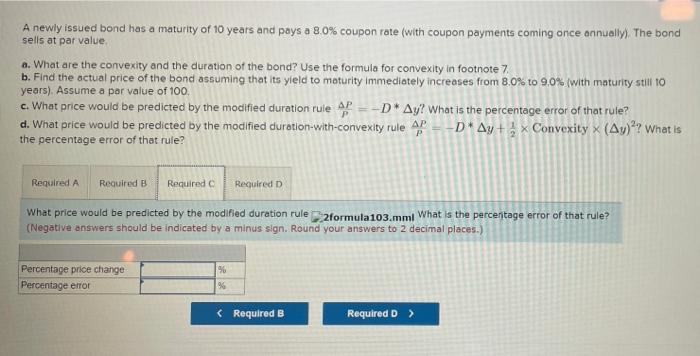

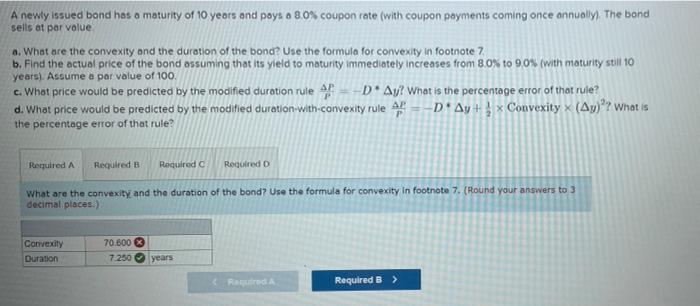

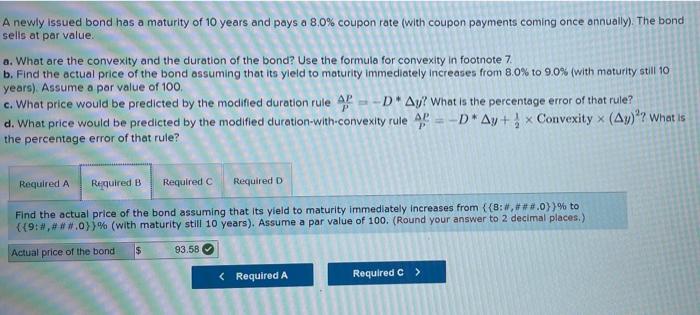

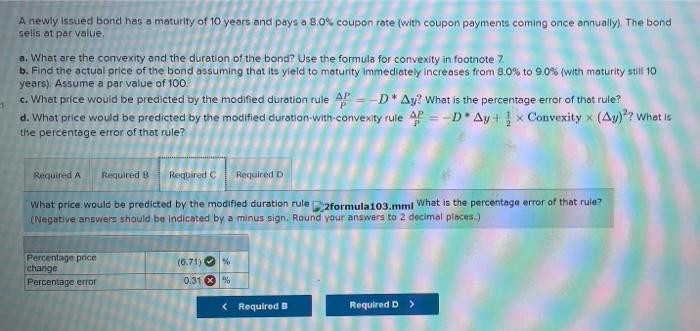

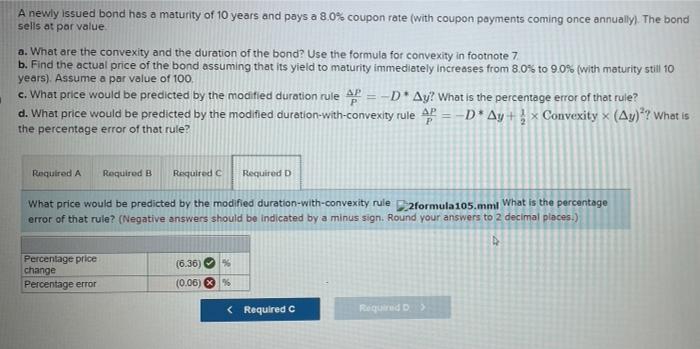

A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The bond sells at par value. a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7. b. Find the actual price of the bond assuming that its yield to moturity immediately increases from 8.0% to 9.0% (with maturity stili to years). Assume a par value of 100 . c. What price would be predicted by the modified duration rule PP=Dy ? What is the percentage error of that rule? d. What price would be predicted by the modified durotion-with-convexity rule PP=Dy+21 Convexity (y)2? What is the percentage error of that rule? What price would be predicted by the modified duration rule 2.2 formula103.mmi What is the perceritage error of that rule? (Negative answers should be indicated by a minus sign. Round your answers to 2 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The band sells at par value a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7 . b. Find the actual price of the bond assuming that its yield to moturity immediately increases from 8.0% to 9.0. (with maturity still 10 years). Assume a par value of 100 . c. What price would be predicted by the modified duration rule PP=Dy ? What is the percentage error of that rule? d. What price would be predicted by the modified duration-with-convexity rule PP=D+y+21 Convexity (y)2? What is the percentage error of that rule? What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7 . (Round your answers to 3 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The bond sells at par value. a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7. b. Find the actual price of the bond assuming that its yield to maturity immediately increases from 8.0% to 9.0% (with maturity still 10 years) Assume a par value of 100 . c. What price would be predicted by the modified duration rule PP=Dy ? What is the percentage error of that rule? d. What price would be predicted by the modified duration-with-convexity rule PP=Dy+21 Convexity (y)2 ? What is the percentage error of that rule? Find the actual price of the bond assuming that its yield to maturity immediately increases from {{8:#,###.0}}% to {{9:A,###,0}}% (with maturity still 10 years), Assume a par value of 100 . (Round your answer to 2 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The bond selis at par value, a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7. b. Find the actual price of the bond assuming that its yield to maturity immediately increases from 8.0% to 9.0% fwith maturity still 10 years). Assume a par value of 100 . c. What price wou'd be predicted by the modified duration rule PP=D * y ? What is the percentage error of that rule? d. What price would be predicted by the modified duration-with-convexity rule 5P=D=y+21( Convexity (y)2 ? What is the percentage error of that rule? What price would be predicted by the modified duration rule Z2formula 103.mml What is the percentage error of that rule? (Negative answers should be Indicated by a minus sign. Round your answers to 2 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The bond sells at par value. a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7 b. Find the actual price of the bond assuming that its yield to maturity immediately increases from 8.0% to 9.0% (with maturity still to years). Assume a par value of 100 . c. What price would be predicted by the modified duration rule PP=Dy ? What is the percentage error of that rule? d. What price would be predicted by the modified duration-with-convexity rule PP=Dy+21 Convexity (y)2 ? What is the percentage error of that rule? What price would be predicted by the modified duration-with-convexity rule Z.2formula105.mmi What is the percentage error of that rule? (Negative answers should be indicated by a