. Clients often bring you imcomplete accounting records. Often, you must determine what they've failed to record or tell you about. This generally results in requesting additional information. Answer the following questions:

c) What expense would not be fully deductible in most tax years? What expense would not be recorded on the front of the tax return? Why is this reported elsewhere?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started