Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new printing machine costs $19,000 and has an installation cost of $1,000. It belongs to CCA Class 8, which means that it has

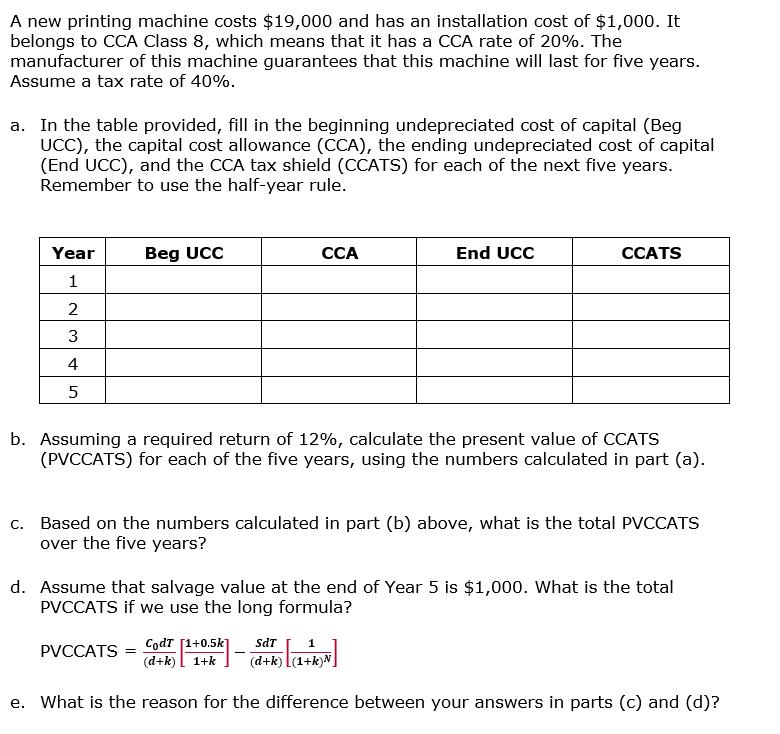

A new printing machine costs $19,000 and has an installation cost of $1,000. It belongs to CCA Class 8, which means that it has a CCA rate of 20%. The manufacturer of this machine guarantees that this machine will last for five years. Assume a tax rate of 40%. a. In the table provided, fill in the beginning undepreciated cost of capital (Beg UCC), the capital cost allowance (CCA), the ending undepreciated cost of capital (End UCC), and the CCA tax shield (CCATS) for each of the next five years. Remember to use the half-year rule. Year Beg UCC End UCC ATS 1 2 3 4 b. Assuming a required return of 12%, calculate the present value of CCATS (PVCCATS) for each of the five years, using the numbers calculated in part (a). c. Based on the numbers calculated in part (b) above, what is the total PVCCATS over the five years? d. Assume that salvage value at the end of Year 5 is $1,000. What is the total PVCCATS if we use the long formula? Codt [1+0.5k (d+k) SdT PVCCATS 1+k (d+k) [(1+k)N e. What is the reason for the difference between your answers in parts (c) and (d)?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution of all parts is given below Printing machine cost 19000 Installation cost 1000 Total Cost o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e26a9e222c_181889.pdf

180 KBs PDF File

635e26a9e222c_181889.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started