Question

3. Delta Medical Instruments, a largest medical equipment producer, has the following as of Dec. 31: Stockholders' Equity Common stock-$0.80 par value: Authorised 35,000,000

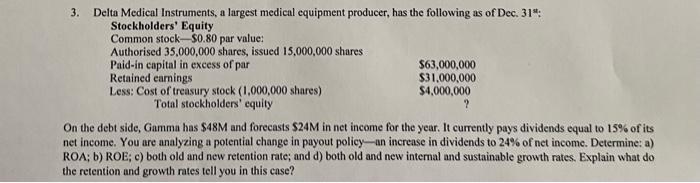

3. Delta Medical Instruments, a largest medical equipment producer, has the following as of Dec. 31": Stockholders' Equity Common stock-$0.80 par value: Authorised 35,000,000 shares, issued 15,000,000 shares Paid-in capital in excess of par Retained earnings Less: Cost of treasury stock (1,000,000 shares) Total stockholders' equity $63,000,000 $31,000,000 $4,000,000 ? On the debt side, Gamma has $48M and forecasts $24M in net income for the year. It currently pays dividends equal to 15% of its net income. You are analyzing a potential change in payout policy-an increase in dividends to 24% of net income. Determine: a) ROA; b) ROE; c) both old and new retention rate; and d) both old and new internal and sustainable growth rates. Explain what do the retention and growth rates tell you in this case?

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

15th edition

132554909, 978-0132554909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App