minus sign. Round your answers to 2 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The bond sells at par value. a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7. b. Find the actual price of the bond assuming that its yield to moturity immediately increases from 8.0% to 9.0% (with maturity stili to years). Assume a par value of 100 . c. What price would be predicted by the modified duration rule PP=Dy ? What is the percentage error of that rule? d. What price would be predicted by the modified durotion-with-convexity rule PP=Dy+21 Convexity (y)2? What is the percentage error of that rule? What price would be predicted by the modified duration rule 2.2 formula103.mmi What is the perceritage error of that rule? (Negative answers should be indicated by a minus sign. Round your answers to 2 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The band sells at par value a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7 . b. Find the actual price of the bond assuming that its yield to moturity immediately increases from 8.0% to 9.0. (with maturity still 10 years). Assume a par value of 100 . c. What price would be predicted by the modified duration rule PP=Dy ? What is the percentage error of that rule? d. What price would be predicted by the modified duration-with-convexity rule PP=D+y+21 Convexity (y)2? What is the percentage error of that rule? What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7 . (Round your answers to 3 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The bond sells at par value. a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7. b. Find the actual price of the bond assuming that its yield to maturity immediately increases from 8.0% to 9.0% (with maturity still 10 years) Assume a par value of 100 . c. What price would be predicted by the modified duration rule PP=Dy ? What is the percentage error of that rule? d. What price would be predicted by the modified duration-with-convexity rule PP=Dy+21 Convexity (y)2 ? What is the percentage error of that rule? Find the actual price of the bond assuming that its yield to maturity immediately increases from {{8:#,###.0}}% to {{9:A,###,0}}% (with maturity still 10 years), Assume a par value of 100 . (Round your answer to 2 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The bond selis at par value, a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7. b. Find the actual price of the bond assuming that its yield to maturity immediately increases from 8.0% to 9.0% fwith maturity still 10 years). Assume a par value of 100 . c. What price wou'd be predicted by the modified duration rule PP=D * y ? What is the percentage error of that rule? d. What price would be predicted by the modified duration-with-convexity rule 5P=D=y+21( Convexity (y)2 ? What is the percentage error of that rule? What price would be predicted by the modified duration rule Z2formula 103.mml What is the percentage error of that rule? (Negative answers should be Indicated by a minus sign. Round your answers to 2 decimal places.) A newly issued bond has a maturity of 10 years and pays a 8.0% coupon rate (with coupon payments coming once annually). The bond sells at par value. a. What are the convexity and the duration of the bond? Use the formula for convexity in footnote 7 b. Find the actual price of the bond assuming that its yield to maturity immediately increases from 8.0% to 9.0% (with maturity still to years). Assume a par value of 100 . c. What price would be predicted by the modified duration rule PP=Dy ? What is the percentage error of that rule? d. What price would be predicted by the modified duration-with-convexity rule PP=Dy+21 Convexity (y)2 ? What is the percentage error of that rule? What price would be predicted by the modified duration-with-convexity rule Z.2formula105.mmi What is the percentage error of that rule? (Negative answers should be indicated by a minus sign. Round your answers to 2 decimal places.)