Answered step by step

Verified Expert Solution

Question

1 Approved Answer

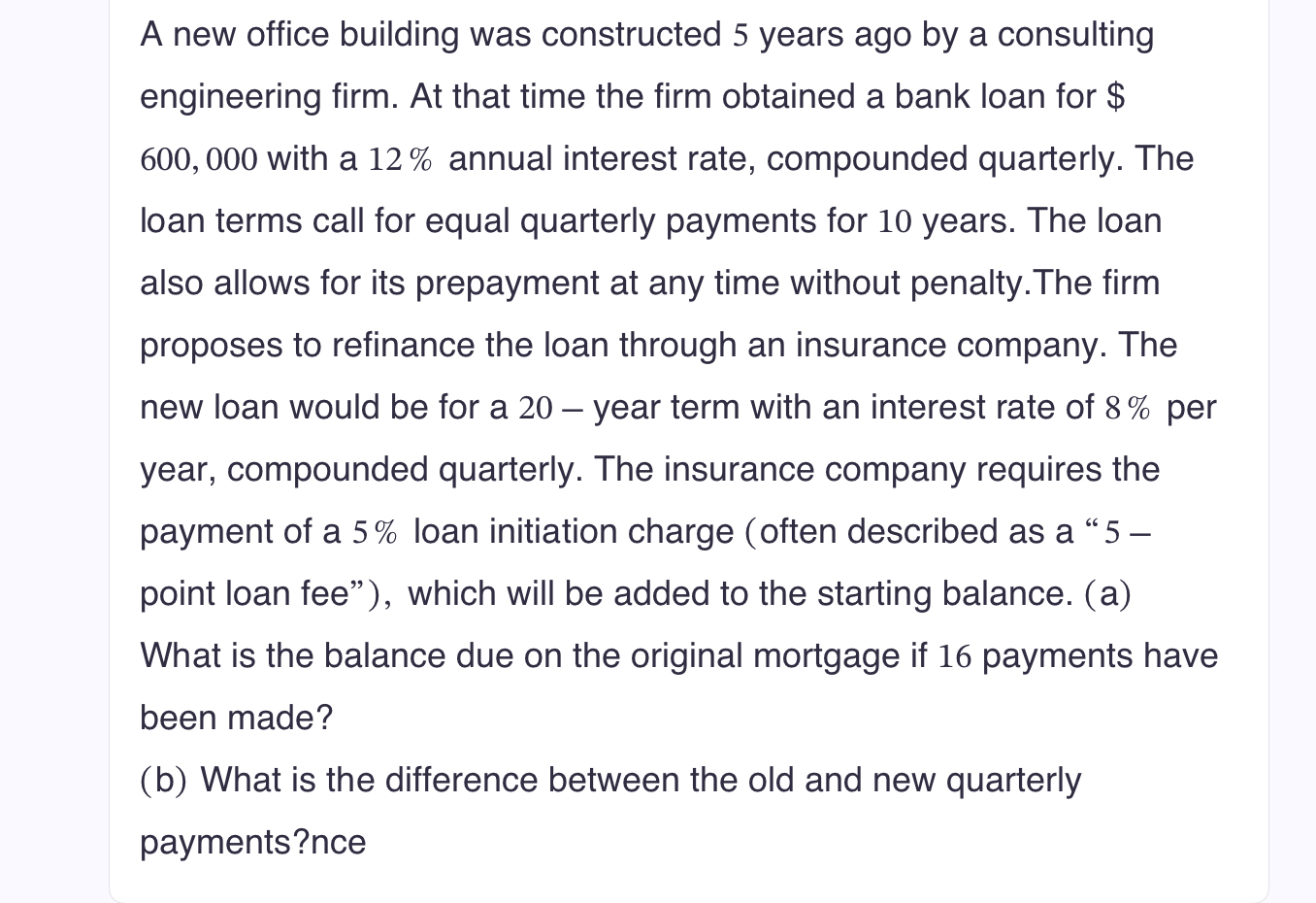

A new office building was constructed 5 years ago by a consulting engineering firm. At that time the firm obtained a bank loan for $

A new office building was constructed years ago by a consulting

engineering firm. At that time the firm obtained a bank loan for $

with a annual interest rate, compounded quarterly. The

loan terms call for equal quarterly payments for years. The loan

also allows for its prepayment at any time without penalty. The firm

proposes to refinance the loan through an insurance company. The

new loan would be for a year term with an interest rate of per

year, compounded quarterly. The insurance company requires the

payment of a loan initiation charge often described as a

point loan fee" which will be added to the starting balance. a

What is the balance due on the original mortgage if payments have

been made?

b What is the difference between the old and new quarterly

payments?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started