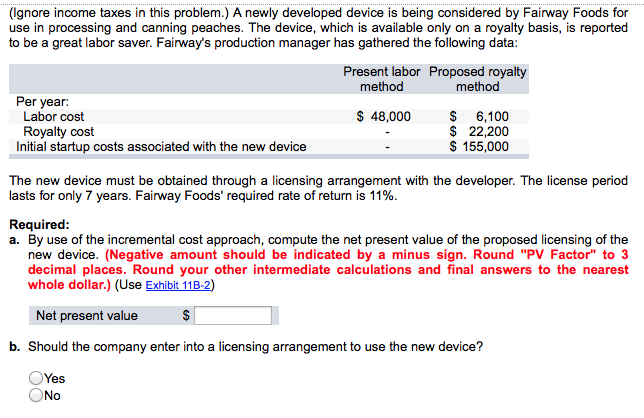

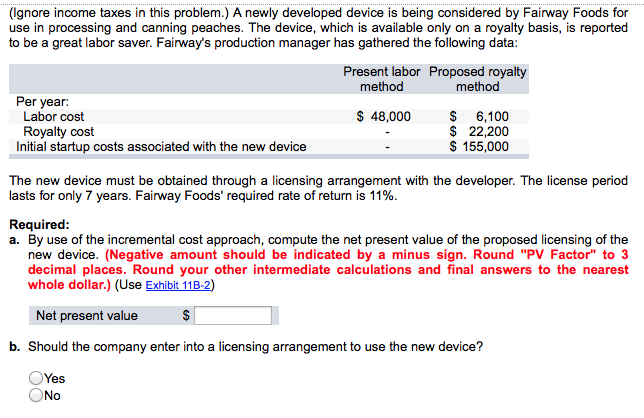

A newly developed device is being considered by Fairway Foods for use in processing and canning peaches. The device, which is available only on a royalty basis, is reported to be a great labor saver. Fairway's production manager has gathered the following data

(Ignore income taxes in this problem.) The Jackson Company has invested in a machine that cost $210,000, that has a useful life of fifteen years, and that has no salvage value at the end of its useful life. The machine is being depreciated by the straight-line method, based on its useful life. It will have a payback period of six years. Given these data, the simple rate of return on the machine is closest to....

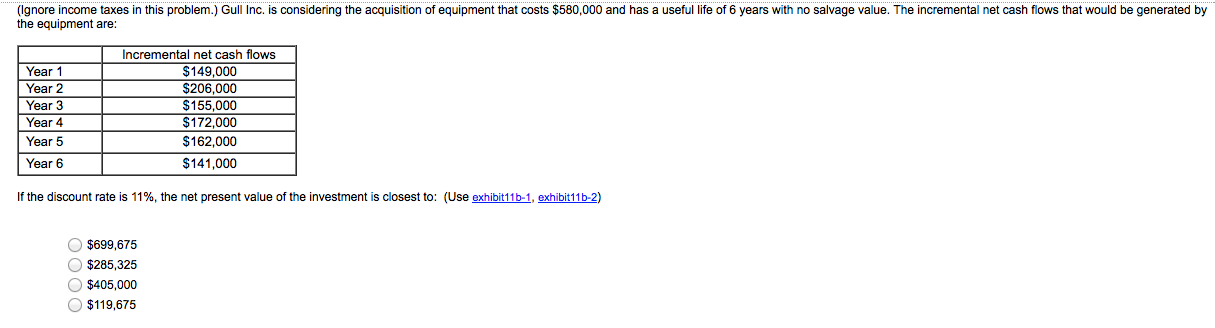

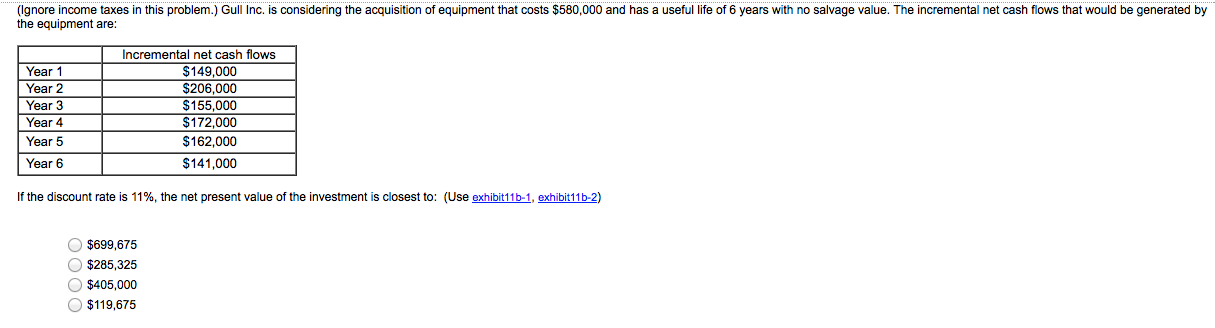

A newly developed device is being considered by Fairway Foods for use in processing and canning peaches. The device, which is available only on a royalty basis, is reported to be a great labor saver. Fairway's production manager has gathered the following data: The new device must be obtained through a licensing arrangement with the developer. The license period lasts for only 7 years. Fairway Foods' required rate of return is 11%. a. By use of the incremental cost approach, compute the net present value of the proposed licensing of the new device. (Negative amount should be indicated by a minus sign. Round "PV Factor" to 3 decimal places. Round your other intermediate calculations and final answers to the nearest whole dollar.) Should the company enter into a licensing arrangement to use the new device? (Ignore income taxes in this problem.) Gull Inc. is considering the acquisition of equipment that costs dollar 580,000 and has a useful life of 6 years with no salvage value. The incremental net cash flows that would be generated by the equipment are: If the discount rate is 11%, the net present value of the investment is closest to: (Use exhibit1b-1, exhibit11b 2) A newly developed device is being considered by Fairway Foods for use in processing and canning peaches. The device, which is available only on a royalty basis, is reported to be a great labor saver. Fairway's production manager has gathered the following data: The new device must be obtained through a licensing arrangement with the developer. The license period lasts for only 7 years. Fairway Foods' required rate of return is 11%. a. By use of the incremental cost approach, compute the net present value of the proposed licensing of the new device. (Negative amount should be indicated by a minus sign. Round "PV Factor" to 3 decimal places. Round your other intermediate calculations and final answers to the nearest whole dollar.) Should the company enter into a licensing arrangement to use the new device? (Ignore income taxes in this problem.) Gull Inc. is considering the acquisition of equipment that costs dollar 580,000 and has a useful life of 6 years with no salvage value. The incremental net cash flows that would be generated by the equipment are: If the discount rate is 11%, the net present value of the investment is closest to: (Use exhibit1b-1, exhibit11b 2)